Appraisals are better checking out with what owners perceive, just 0.53 percent below what was expected by homeowners, according to the February Quicken Loans National Home Price Perception Index (HPPI). The Quicken Loans National Home Value Index (HVI) shows appraised values rose 6.37 percent year-over-year.

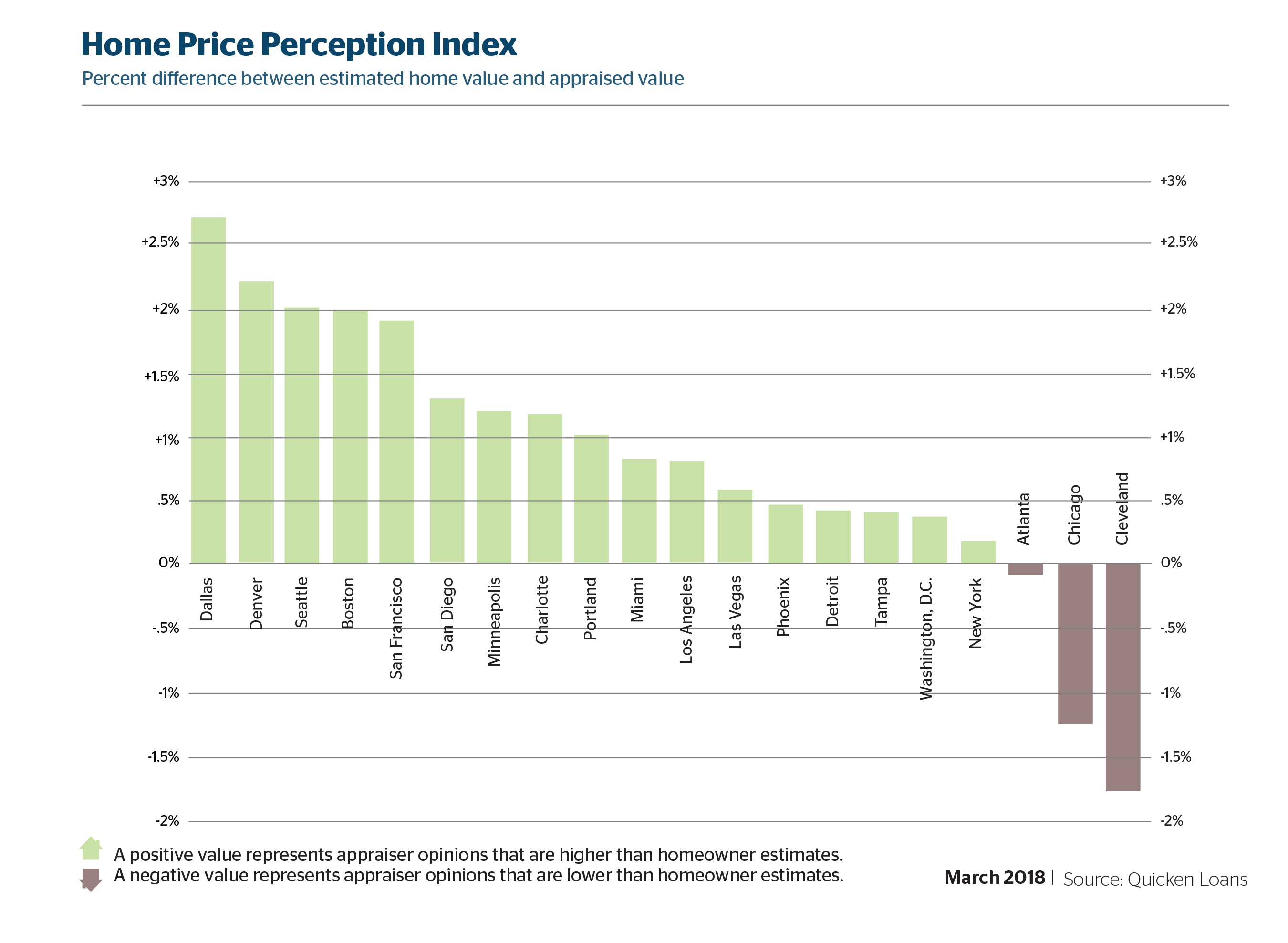

Appraisals continue to fall short of owner expectations; however, the difference between the two data points is shrinking. The Quicken Loans HPPI reported appraiser opinions of home values were an average of 0.53 percent lower than what owners expected, at a national level. Bucking the national trend, more than three quarters of metro areas measured have appraisal values that are higher than owner estimates. The leader among them is Dallas, with appraisals an average of 2.72 percent higher than expected.

“The Home Price Perception Index is a perfect example of how localized housing is across the country,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “The fact that appraisals are showing home values nearly 3 percent higher than expected in Dallas, but the average appraisal is lower than the owner estimates by almost 2 percent in Philadelphia, illustrates this to a T. Dallas is an incredibly hot housing market right now, and appraisers are seeing just how fast home values are climbing. When shopping for a home, or even refinancing a current mortgage, consumers should always keep the changes in their local market in mind before estimating a home’s value.”

The Quicken Loans HVI reported that annual home equity continued its ascent in February, but the pace slowed slightly. Appraisal values increased 6.37 percent compared to February 2017, despite a monthly decrease of just 0.07 percent. The West was the only region with a monthly drop in home values, showing a 1.87 percent decrease from January to February. On the other hand, the Midwest had the largest gain in year-over-year home value growth, showing a 7.23 percent jump from February 2017.

“With little movement in the HVI data from January to February, it’s clear the same narrative from the beginning of the year remains,” Banfield says. “Low home inventory continues to be a drag on the housing market. As the economy grows and more consumers are in the right place financially to purchase a home, the high demand is driving prices up. As we move into the spring selling season, all eyes will be on whether today’s strong economy can support the higher prices.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.