Affordability is a growing problem—but for black buyers, it has created a deep disadvantage over other groups, according to an analysis newly released by Zillow.

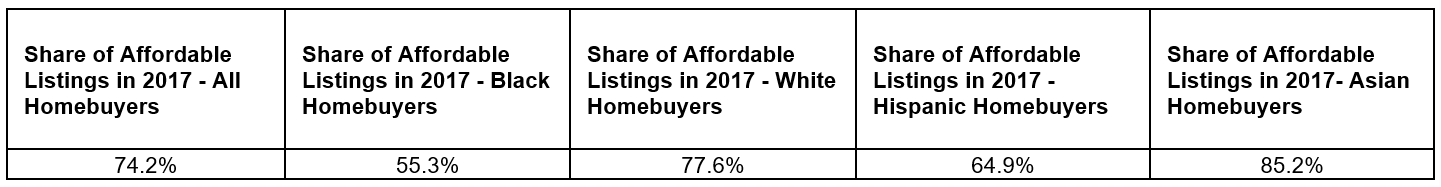

Based on the black household income (a median $39,466), and without exceeding the 30 percent housing spend standard, black buyers could afford just 55.3 percent of listings nationwide in 2017—a considerable disparity from Asian buyers, and buyers who are Hispanic or white:

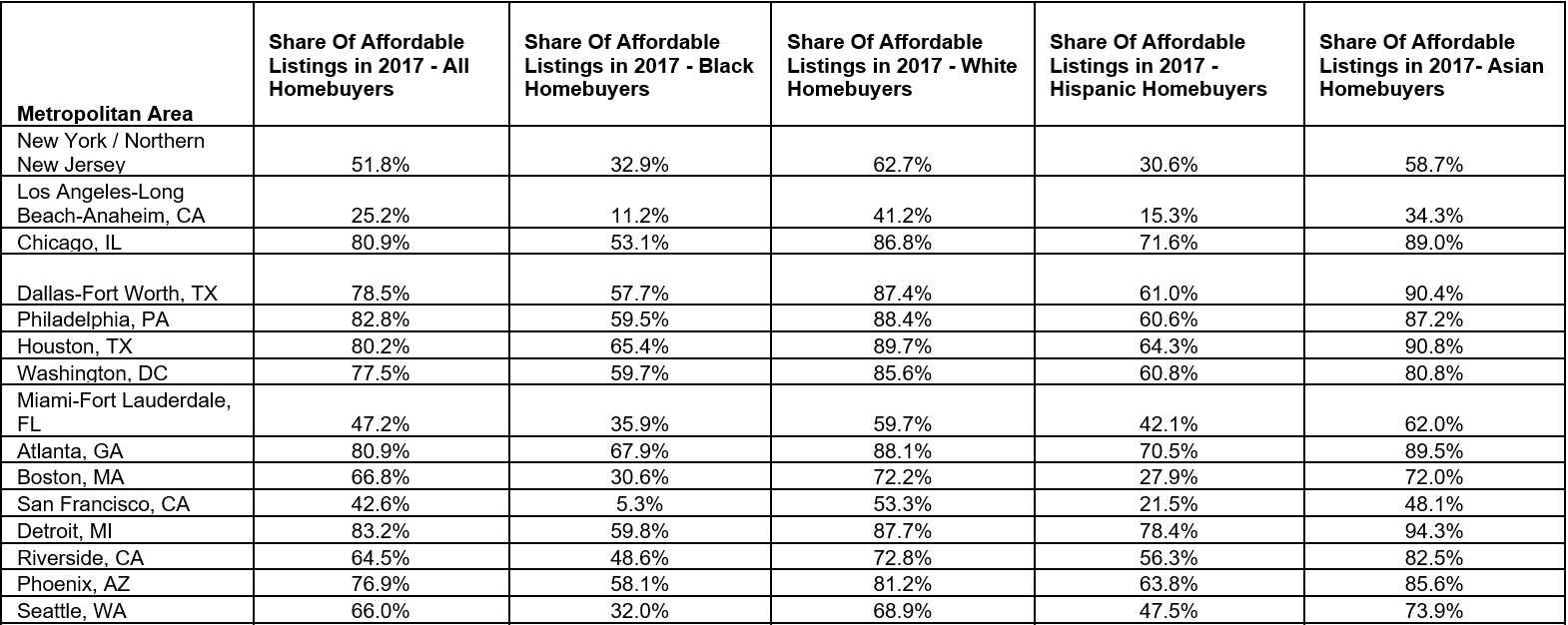

Across the 20 largest markets, there are areas with different proportions:

Considering the financial implications of homeownership—namely, wealth—the gap is limiting opportunities.

“The divide between black and white Americans has proven stubbornly persistent across the long arc of American history, visible in incomes, accumulated wealth and homeownership,” says Aaron Terrazas, senior economist at Zillow. “Greater wealth eases the path to homeownership, and the relationship becomes self-reinforcing: Homeowners have greater access to financial wealth that, in turn, makes it easier to become and remain homeowners. Distinct racial and ethnic gaps in homeownership exist nationwide, which could have long-lasting implications for future generations.”

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.