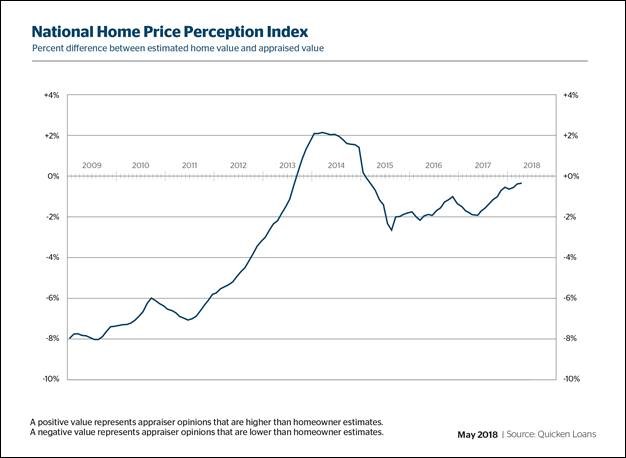

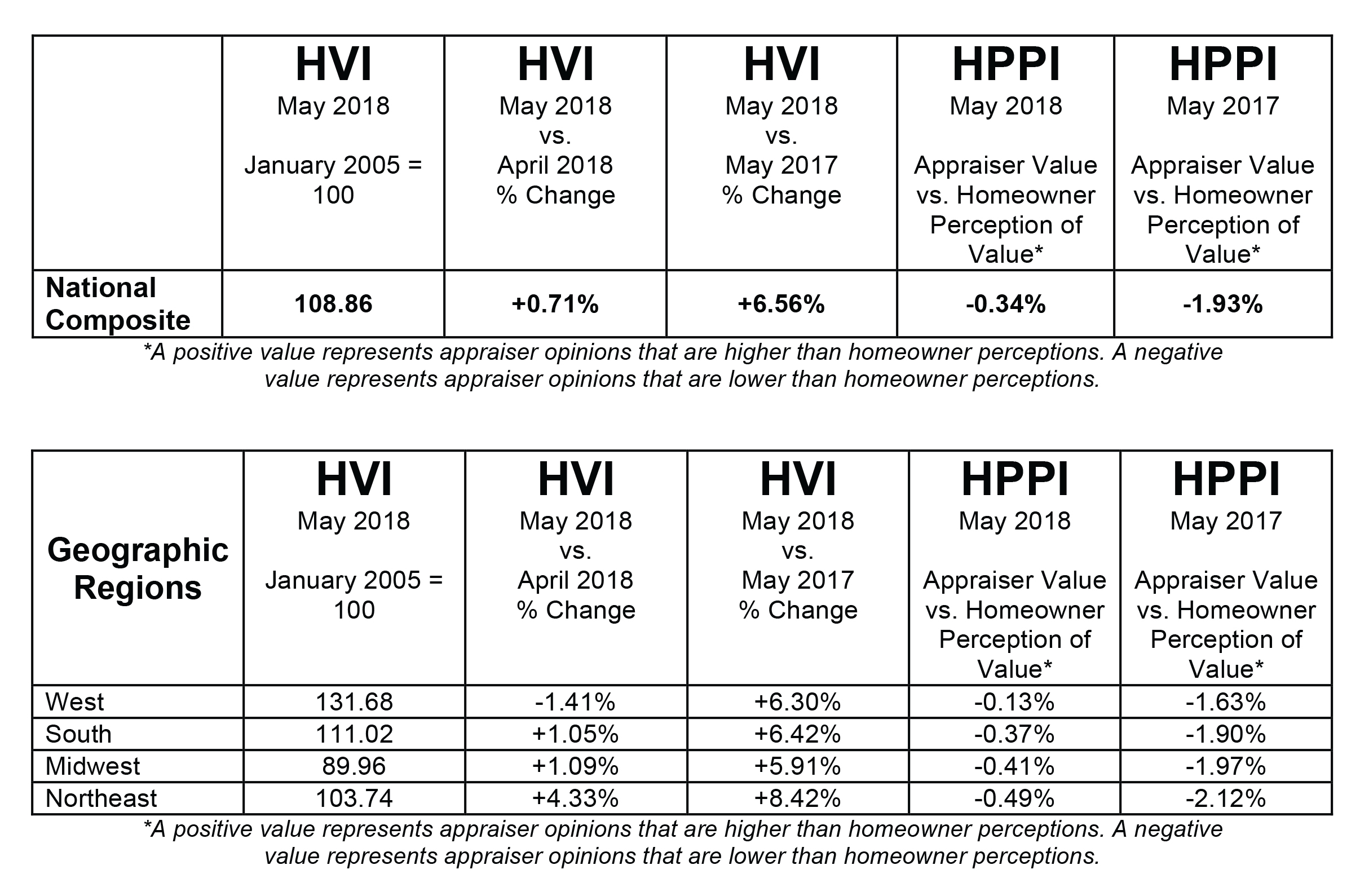

Homeowners and appraisers are coming closer to being on the same page, and in an increasing number of metro areas, appraisals are even higher than what owners expected. In May, appraised values were 0.34 percent lower than expected, according to Quicken Loans’ National Home Price Perception Index (HPPI). This is a vast improvement from the year prior, when the