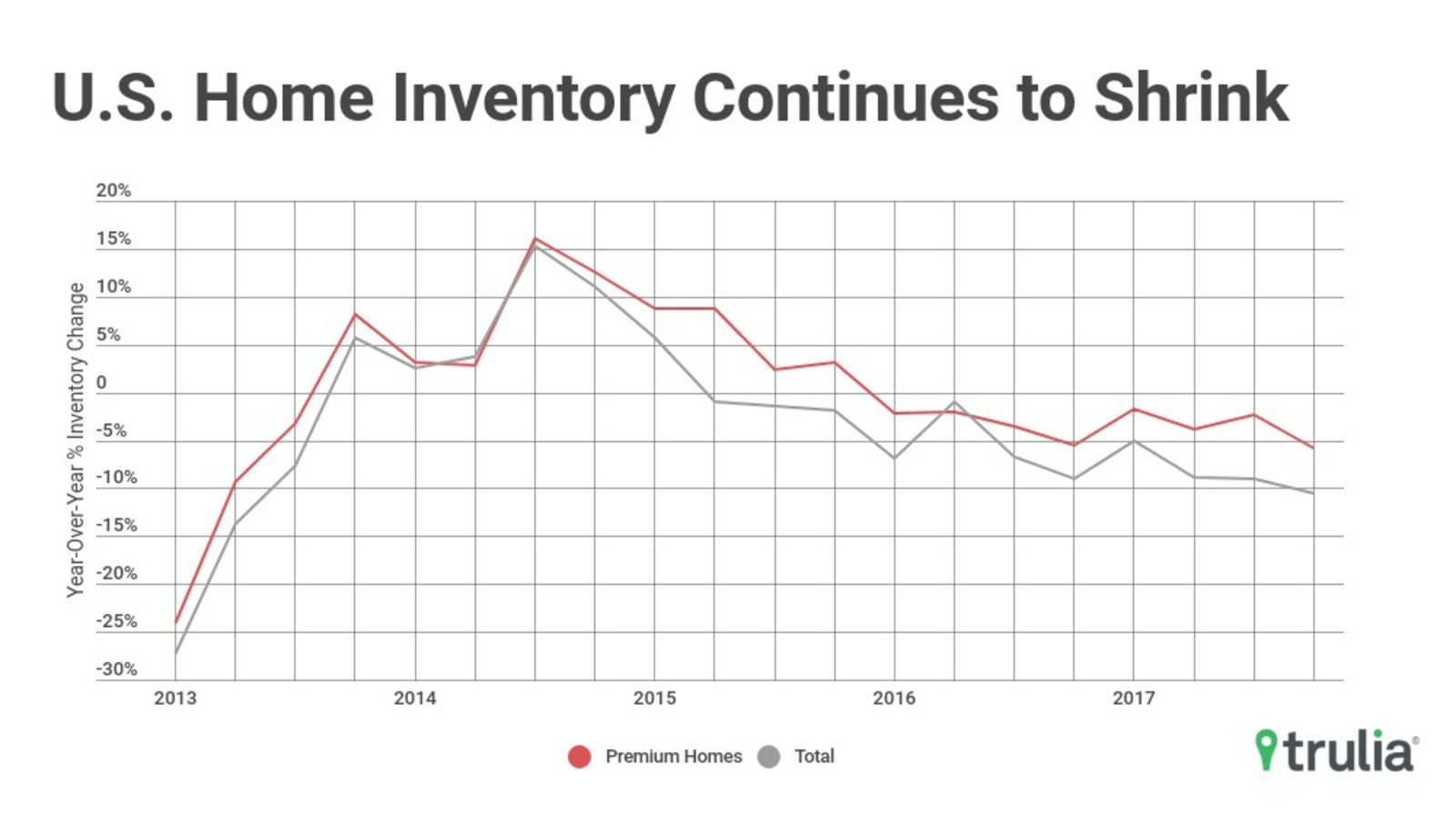

Housing inventory is shrinking, still, according to the recently released Trulia Inventory and Price Watch for the fourth quarter of 2017. Across the board, in the premium, starter and trade-up tiers, inventory has tumbled 10.5 percent year-over-year—the most considerable drop-off since 2013.

The issue is most pervasive at the entry level, which accounts for just 22.9 percent of available inventory. To compare, higher-end, or premium, supply comprises 53.1 percent.

“While the number of premium homes on the market have seen a sharp fall, they continue to make up a larger share of the for-sale market, which spells trouble for first-time homebuyers,” says Ralph McLaughlin, chief economist at Trulia. “Coupled with record-low inventory, saving enough money for a down payment will continue to be their biggest obstacle to homeownership.”

Affordability, as such, has dwindled. Buying a starter home necessitates 39.8 percent of monthly income, up 1.7 percent from the fourth quarter of 2016; buying a trade-up or premium home requires 25.8 percent and 14.0 percent, respectively.

The crisis could take a turn, however.

“While the inventory crunch continues, I’m cautiously optimistic that 2018 will be a year for inventory rebound,” McLaughlin says. “Not only is American optimism about selling homes at levels not seen since 2014, 16 percent of homeowners plan to sell a home in the next two years. If we see them follow through, there may finally be an uptick in inventory.”

For more information, please visit www.trulia.com.

For the latest real estate news and trends, bookmark RISMedia.com.