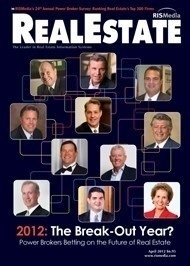

While the outcome varied a bit depending on your corner of the map, most power brokers agree that 2011 was yet another challenging year for real estate. According to the results of RISMedia’s 24th Annual Power Broker Survey—(like us on Facebook to see the Top 300 list, which can now be viewed while on-the-go on our new tablet-friendly digital magazine!)—while the overall numbers for 2011 show some improvement—$609,599,730,801 total sales volume in 2011 versus $564,996,585,483 in 2010—brokers reported another year of declining home values in most markets, a direct reflection of a continued increase in REO business and short sales. Distressed property business is also most likely the reason behind the rise in total transactions last year—2,448,845 in 2011 versus 2,218,184 in 2010.

While the outcome varied a bit depending on your corner of the map, most power brokers agree that 2011 was yet another challenging year for real estate. According to the results of RISMedia’s 24th Annual Power Broker Survey—(like us on Facebook to see the Top 300 list, which can now be viewed while on-the-go on our new tablet-friendly digital magazine!)—while the overall numbers for 2011 show some improvement—$609,599,730,801 total sales volume in 2011 versus $564,996,585,483 in 2010—brokers reported another year of declining home values in most markets, a direct reflection of a continued increase in REO business and short sales. Distressed property business is also most likely the reason behind the rise in total transactions last year—2,448,845 in 2011 versus 2,218,184 in 2010.

While bright spots peppered the landscape in 2011, pushing real estate forward a few steps, unanticipated events—i.e., the debt ceiling debacle and overseas credit crises—pushed us a few steps back. However, with 2011 now in the past, power brokers are optimistically moving forward in the year at hand. Regarding 2011 as potentially the final chapter in a six-year struggle, some brokers are preparing to break out in 2012. But can we really put the downturn behind us? Here’s why some say we can.

Tough Times Prevail…But Bright Spots Emerge

The majority of power brokers anticipated yet another rocky road for real estate in 2011 and prepared accordingly to sustain business throughout the year.

“It was a challenging year but our net results, measured in profitability, were about what we expected,” reports HomeServices of America Chairman and CEO Ron Peltier. “We have had six years of consecutive decline—a decline in home sale units and six years of falling prices. To get the results we were striving for required a really serious attention to detail and an ongoing resolve to extract the excesses out of our business that many companies put in place during the boom times. Each year out of the last six, we found additional expenses that could be taken out.”

Expense cutting was a common practice among power brokers yet again last year. “We noticed in 2011 that we were overstaffed, so we had to cut back on our staff in order to adjust to our market conditions,” says Barbara Grande, managing broker of Coldwell Banker First Real Estate in Fargo, N.D. (see Grande’s entire interview on page 22). “Back in the heyday when we were all so busy, we had gained staff; we failed to correct this as the market went down a bit.”

Dick Schlott, chairman and CEO of New Jersey-based Gloria Nilson REALTORS®, Real Living, describes 2011 as a good year yet a “painful” one.

According to the real estate veteran, 2011 represented the first time in his 40-year industry experience where his projections were so far off. “We sold more units but our average sales price was substantially lower,” Schlott explains. “Our prices were down in excess of 8 percent over the year before. However, we sold more homes and gained marketshare on our competitors, which I would normally be bragging about, but I still struggled to get prices to what I expected. It’s very hard to absorb that kind of a drop.”

For another industry veteran, Peter Hunt, chairman and CEO of Buffalo, New York’s Hunt Real Estate Corporation, an unpredictable year made it difficult for the firm to fully enjoy a momentous achievement. “2011 was a milestone year for us as we celebrated our 100th anniversary, but it’s a year I’d like to forget,” says Hunt. “It was tough to celebrate in many respects because of all the things we had to deal with.” However, thanks to a mild winter and improving consumer confidence, Hunt Real Estate is off to a positive start in 2012.

On the other side of the country in San Diego, David Romero, president and CEO of Century 21 Award, has used the downturn to his advantage. “It’s been a long five years during which only the strong have survived and the result is an increased professionalism within the industry that was much needed,” says Romero (see Romero’s entire interview on page 22). “We’ve been persevering by being nimble about what we need to do to be successful.”

Prudential Florida Realty, Florida Real Estate Services President & CEO, Rei Mesa also believes that sustaining business in 2011 required adapting to what the market at hand provided. “A large part of the market opportunities in 2011 were distressed properties, so we needed to increase our marketshare in foreclosure sales and improve our efficiencies in short sales,” Mesa explains.