gap between the appraisers’ and owners’ opinions was five times larger.

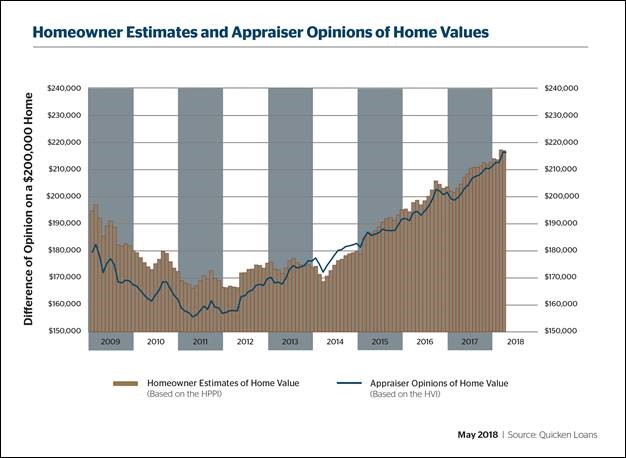

Both perceptions of home values and the appraisal values themselves are improving. Quicken Loans’ National Home Value Index (HVI) reported 0.71 percent growth in May. Appraisal values rose even more on an annual basis, jumping 6.56 percent year-over-year.

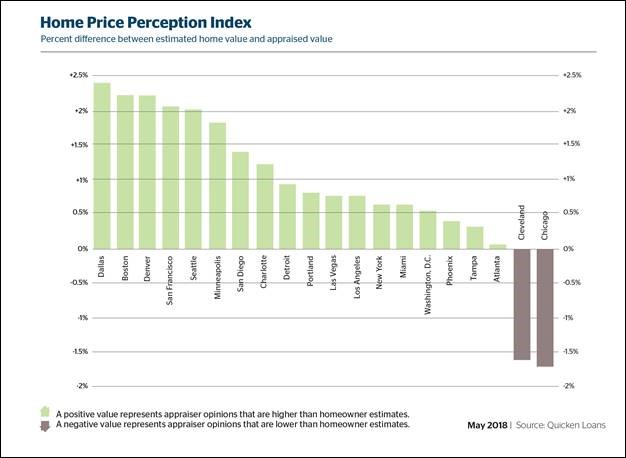

Home Price Perception Index (HPPI)

