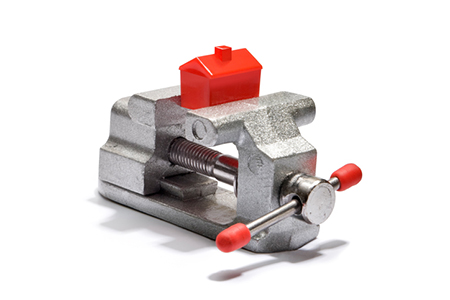

Housing affordability took a turn downward in the second quarter of 2017, as home prices and mortgage rates moved opposite, according to the latest National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI). Approximately 59 percent of homes sold in the second quarter were affordable based on the national median income, $68,000, a share down from roughly 60 percent in the first quarter. The national median home price in the second quarter was $256,000, weighed against the average mortgage rate, 4.08 percent.

“The job market continues to gain steam and this is boosting housing demand,” said Robert Dietz, chief economist of the NAHB, in a statement. “Meanwhile, growing incomes and attractive mortgage rates are helping to keep housing affordable by partially offsetting ongoing home price appreciation.”

The most affordable major metropolitan areas in the second quarter, based on local median home price and median income, were (in order): Youngstown-Warren-Boardman, Ohio-Pa. Syracuse, N.Y.; Dayton, Ohio; Buffalo-Cheektowaga-Niagara Falls, N.Y.; and Scranton-Wilkes Barre-Hazleton, Pa., according to the Index.

“While builder confidence remains solid and sales and starts are running at a healthy clip above last year’s levels, housing continues to confront persistent headwinds,” said Granger MacDonald, chairman of the NAHB. “Rising material prices, particularly lumber, along with chronic shortages of buildable lots and skilled labor are putting upward pressure on home prices and impeding a more robust housing recovery.”

“Home prices will continue to rise as inventory remains tight,” Dietz said. “NAHB expects the housing market will continue to make gradual gains in 2017.”

Source: National Association of Home Builders (NAHB)

For the latest real estate news and trends, bookmark RISMedia.com.