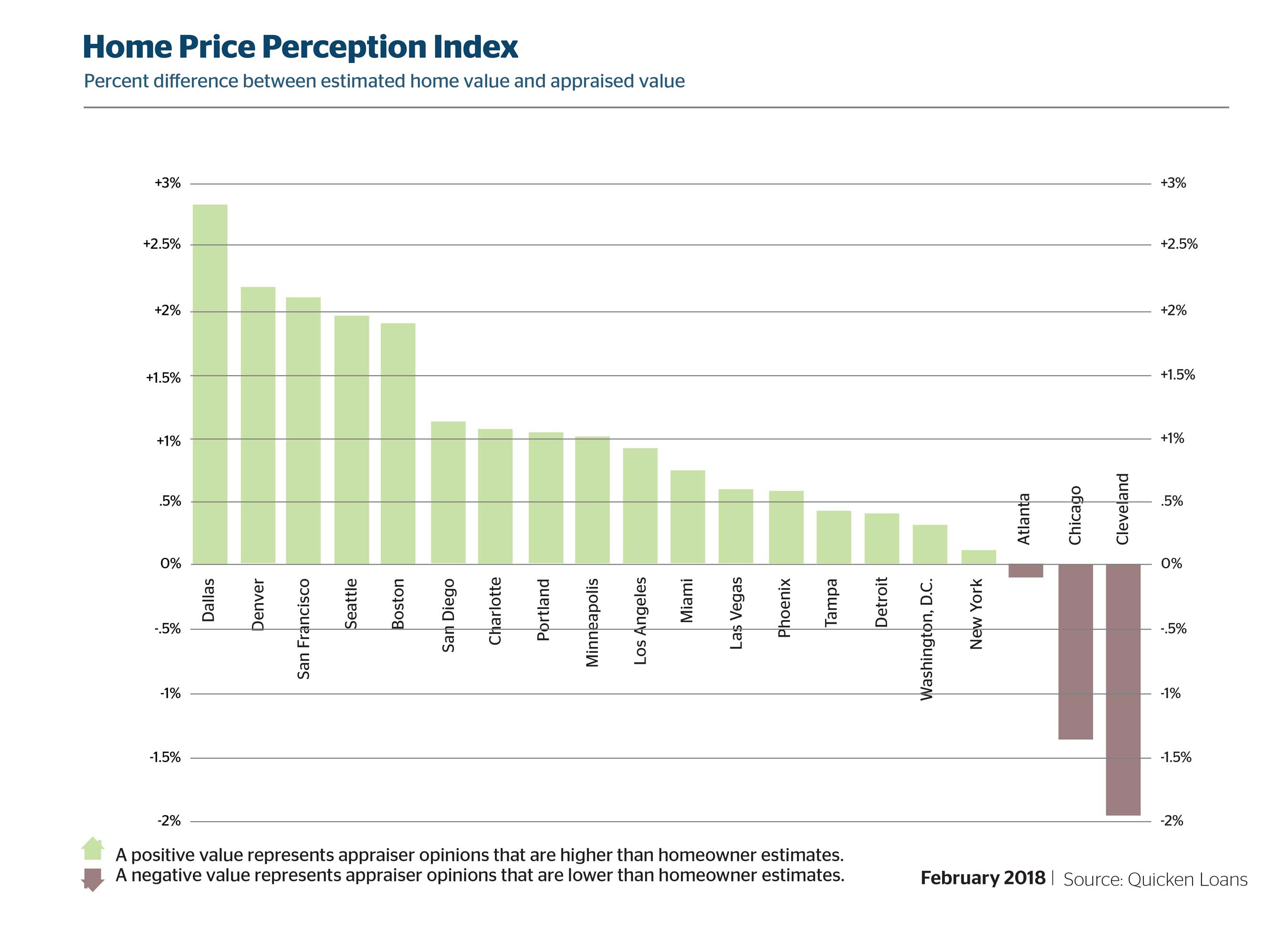

Appraisals are off by a larger margin, 0.6 percent below what was expected by homeowners in January, according to the latest Quicken Loans’ National Home Price Perception Index (HPPI). The latest Quicken Loans National Home Value Index (HVI) shows appraised values rose 7.03 percent year-over-year.

Appraisals in January were an average of 0.6 percent lower than the estimate homeowners give at the beginning of the mortgage process, as measured by the National HPPI. While not a drastic change from December, this marks the first decrease in the HPPI in eight months; however, January’s National HPPI value is much improved compared to the same time last year, when appraiser opinions were 1.47 percent lower than owner expectations.

“The appraisal is one of the most important pieces of data in the mortgage process,” says Bill Banfield, executive vice president of Capital Markets for Quicken Loans. “Often the entire transaction hinges on the appraisal showing a number similar to what the homeowner estimated at the beginning of the process. If the appraisal is lower, it could mean the homeowner needs to bring additional cash to close, or the loan may need to be reworked. It’s very promising to see the homeowner estimate and the appraiser opinion so close together.”

Home equity continued to rise across the country in January, with appraisal values increasing 0.46 percent from the previous month and jumping 7.03 percent as compared to the previous January. The only region that dropped in value was the South, showing a 0.54 percent decrease from December to January. Every region reported annual appraisal growth with the West continuing to lead the way.

“Low inventory of homes available for sale and a growing economy has led to steadily rising home values as indicated by the strong annual increase of the HVI index,” Banfield says. “The recent increase in interest rates could test affordability in the short run, but the desire to own a home remains on firm ground and may ultimately help normalize the inventory issues.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.