Succeeding in the 2011 market also meant properly preparing agents to do business within the market realities, Mesa adds. “Providing our sales professionals with tools like RREIN (RISMedia’s Real Estate Information Network®) allowed us to position our company and its associates as the source for real estate news, trends and updates,” says Mesa. “Our greatest investment continues to be in our people. We continued to follow our ‘People First’ philosophy by increasing learning opportunities, providing timely and relevant information on a consistent basis, and leveraging today’s technology and e-marketing efficiencies.”

For some brokers, 2011 yielded very positive results as, with every real estate story, the tale of 2011 varied from location to location. Chad Ochsner, for example, owner of RE/MAX Alliance in Colorado’s Front Range region, witnessed an upswing in business.

“Our transaction sides and sales volume both increased and commissions increased,” Ochsner reports. “We saw our inventory decline significantly, which created upward pressure on pricing in certain pockets. We also saw some job growth and Money magazine ranked one of our suburbs as the top place to live.”

Dottie Bowe, owner of Keller Williams Realty in Portland, Maine, also reports a positive 2011. “We’ve been open for nine years, and 2011 was our best year financially,” says Bowe. “There are a lot of folks complaining about the market, but the fact of the matter is, we can’t change the landscape we are working in—the only thing we can change is ourselves.”

2011: Swing Factors

While power brokers approached 2011 with a firm grasp of market realities, there were several factors that caught them somewhat by surprise—in both good and bad ways.

According to Long & Foster President & COO Jeff Detwiler, while 2011 did end up as his company had projected, there was one significant surprise: “We looked at our sales numbers and purchase agreements and they compared to NAR’s pending home sales index. But what surprised us is the number of contracts that fell through. That rate rose to 18–20 percent—double what it normally is. This is a byproduct of financing struggles and faulty appraisals.”

NRT President & CEO Bruce Zipf also saw less than expected results in 2011. “The year did not meet expectation levels,” he explains. “Certainly in the front part of 2011 there was greater anticipation that the market had found its floor, but some of the issues we experienced domestically on the economic front—such as Washington trying to figure out how to balance the budget—affected the psyche of homebuyers.”

Peltier reports that while 2011 went largely as expected, he had hoped banks would have released more REOs. “I know there’s a lot of distressed real estate on the books, and in order for our industry to start moving toward meaningful recovery, we need to clear the inventory of distressed real estate. That process didn’t start to loosen up until the end of last year,” he explains.

Surprising demographic trends also factored into market performance in 2011. “Our strongest market right now is first-time homebuyers,” says Zipf. “Intermediate and third-homebuyers are our weakest population. They’re not buying—they’re renting, which is an issue. Rental activity has tripled in many marketplaces. We support that segment of the business but it’s not the same as when people step up and buy a home.”

Necessary Adaptations

No matter how 2011 played out, adaptability is and will continue to be critical to surviving and succeeding in real estate. Power brokers adjusted their business strategies not only for the downturn but for the new normal that’s here to stay.

“Back in late 2009 and early 2010, I think all of us in the real estate industry had to accept the ‘new normal,’” Detwiler explains. “It was important for us to acknowledge that the housing recovery is going to be a many, many-year process versus a one-year correction.”

Like many brokers, one strategy Detwiler deployed to survive in the new normal was eliminating office space. “We like multiple locations, but we reduced the size of many offices,” he explains. “That allowed us to reallocate money that we were spending on occupancy and drive transactions by investing more in marketing, technology, education and development for agents and managers.”

Mesa also took measures to eliminate overhead expenses. “Our entire organization is focused on continuing to look for areas where efficiencies can be implemented—for example, creating more efficient branch office designs,” he explains. “Technology and design has allowed us to reduce our office square footage and, therefore, re-negotiate existing leases.”

Peltier agrees: “As long as we are in a market environment where we have no growth in sales units and no growth in home prices, then we have to make certain that we are right-sized for the current economy and current marketplace and not maintaining excess capacity and excess square footage beyond what our real needs are.”

Both Mesa and Peltier focused on driving core services to compensate for lost revenue on the real estate side. “We are paying attention to our ongoing initiative for home services and maximizing the opportunity for the customer,” says Peltier. “By that, I mean getting more share of the customer by offering the customer mortgage financing services, title services, insurance coverage and casualty insurance.”

Mesa took a similar approach. “Our ‘Family of Services’—which includes Florida Home Finance Group, an affiliate of Wells Fargo Home Mortgage, and Florida Title & Guarantee—did an exceptional job in delivering our value-added services to both our sales professionals and their consumers.”

