The housing market is slowing down, with home values seeing the first negative monthly change since the market began its recovery nearly four years ago, according to the Zillow® July Real Estate Market Reports.

The housing market is slowing down, with home values seeing the first negative monthly change since the market began its recovery nearly four years ago, according to the Zillow® July Real Estate Market Reports.

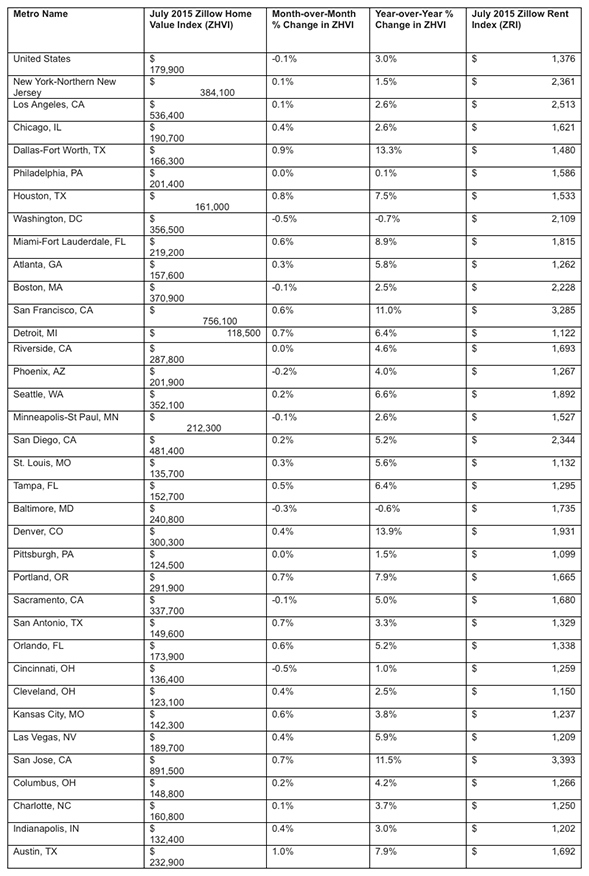

Nationally, home value appreciation is leveling off after its rapid pace in the early years of the recovery. Homes lost 0.1 percent of their value in July, falling to a Zillow Home Value Index of $179,900. Homes appreciated three percent on an annual basis, down from 3.4 percent in June.

Of the 517 metros covered by Zillow, 204 saw a slowdown, including major metros like Washington, D.C. and Cincinnati, where home values declined month-over-month in July. The slowing appreciation is a sign that the market is returning to normal; economists have expected to see growth flattening out as the recovery continues.

Even hot markets like Denver, Dallas, San Jose and San Francisco, which had double-digit annual home value growth in July, saw their monthly appreciation rates ease from June.

“This slight dip in home values is a sign of the times. Many people didn’t think it was happening, but it is: we’re going negative,” says Zillow Chief Economist Svenja Gudell. “We’ve been expecting to see a monthly decline as markets return to normal. However, this is not like the bubble bust. We’re not going to see 10 percent declines. The market is leveling off, and it’s good news, particularly for buyers, because it will ease some of the competitive pressure.”

Slowing home values could provide more opportunities for hopeful buyers who have been waiting on the sidelines for the market to cool off. More homes may be coming online as homeowners who have been watching strong home value growth decide to list their houses as appreciation slows and smaller gains are expected. This could help ease the constrained inventory the market has been facing for the past several months.

Meanwhile, rents continue to grow at a rapid pace, up 4.2 percent from last July to a Zillow Rent Indexof $1,376. With no sign of rents slowing down and the potential for more homes for sale, conditions may be right for buyers to enter the market.

For more information, visit www.zillow.com/research/data.