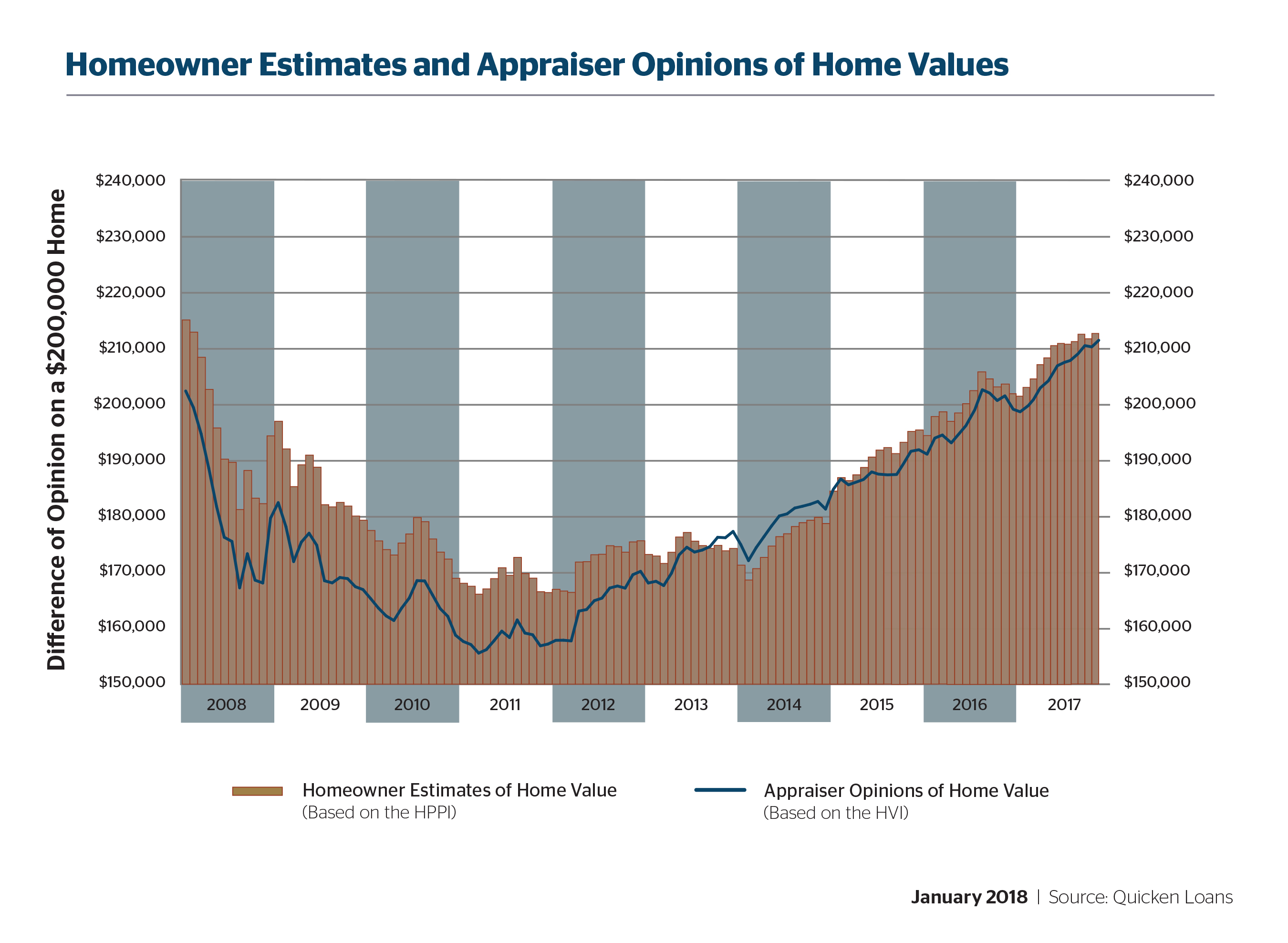

Appraisals arrived 0.5 percent below what was expected by homeowners in December, according to the latest Quicken Loans’ National Home Price Perception Index (HPPI). The latest Quicken Loans National Home Value Index (HVI) shows appraised values rose 6.17 percent year-over-year.

