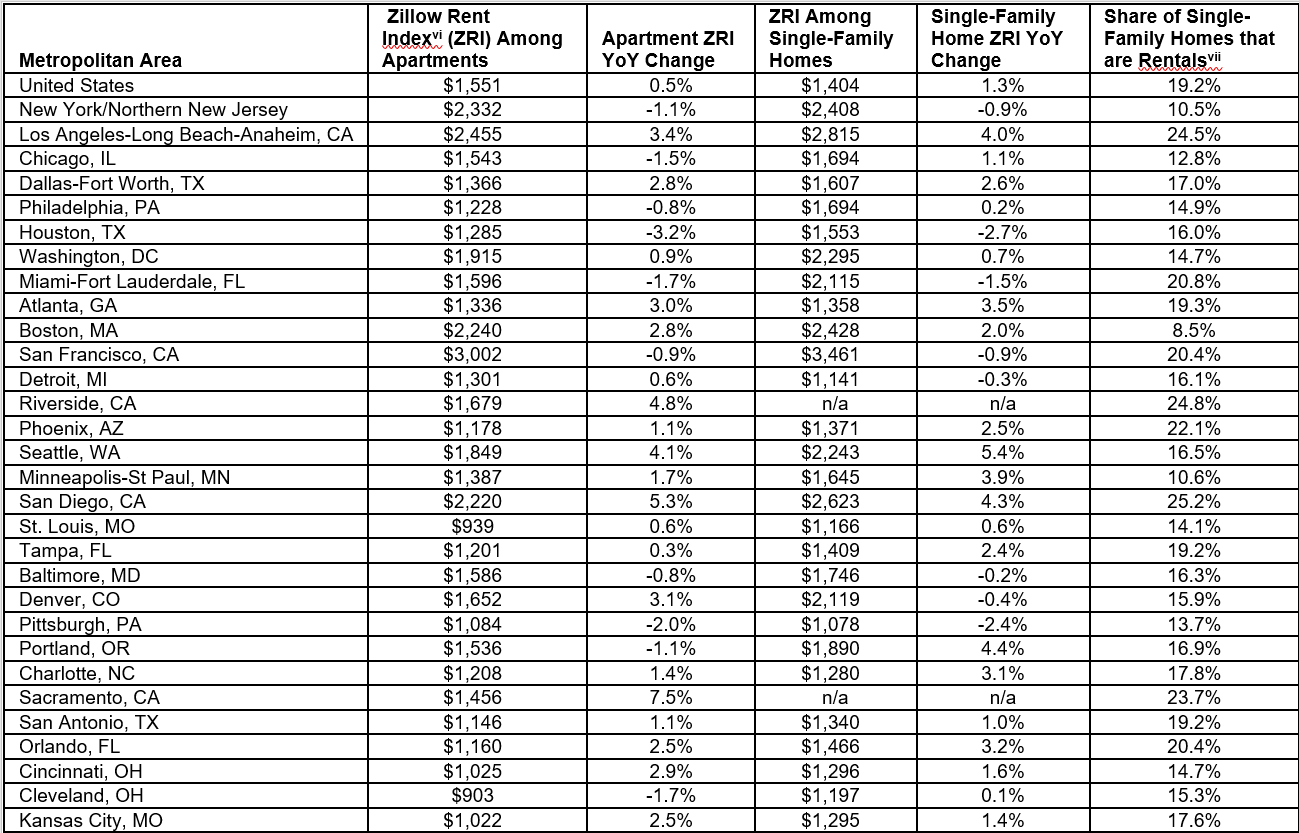

Apartment rents are appreciating less than house rents, thanks to shifting demand for single-family rentals, according to a recent analysis by Zillow. Apartment rents nationally increased a median 0.5 percent, to $1,551, year-over-year—relatively flat—while house rents increased 1.3 percent to $1,404.

Several colliding factors are driving the trend, says Dr. Svenja Gudell, chief economist at Zillow.

“When the market crashed, many families lost homes they owned during the foreclosure crisis, and now may not be able to afford to buy another as home prices rise,” Gudell says. “Those who want to buy are finding it difficult to find the right one, or may need a bit more time to come up with a down payment, but still want the advantage of space that single-family residences often provide. This, coupled with the foreclosure crisis turning millions of homeowners into renters, is a big reason why demand for single-family rental homes has risen over the last few years.”

Renters aged 38 to 52 (Generation X) are exhibiting the strongest demand, with roughly 40 percent renting a house, followed by renters aged 18 to 37 (millennials) at 25 percent and renters aged 73 and older (Silent Generation) at 10 percent.

Demand can be an imperfect indicator of the future, however. Forty-five percent of renters surveyed for the 2017 Zillow Group Consumer Housing Trends Report, soon to be released, have considered renting a house, but just 28 percent followed through on their plan.

The disparity between apartment rent appreciation and house rent appreciation varies from market to market, as well. Apartment rents in Portland, Ore., for example, have depreciated 1.1 percent year-over-year, but house rents have appreciated 4.4 percent. In the top 30 metropolitan areas:

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

For the latest real estate news and trends, bookmark RISMedia.com.