Changes to the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac are on the table—and although they intend to mitigate risk to taxpayers, they could harm homeowners in the process, according to an analysis by Zillow. Borrowers, in fact, could be burdened by hundreds more on their monthly mortgage payment.

The GSEs’ guarantee is associated with favorable rates (though not explicit, it is implied that the government will not allow the GSEs to fail); however, there could be higher rates and shorter terms if the guarantee is modified. The analysis found:

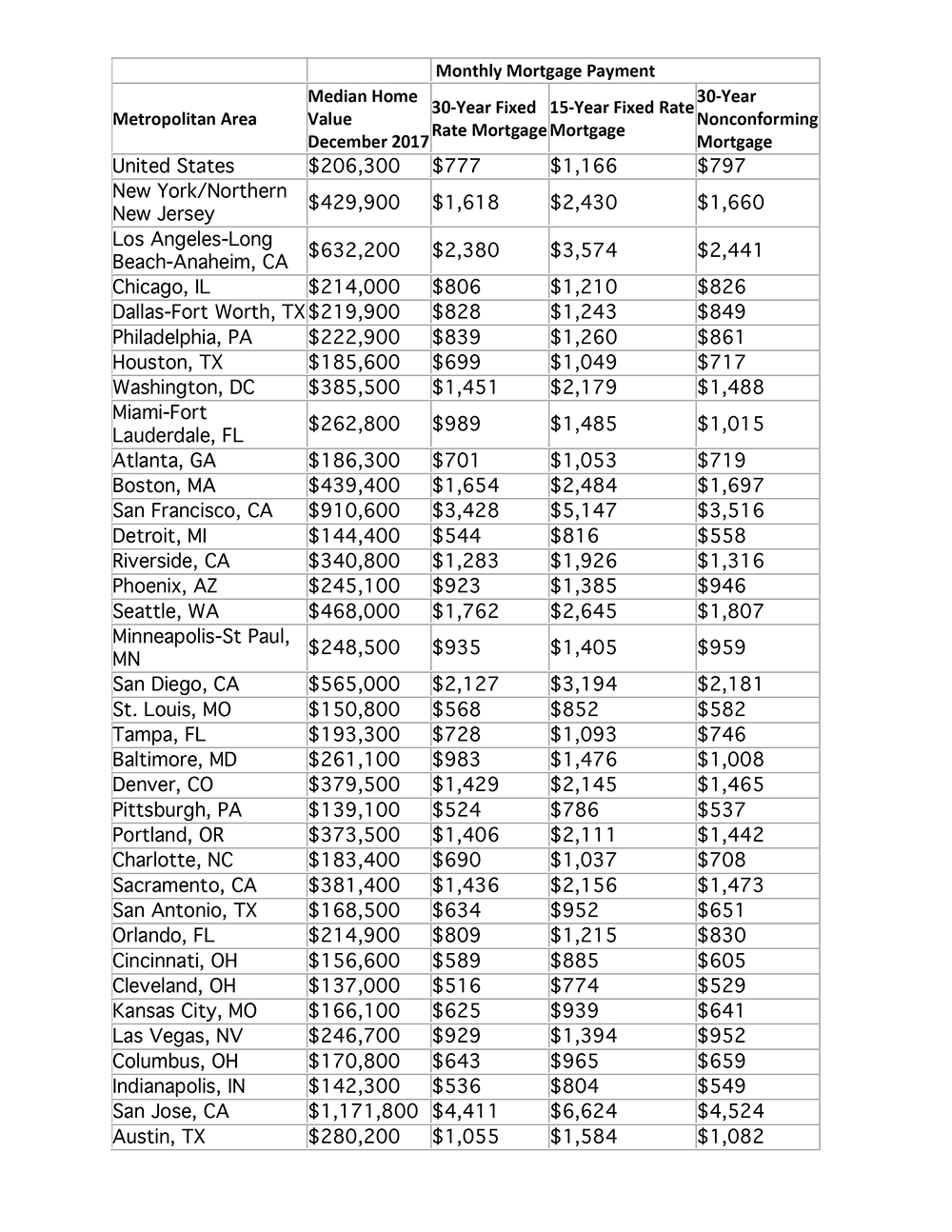

- The average borrower’s monthly mortgage payment, now with a 15-year, fixed mortgage on a home at the median value ($206,300), would go up $389 to $1,166 (compared to a 30-year, fixed mortgage, all conditions identical, which has a $777 monthly payment).

- The average borrower’s monthly mortgage payment, now with a 30-year, jumbo/non-conforming mortgage (generally not guaranteed by the GSEs) on a home at the median (national) value, would go up $20 to $797 (compared to the above 30-year, fixed mortgage scenario).

If Congress follows through on the proposed reforms, affordability could suffer, says Aaron Terrazas, senior economist at Zillow.

“Some GSE reform proposals could lead to the end of the 30-year mortgage as we know it, which has long been the bedrock for financing homeownership in America,” Terrazas says. “If monthly payments do rise and, more importantly, stay elevated, at some point we’d expect home prices to come down a bit in response to this decreased purchasing power, and some long-time owners could opt not to sell to preserve their smaller monthly payments. A shorter loan period would mean the lifetime cost of the home is lower, and some households may be able to absorb the extra monthly cost on their mortgage, but in the nearer term, first-time homebuyers or buyers on the margin could feel a real pinch as homeownership becomes significantly less affordable.”

According to the analysis, the implications in the largest metros:

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.