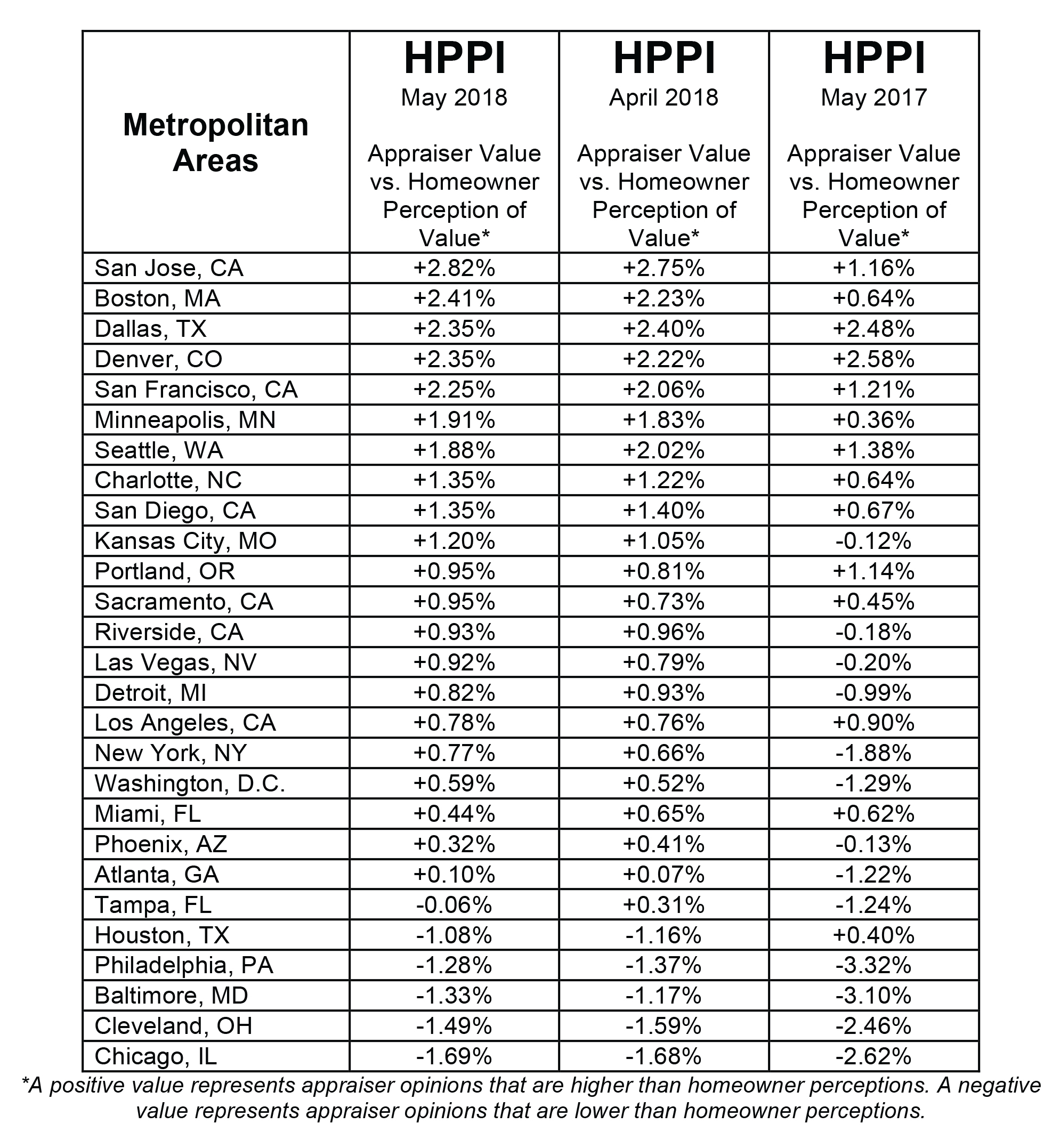

In the heart of the spring real estate season, homeowners are increasingly understanding their home values. Nationally, appraisal values are an average of 0.34 percent higher than owners expected, according to the HPPI. A slight tick up from April’s level, but a minuscule difference overall. While home value perceptions vary from city to city, more metro areas are experiencing appraisals that are actually higher than expected. This is the case in three quarters of the cities studied in the HPPI. Homeowners in San Jose, for example, are receiving appraisals that are an average of 2.82 percent higher than they expected. Homeowners in The Windy City, on the other hand, are receiving appraisals an average of 1.69 percent lower than what they estimated.

“Real estate is incredibly local, from style preferences to the direction of the market and everything in between,” said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. “Our hope is that this report can help homeowners realize that national headlines don’t always apply in their community. It’s important homeowners talk to real estate or mortgage experts who have experience analyzing their community when they’re thinking of selling, or utilizing their home’s equity.”

Home Value Index (HVI)

Home appraisal values rose 0.71 percent in May, according to the Quicken Loans HVI – the only measurement of home-value changes based solely on appraisal data. Annually, home values posted healthy growth, increasing 6.56 percent year-over-year. The West was the only region to buck the trend of monthly gains – posting a 1.41 percent decline in value from April to May. All four regions analyzed show annual growth ranging from a 5.91 percent increase in the Midwest to an 8.42 percent jump in the Northeast.

“As we hit peak real estate season, the number of eager buyers continued to outpace the number of homes that were available, which has led to surges in appraisal values across the country and especially in the Northeast,” Banfield said. “The only remedy is to accelerate the pace of construction to fill this need.”

For more information visit Quicken Loans.

For the latest real estate news and trends, bookmark RISMedia.com.