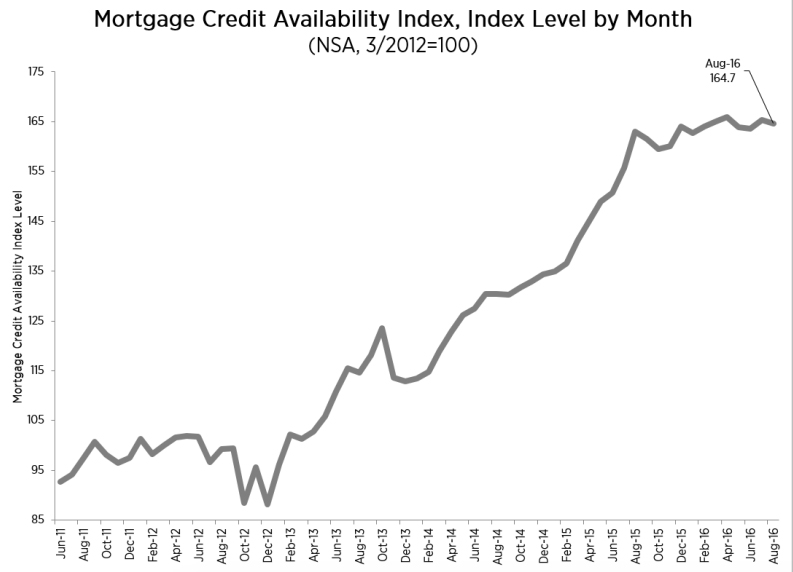

Mortgage credit availability decreased in August according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) which analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

The MCAI decreased 0.4 percent to 164.7 in August. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. Of the four component indices, the Conforming MCAI saw the greatest decrease in availability over the month (down 0.9 percent), followed by the Government MCAI (down 0.5 percent), and the Conventional MCAI (down 0.2 percent). The Jumbo MCAI increased 0.5 percent from last month.

“Credit availability decreased slightly over the month, driven by one mid-sized investor closing their correspondent operations,” says Lynn Fisher, MBA’s Vice President of Research and Economics. “Despite the loss of all of the programs associated with this investor, the Jumbo MCAI increased by 0.5 percent, indicating that credit conditions continue to ease among jumbo loan programs.”

For more information, visit www.mba.org.