Over the last 5 years, Chinese nationals have invested over $150 billion into the U.S. housing market, pouring in $28.6 billion in 2015 alone, according a new report released recently by Asia Society and the Rosen Consulting Group.

Currently the biggest foreign buyers of American homes, this immense push from Chinese buyers has been extremely beneficial in aiding the success of the U.S. housing market recovery.

While Chinese nationals have been purchasing both residential and commercial properties, the study shows more purchasing power going toward residential homes than commercial buildings, with $23 billion funneled into U.S. commercial real estate and a stunning $127 billion into housing.

A 2015 study by the National Association of REALTORS® showed that buyers from China made up 16 percent of all international buyers locking in single family homes in the U.S., jumping from 12 percent in 2013, inching above the long-standing top foreign real estate buyer, the Canadians.

“Chinese buyers are buying real estate in the U.S. and they are buying lots of it,” says John Yen Wong, Founding Chairman of the Asian Real Estate Association of America (AREAA), a Strategic Partner with the recently released study. “These property purchases are broadening across the country and communities benefit from the infusion of capital into the neighborhoods.”

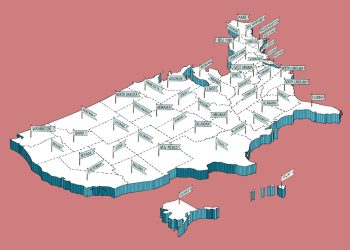

So where are Chinese nationals buying real estate, and why? In 2015, 35 percent of these home purchases were made in California, with New York following suit. Top hot spots, according to the study, include Los Angeles, San Francisco, New York, Seattle, Chicago, Miami and Las Vegas. These high-end locations mean buyers are purchasing high-end homes. The study shows that in 2015, Chinese buyers paid an average of $832,000 per home, doubling the average of other foreign purchases landing at $499,600.

Motivations vary. Wong comments, “Three of the key drivers for these buyers are fee-simple ownership—rare if at all, in China; the rule of law—recourse if something goes wrong; and a stable government, despite what we might think during presidential election season.”

Many buyers are relocating on investor visas, some are purchasing rental properties or second homes, while others are motivated by worry over the devaluing of the Chinese yuan, pushing many to translate their assets to the U.S. dollar.

“New real estate owners do not stop spending once the real estate purchase is completed,” says Wong. “Whether buying new appliances, new cars, or eating at restaurants, these new owners infuse money into local economies. The Chinese buyers can lay the foundation for vibrant community growth.”