Rents are so high that the average renter could buy a home worth approximately 50 percent more than the median home value without spending any more money, according to a recent analysis by Zillow.

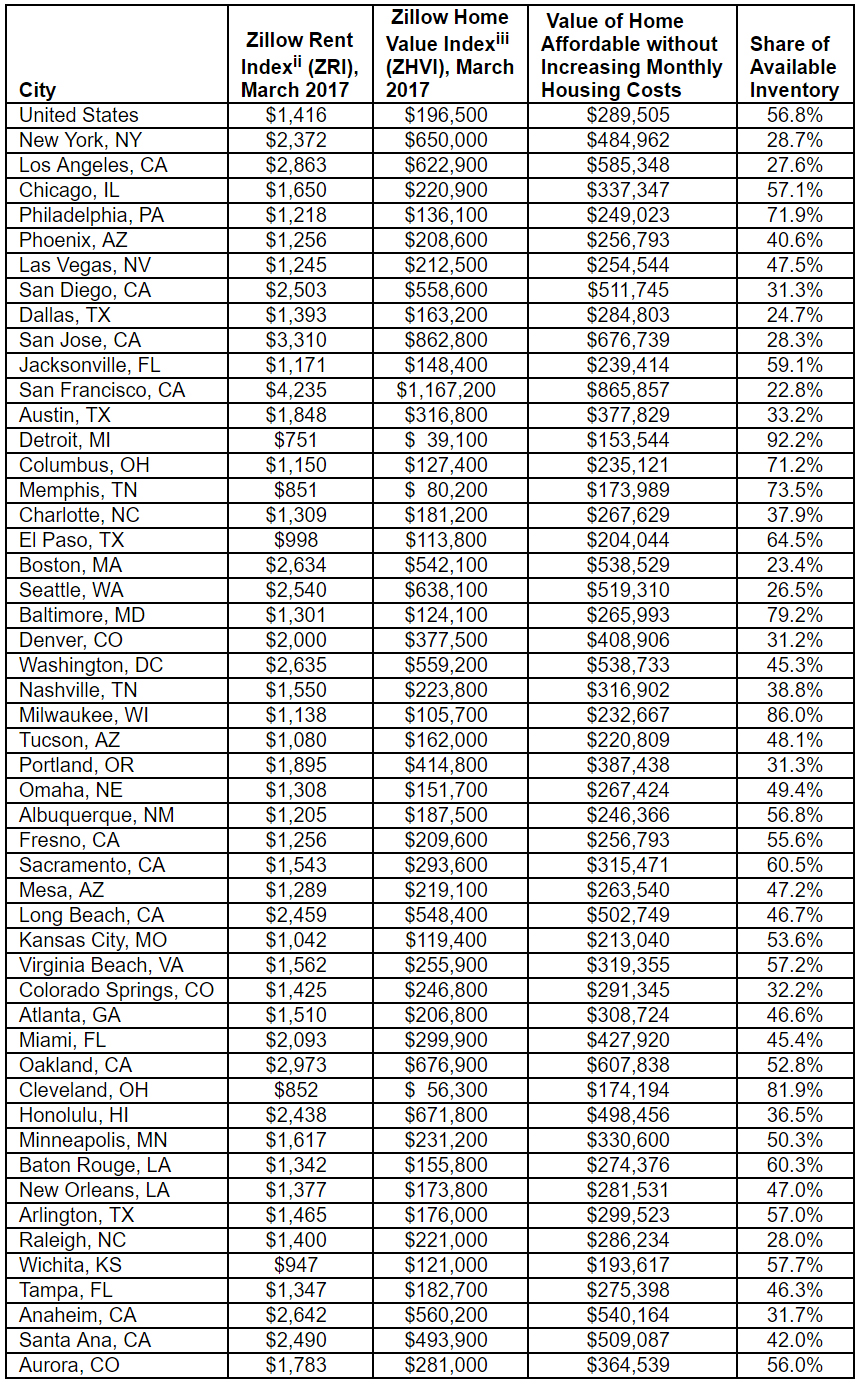

The national median rent, $1,416, is enough to cover the monthly expense (including insurance, maintenance and taxes) of owning a home worth $289,505—considerably more than the national median home value of $196,500.

Similar outcomes shake out in the majority of cities analyzed:

“Renters hesitant to enter the home-buying market for fear of not being able to find an affordable home should be encouraged to discover they may have more options than they thought,” says Dr. Svenja Gudell, chief economist at Zillow.

“However, it’s worth noting that many of the more affordable homes for sale may be older, smaller and/or located in less-desirable neighborhoods than they might like,” Gudell says. “The decision between buying and renting is a financial trade-off between saving more each month on a mortgage payment versus spending more on rent, but taking advantage of the location and lifestyle amenities urban renting often offers.”

Scraping together enough for a down payment is another issue—though lesser now that rents are losing steam.

“Recent slowdowns in rent growth may take some of the edge off for renters saving to become homeowners,” says Gudell. “This is good news, since saving a down payment, qualifying for a loan and finding a home available at a manageable price remain hurdles for millions of aspiring buyers.”

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.