For some power brokers, adapting to the new normal meant strategic investment, expansion and growth. Ed Krafchow, for example, chairman of the board for Better Homes and Gardens Real Estate Mason-McDuffie, believes surviving means expanding into new locations.

“We took a risk and acquired a very large company,” reports Krafchow. “I moved out of damaged markets and into markets that are equity markets, like the wine country (northern California). An REO transaction is four times harder than a regular transaction with half the pay. It’s a difficult task with diminishing returns.”

Other brokers expanded through increased agent count. “We focused on living within our budget, but at the same time, seeing the opportunity going forward, we put on a tremendous recruiting campaign,” reports Schlott. “For a smaller company, we added a significant number of agents—260. It’s a constant focus of ours to bring in new blood. We brought in 50 percent more new managers.”

Zipf also reports an emphasis on recruiting. “We can’t change the market conditions or the macroeconomic situation, so you have to learn to work with it,” he explains. “You have to focus on organic growth and recruiting and retaining productive agents and developing the skill sets of your current agent base. Doing so allows us to focus on garnering as much marketshare as possible.”

To this end, Zipf reports a “fairly aggressive” acquisition and rollover strategy in 2011. “There are a lot of brokerage firms that are barely hanging on,” he explains. “Many are looking for exit strategies.”

Hunt’s multi-tiered adaptation strategy included expansion in several areas. “First, we had to become more efficient,” he explains. “Over the past 12–18 months, we have fundamentally taken apart every aspect of the company and rebuilt or dismantled things where necessary. We have changed everything from our office footprint to marketing to staffing. Second, we have tried to grow within the environment. To do this, we have reemphasized our recruiting efforts, looking at fold-ins and acquisitions. And third, we made very selective investments, mostly in technology.”

For Grande, surviving in 2011 meant strategic marketing investments. “In 2011, we actually increased our marketing and advertising budget by a couple percent and we are sustaining that going into 2012,” she reports. “I feel that this has made a key difference in increasing our marketshare.”

Howard “Hoddy” Hanna III, CEO of Pennsylvania’s Howard Hanna Real Estate Services, focused on adapting attitudes throughout his firm. “From the top of the company to the bottom, we have focused on being very positive and enthusiastic, and on having pride in our performance,” he explains. “While there are certain things that we can’t change, we have to keep the organization pumped up and ready for today’s problems. We also have to be enthusiastic about how to get over them.”

Bowe agrees. “Mindset is huge,” she explains. “A lot of agents came into the business between 2000-2005 when you didn’t need the same kind of skills needed to find success in today’s market, so we have had to reeducate our agents. We have had economists come into our market center and do an economic update every month so our agents can educate clients about the realities of today’s market.”

No matter what their particular adaptation strategy centered upon, power brokers agree that a return to fundamental real estate principles is essential for operating in the current market conditions.

“In order to be effective in this business, you have to have people going back to the fundamentals,” says Krafchow. “You have to prospect door to door and face to face, especially in markets with short sales. Our biggest successes are happening at mega open houses, where we have four or five agents present, and by farming communities. Part of the new normal is that you have to go out and prospect.”

Hanna agrees. “Everyone has gotten away from the basics, and this is what we need to focus on,” he explains. “As real estate professionals, our job is to take on the current issues and give our agents and management the tools they need to take on the challenges presented within today’s market.”

To make sure agents are armed with the necessary tools, Ochsner has implemented systematic coaching through Tom Ferry and other trainers. “It’s all about getting back to basics,” Ochsner explains. “You can use social media until you’re blue in the face, but that list you have of your sphere of past clients and people you know is more valuable than any glorified Facebook page. We have to get back to touching clients and reaching out to past clients.”

D’Ann Harper, broker/owner of Coldwell Banker D’Ann Harper realtors® in San Antonio, Texas, concurs. “We have and will continue to emphasize getting back to the basics…meaning cold calling, open houses, and working your sphere of influence. We have really worked hard at not taking overpriced listings. Our associates know that overpriced listings will not sell. They just give the seller a false sense of the market.”

Breaking Out in 2012?

While there has been a lot of false optimism and perhaps even a degree of denial among real estate professionals over the past few years, most power brokers believe that 2012 will be an important year of stabilization and moving forward.

“Everyone has an opinion and perspective, and over each of the last six years, more people had a rosy and optimistic expectation of the coming year than was justified by the real evidence,” says Peltier. “We have been very cautious at HomeServices and have budgeted for each of the last six years, including 2012, to be very cautious. However, for the first time in six years, I have moved from being overly cautious to being reasonably optimistic that 2012 will be a break-out year—that we will move from continued unit and price destruction and start to move north into high, single-digit growth in the 8, 9, 10 percent range. I say that because we actually have moved over the past couple of years to having a tremendous excess inventory in almost every market. When you have demand now balanced off with supply, and maybe starting to exceed supply, we’ll start seeing some pressure on prices going forward.”

