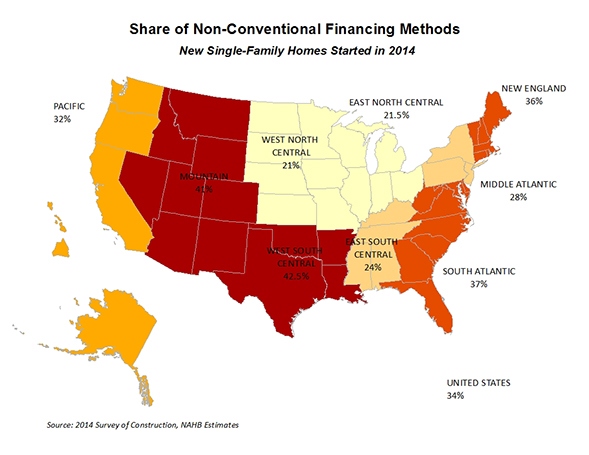

Non-conventional forms of financing new single-family home purchases remained elevated in 2014, but their use and mix varied widely across the country, according to NAHB analysis of a recent Census Bureau Survey of Construction (SOC) data. In the West North Central division, only 21 percent of new homes started in 2014 were purchased using non-conventional financing methods. The share was twice as high in the West South Central division, 42.5 percent, and exceeded 41 percent in the Mountain division.

Non-conventional forms of financing new single-family home purchases remained elevated in 2014, but their use and mix varied widely across the country, according to NAHB analysis of a recent Census Bureau Survey of Construction (SOC) data. In the West North Central division, only 21 percent of new homes started in 2014 were purchased using non-conventional financing methods. The share was twice as high in the West South Central division, 42.5 percent, and exceeded 41 percent in the Mountain division.

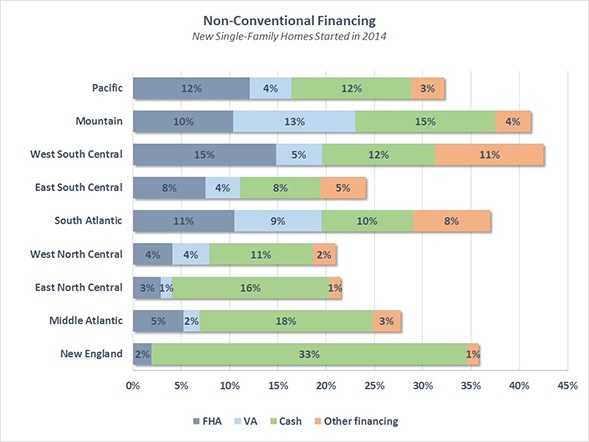

For the first time since 2007, cash purchases became the most common type of non-conventional financing used for purchasing new single-family homes. For homes started in 2014, cash purchases accounted for almost 13 percent of the market. New England registered the nation’s highest share, with one in three new homes started in 2014 purchased with cash. The Middle Atlantic and East North Central divisions registered the second and third highest shares, 18 and 16 percent, respectively. At the other end of the spectrum is the East South Central division where only 8 percent of new homes were cash purchases.

The high prevalence of cash financing in the New England, East North Central and Middle Atlantic divisions can be partially explained by the popularity of custom homebuilding in these divisions, with all three claiming the top three custom home market shares in 2014. Custom homes are more likely to be financed with cash, especially if built by the owner acting as the general contractor. In 2014, one in three custom homes built by the owner were financed with cash, while less than 9 percent of spec homes were purchased with cash.

Mortgages insured by the Federal Housing Administration (FHA) made up close to 10 percent of the market. Following the implemented decline in FHA loan limits that went into effect on January 1, 2014, the share of FHA-insured loans dropped and they lost their status as the most prevalent form of non-conventional financing of new home purchases. As we had predicted last year, the Pacific, Mountain and South Atlantic divisions were among the hardest hit by the implemented declines. FHA-insured loans lost between 4 to 5 percent of the market in these divisions.

Interestingly, markets in these divisions reacted differently to filling the void left by the lower FHA loan limits. In the Mountain division, mortgage loans guaranteed by the Veteran’s Administration (VA) grew in importance, gaining additional 5 percent of new homebuyers. Their share came close to 13 percent, more than double the national average of 6 percent. The South Atlantic division is the only other division that reported the above national average share of the VA-guaranteed loans, 9 percent.

In the Pacific and South Atlantic divisions, there was a shift towards cash purchases. In the South Atlantic and West South Central divisions that also registered a steep decline in the share of the FHA-insured loans, new homebuyers turned to other types of non-conventional financing methods such as the Rural Housing Service, Habitat for Humanity, loans from individuals, State or local government mortgage-backed bonds and other. In the West South Central division, the share of other types of non-conventional financing more than doubled and exceeded 11 percent in 2014. The South Atlantic division registered the second highest share of 8 percent, also exceeding the national average of 6 percent.

The East South Central division, where more than a quarter of new homes were built in rural areas, reported close to a 5 percent share of other types of financing, most likely through the Rural Housing Service.

This post was originally published on NAHB’s blog, Eye on Housing.