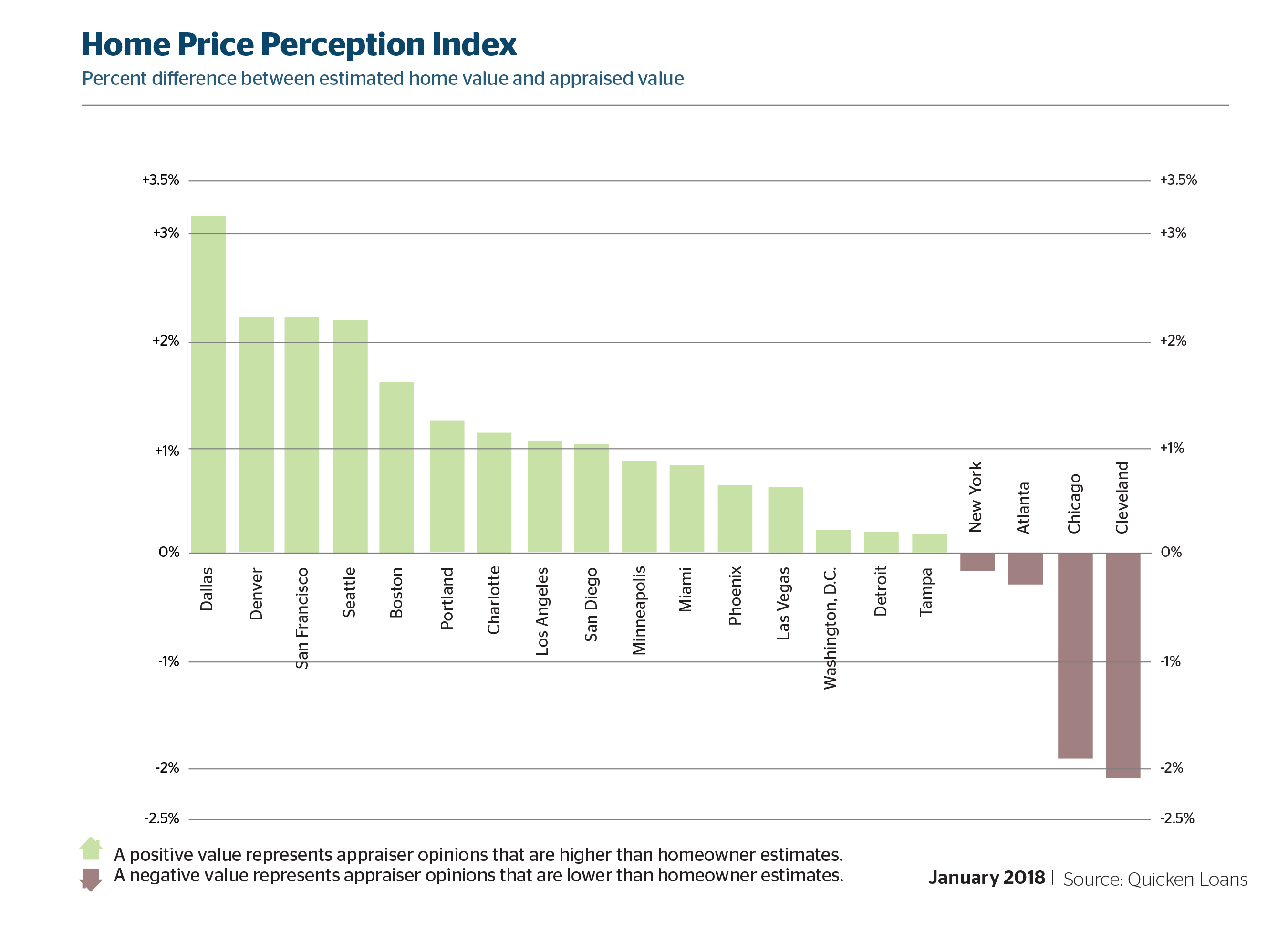

Although the average appraisal continues to lag homeowner estimates, the gap between the two numbers was narrower in December than it has been since March 2015. The current narrowing trend is in its seventh straight month. While perceptions vary between metro areas, they are improving at the metro level. A negative value, which indicates that appraiser opinions are lower than homeowner perceptions, was only indicated in a quarter of metro areas measured by the HPPI.

“Appraisers and real estate professionals evaluate their local housing markets daily. Homeowners, on the other hand, may only think about their housing market when they see ‘for sale’ signs hit front yards in the spring or when they think about accessing their equity,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “This is reflected in the HPPI. The housing markets that are rising quickly, like those in the West, are having appraisal values increasing above owner estimates because owners don’t realize just how quickly those markets are advancing.”

The HVI, the only measure of home value change based solely on appraisal data, showed promising growth. Values rose 0.5 percent from November to December, and 2017 ended on a strong note, with the HVI rising 6.54 percent from January to December. The Northeast is the only region to show a monthly dip in value, but all regions reported annual growth—topping out with a 7.42 percent jump in the West.

“Homeowners received the gift of added equity this holiday season,” Banfield says. “With several years of growth, owners may have more equity than they realize. Many consumers use the tax season at the beginning of the year to reevaluate their entire financial life. It also provides a good opportunity for them to consider how best to take advantage of their equity while mortgage interest rates and borrowing costs are still near record lows.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.