Home values in housing markets the nation over continue to heighten—but while homeowners are cheering the gain in equity, some homebuyers’ hopes, especially in large locations, are being hosed down.

“Homes have gotten so expensive in many major cities that even with low mortgage rates, monthly costs for homes that are currently for sale are starting to be unaffordable,” says Dr. Svenja Gudell, chief economist at Zillow. “Down payments are a top concern for today’s homebuyers, but the reality is that monthly costs are becoming unaffordable, as well.”

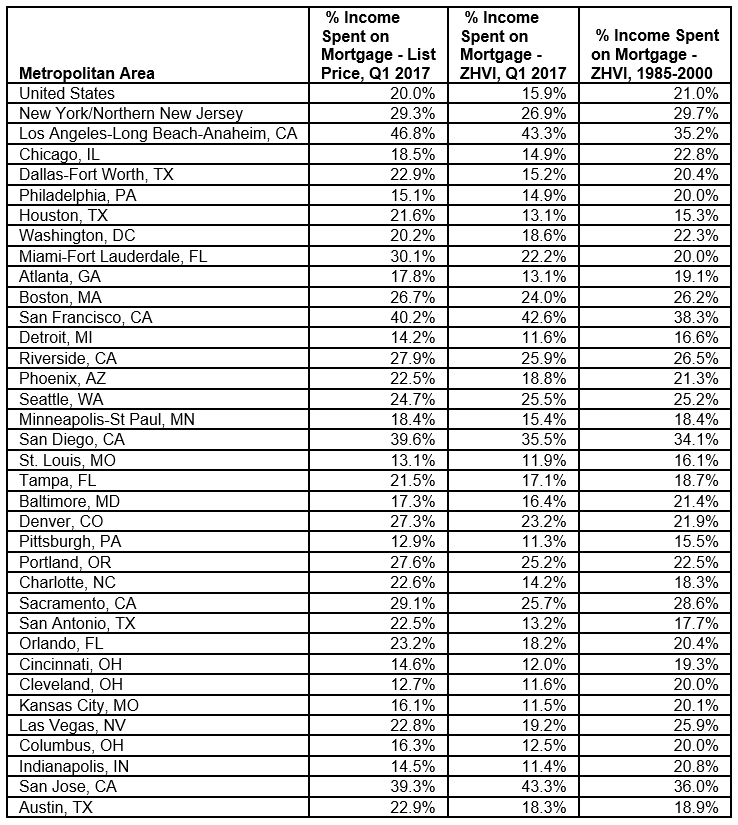

A recent analysis from Zillow reveals homebuyers in over half of the nation’s 35 largest housing markets will need more of their income to afford mortgage payments on a median-valued home than the historic spend. Buyers in Los Angeles, Calif., will need the most: 46.8 percent of their income, up sharply from the 35.2 percent needed in the years prior to the collapse. Buyers in San Francisco, Calif., San Diego, Calif., and San Jose, Calif., will also need to allocate a considerable portion of their income to a mortgage, ranging from roughly 39-40 percent.

Affordability constraints will tighten, according to Gudell, so long as supply shortages hold.

“Low inventory is pushing sticker prices higher, and when mortgage rates start to rise, monthly payments will be driven further into unaffordable territory,” Gudell says.

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.