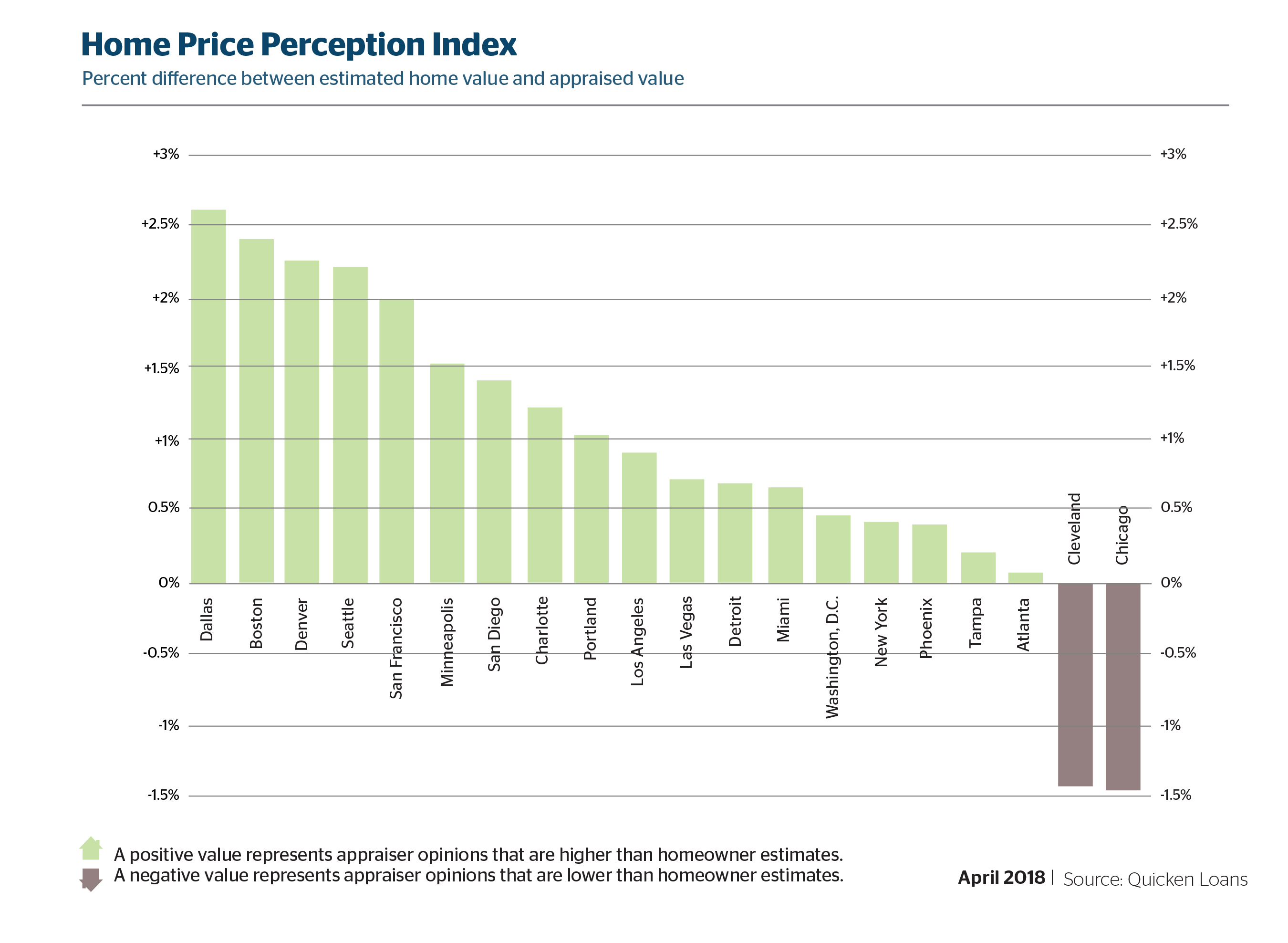

Appraisals are closing in on estimates by homeowners, just 0.36 percent below what was expected, according to the March Quicken Loans National Home Price Perception Index (HPPI). The Quicken Loans National Home Value Index (HVI) shows appraised values rose 7.64 percent year-over-year.

“This month’s HPPI is great news for homeowners who may be thinking of selling their home, or using some of their equity,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “Not only are owners’ and appraisers’ views of the housing market getting closer together when looking at the nation as a whole, but homeowners in many major areas are building equity at a rapid pace.”

The HPPI in March is an improvement from February, when appraisals lagged behind owner expectation by 0.53 percent. Additionally, more than 80 percent of the metro areas reviewed in the HPPI showed appraisals at, or higher than, the owner’s estimate. Owners estimate their home’s value at the beginning of the mortgage process. Then, later in the process, an appraiser provides their opinion of the home’s value.

Home equity is also continuing to climb, according to the HVI, a measure of home value change based solely on appraisal data. Nationally, home values rose an average of 1.84 percent in March. Even more promising, the national index grew 7.64 percent in the past year. Every region followed the trend of increased appraisal values, ranging from the Northeast showing 5.53 percent home value growth to the West reporting a 9.99 percent jump in appraisal values.

“A monthly increase in home values, after a stable report last month, shows that demand for the few available homes for sale ramped up in March,” Banfield says. “The true test will be whether more homeowners decide to take advantage of their higher home value and provide some much-needed inventory for buyers.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.