Existing-home sales floundered in August, posting higher than one year prior but lower than in July, the National Association of REALTORS® (NAR) reports.

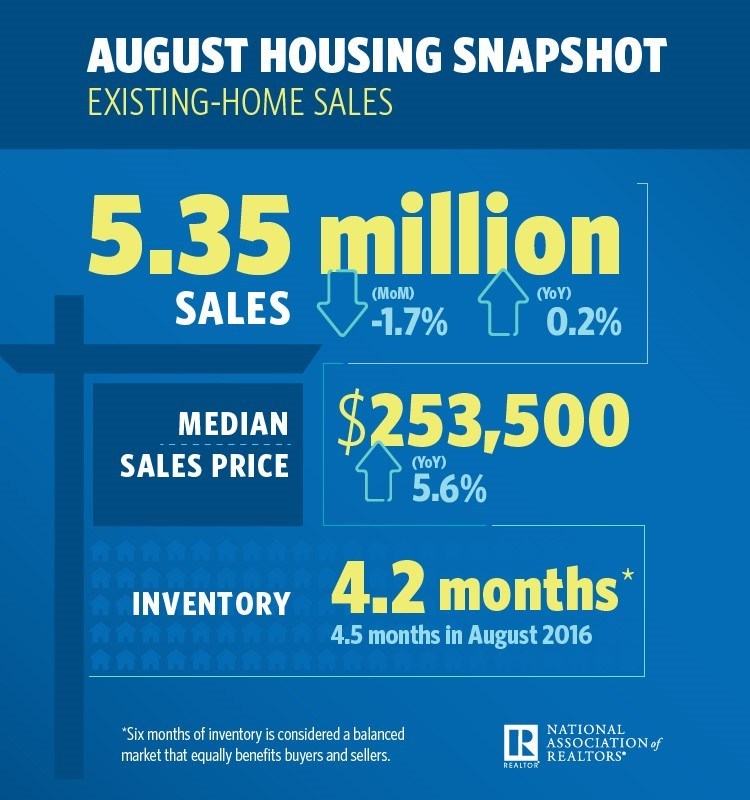

Existing-home sales totaled 5.35 million, a 1.7 percent decrease from July but a 0.2 percent increase from one year prior. Inventory decreased 2.1 percent to 1.88 million, 6.5 percent below one year prior.

“Steady employment gains, slowly rising incomes and lower mortgage rates generated sustained buyer interest all summer long, but unfortunately, not more home sales,” says Lawrence Yun, chief economist at NAR. “What’s ailing the housing market, and continues to weigh on overall sales, is the inadequate levels of available inventory and the upward pressure it’s putting on prices in several parts of the country. Sales have been unable to break out because there are simply not enough homes for sale.”

“Steady employment gains, slowly rising incomes and lower mortgage rates generated sustained buyer interest all summer long, but unfortunately, not more home sales,” says Lawrence Yun, chief economist at NAR. “What’s ailing the housing market, and continues to weigh on overall sales, is the inadequate levels of available inventory and the upward pressure it’s putting on prices in several parts of the country. Sales have been unable to break out because there are simply not enough homes for sale.”

Inventory is currently at a 4.2-month supply. Existing homes averaged 30 days on market in August, six less days than one year prior. All told, 51 percent of homes sold in August were on the market for less than one month.

The metropolitan areas with the fewest days on market in August, according to data from realtor.com®, were San Jose-Sunnyvale-Santa Clara, Calif. (29 days); Seattle-Tacoma-Bellevue, Wash. (30 days); Vallejo-Fairfield, Calif. (31 days); and San Francisco-Oakland-Hayward, Calif., and Salt Lake City, Utah (both 32 days).

The median existing-home price for all types of houses (single-family, condo, co-op and townhome) was $253,500, a 5.6 percent increase from one year prior. The median price for a single-family existing home was $255,500, while the median price for an existing condo was $237,600.

“Market conditions continue to be stressful and challenging for both prospective first-time buyers and homeowners looking to trade up,” Yun says. “The ongoing rise in home prices is straining the budgets of some of these would-be buyers, and what is available for sale is moving off the market quickly because supply remains minimal in the lower- and mid-price ranges.”

Single-family existing-home sales came in at 4.74 million in August, a 2.1 percent decrease from 4.84 million in July, but a 0.4 percent increase from 4.72 million one year prior. Existing-condo and co-op sales came in at 610,000, a 1.7 percent increase from July, but a 1.6 percent decrease from one year prior.

Twenty percent of existing-home sales in August were all-cash, with 15 percent by individual investors. Four percent were distressed.

The Midwest and Northeast saw positive activity in August, with existing-home sales rising 2.4 percent to 1.28 million in the Midwest, with a median price of $200,500, and 10.8 percent to 720,000 in the Northeast, with a median price of $289,500. Existing-home sales in the South and West fell, 5.7 percent to 2.15 million in the South, with a median price of $220,400, and 4.8 percent to 1.20 million in the West, with a median price of $374,700.

“Some of the South region’s decline in closings can be attributed to the devastation Hurricane Harvey caused to the Greater Houston area,” says Yun. “Sales will be impacted the rest of the year in Houston, as well as in the most severely affected areas in Florida from Hurricane Irma; however, nearly all of the lost activity will likely show up in 2018.”

First-time homebuyers comprised 31 percent of existing-home sales in August, a decrease from 33 percent in July.

Overall, the housing market is on a continuing path to recovery—but its progress is threatened by recently proposed tax reform.

“Consumers are smart and know that any attempt to cap or limit the deductibility of mortgage interest is essentially a tax on homeownership and the middle class,” Brown says. “A study commissioned by NAR found that under some tax reform proposals, many homeowners with adjusted gross incomes between $50,000 and $200,000 would see an average tax increase of $815, along with home values shrinking by an average of more than 10 percent. An even steeper decline would be seen in areas with higher property and state income taxes. Congress must keep homeowners in mind as it looks towards tax reform this year.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.