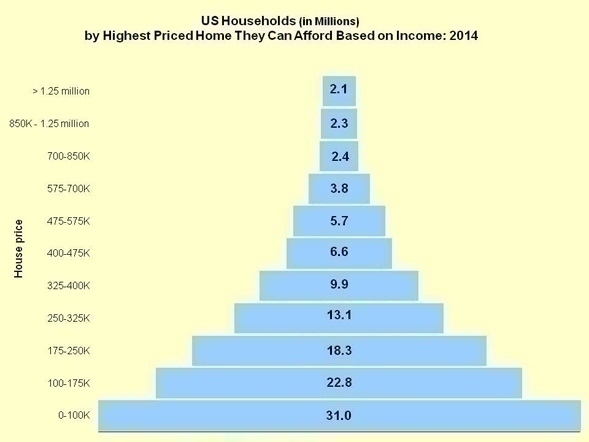

With the release of the 2014 Priced Out estimates, NAHB Economics revised its affordability pyramid that translates U.S. household income data into a distribution of homes that households can afford by price range.

At the base of the market for housing is a large number of households with relatively modest incomes. The homes that these households can afford are also relatively modest. As the price of a home goes up, there are fewer and fewer households in each tier who are able to afford it.

At the base of the market for housing is a large number of households with relatively modest incomes. The homes that these households can afford are also relatively modest. As the price of a home goes up, there are fewer and fewer households in each tier who are able to afford it.

Based on conventional assumptions and underwriting standards, it takes an income of about $26,695 to purchase a $100,000 home. In 2014, about 31 million households in the U.S. are estimated to have incomes lower than that threshold and, therefore, can only afford to buy homes priced under $100,000. These 31 million households form the bottom step of the pyramid. Of the remaining 87 million who can afford a home priced at $100,000, 22.8 million can only afford to pay a top price of somewhere between $100,000 and $175,000 (the second step on the pyramid).

This trend continues up the pyramid of house prices. Each step represents a maximum affordable price range for fewer and fewer households. The peak of the pyramid shows a very small share of households that are able to afford homes priced above $1.25 million. It’s possible to have more million dollar homes than this in the U.S., because many households would have initially purchased homes at lower prices which subsequently appreciated.

The pyramid is based on an income threshold and a 10 percent downpayment assumption. Households at the high-end of the market may be more likely to have equity in a previously owned home or other accumulated wealth for a larger downpayment. However, it is less likely to be the case at the low-end where affordability is a major concern. Increased development costs can easily price these households out of the market for a new home.

This post was originally published on the NAHB blog, Eye on Housing.