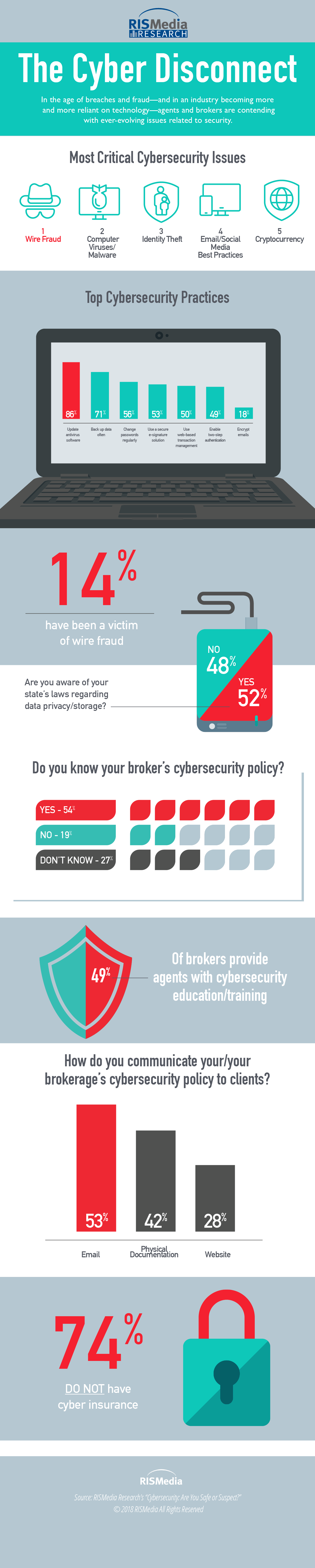

In the age of breaches and fraud—and in an industry becoming more and more reliant on technology—agents and brokers are contending with ever-evolving issues related to security.

Disconcertingly, many either do not have a brokerage cybersecurity policy, or are not aware that one exists—a unique vulnerability, according to findings from the new RISMedia Research survey, “Cybersecurity: Are You Safe or Suspect?” Although 54 percent of the agents and brokers who participated in the survey have a cybersecurity policy, 27 percent are “not sure,” and 19 percent have no policy at all.

Education is lacking, the findings reveal. Agents and brokers are divided on knowledge of the laws pertaining to data privacy and storage: 52 percent know their local statutes, but 48 percent do not. Of the brokers surveyed, 50.2 percent have no agent cybersecurity education or training, but 49.8 percent do—an almost even split. As demonstrated in recent years, information that is mishandled can have ramifications for agents and brokers, who can be held liable, and clients, who have been compromised.

Consumer education is key. Approximately 53 percent of those surveyed inform their clients about their cybersecurity practices/policy by email, 42 percent with a document(s), and 28 percent via their website. Many communicate their cybersecurity policy face-to-face or on the phone throughout the transaction.

The Biggest Issues

The conversation around cybersecurity is focused largely on wire fraud, in which criminals commonly “phish” for transactions—and it was the No. 1 concern cited by respondents (37 percent). Although the majority of those surveyed have not been directly impacted—just 13.7 percent reported they have—many have had attempts made.

“We’ve been able to intercept threats to date, but it’s becoming more frequent,” one respondent said. “This is a big concern.”

“I wasn’t directly involved in the case, but one person asked me to assist her to find housing after she lost thousands of dollars in a wire fraud,” said another respondent.

Of those who have been victimized, 62 percent could not retrieve what was stolen.

Prevention

Despite the challenge continuously developing, agents and brokers are adopting practices to stave off threats, including antivirus software, backing up data and changing passwords regularly. Many also have an e-signature system, and some enable two-step authentication and/or encrypt emails. One-quarter of respondents, roughly, have cyber insurance, which is above and beyond their errors and omissions policy.

“I do whatever I can to ensure cybersecurity,” one respondent said. “I try not to talk to unusual phone calls regarding internet network security, or give access to my computer to potential hackers.”

Get more findings in the following infographic:

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.