Romero agrees. “We are gradually entering into a stabilization period,” he explains. “While all real estate is hyper local, and we’ve been telling the public to ignore the national headlines, the tide is quickly turning. As the media continues to report about positive things, such as consumer confidence getting better, it will help our local market. That being said, it’s crucial that our agents be on top of what’s happening both nationally and locally.”

Hanna is also seeing very important up-trends in his markets. “Throughout each of our marketplaces, there are a couple of things that are consistent,” he explains. “First, consumer confidence when it comes to housing is the strongest it has been in the last five years. Second, inventories are dropping in virtually every city we are in, some more than others. We are also seeing fewer foreclosures in the marketplace. In most parts of the country, we’re getting close to being stabilized.”

Others are tempering their predictions, waiting to see how certain swing factors pan out (see sidebar). “We plan for a flat market in 2012 compared to 2011, with the possibility of some upside if the economy allows for job creation at a rapid and scalable pace. Jobs, jobs and more jobs are what will provide some upside,” says Mesa.

Zipf also believes that real estate success in 2012 will hinge on several factors. “This is an election year, so we’ll have to deal with politicians explaining why they should remain or be elected to office. We’ll also probably see more price stabilization this year—that should spell a better market in 2012. Also, some of the international issues we were dealing with this time last year appear to be coming to a resolution, which will hopefully stabilize the outlook for 2012. We’re looking for 2012 to be a better year. Already in the first quarter, units are up and prices have stabilized in most markets.”

Hunt is also taking a positive but conservative approach to the year. “I don’t think there will be any substantial growth in the market in 2012, but we might see a 5–10 percent increase in units. I also think that prices will remain relatively stable, although they may tick up a little. I think there will still be pressure on prices, particularly on the high end.”

Even though his firm is way ahead of projections, Krafchow is reserving judgment. “I have an absolute distrust of the numbers,” he explains. “Being ahead for 90 days isn’t enough to give you the feeling that you’re going to be successful for the year. We have to get to the spring and summer and see what happens.”

Detwiler is also cautiously bullish on real estate in 2012. “The two most encouraging fundamentals in the entire marketplace are that interest rates are low and we have all-time, historical highs for affordability,” he explains. “Consumers haven’t taken advantage of affordability because they’re just scared. Consumer confidence hit all-time lows in August 2011. We need a recovery in confidence more than anything.”

Harper agrees. “I believe the real estate market is very slowly recovering. However, I do not believe that we are going to see a tremendous change until consumer confidence is restored.”

However, with good news starting to emerge in the latter part of 2011 and into the early part of 2012, Detwiler believes consumer confidence could rise quickly and trigger a better-than-expected year for real estate. Several positive trends—including improving employment numbers and an investor boom in many parts of the country—could quickly turn the tide of consumer confidence.

“I’m optimistic about 2012…about the next several years in a row,” says Detwiler. “But we do not see any massive change in the housing market in terms of size and scope. We still have fundamental headwinds that need to be addressed.”

Hanna believes that an election year equals good things for real estate. “I have tracked every presidential election year, and when there’s an incumbent party running, they want to win. They try to make the consumer/public feel better about themselves. In every past election year, except for 1980, there’s always been a really good spike in housing sales. Most times, these have been double-digit increases.”

Thanks to his rapidly recovering local market, Ochsner is confident about the future. “We’re really excited about 2012,” he says. “In January and February, our company was up over 15 percent from last year. I’m hoping it continues through spring and summer.”

According to Ochsner, there’s also an important new message to deliver in 2012: Now is not just a good time to buy—it’s a good time to sell. “Now that there’s an inventory shortage, we’re coaching people to go back and call the listings they didn’t get over the past couple of years; tell those people you can now list their home at the price they wanted it to sell at because there’s now an inventory shortage.”

Ultimately, with the right approach, there is always a way to grow business for savvy brokers and real estate professionals. As Bowe says, “There are always going to be people who need to sell homes who need us, and they need us more now than they did in the early 2000s. If we can help our 200+ agents become more successful, we as a company will be successful.”

As with any real estate market, 2012 will reflect the innovation and effort that real estate professionals choose to approach the year with. “I’m reasonably optimistic about 2012,” says Schlott. “It’s either sink or swim, so you have no choice but to be proactive. You have to go out into the ocean to get to the other shore.”

To see which firms are included in the Top 300, head over to our Facebook page, and while you’re there, check out our new tablet-friendly digital magazine. Leave a comment and let us know what you think!