Against insufficient inventory and mounting prices, international sales are sliding, according to the National Association of REALTORS® (NAR) 2018 Profile of International Transactions in U.S. Residential Real Estate, an annual survey.

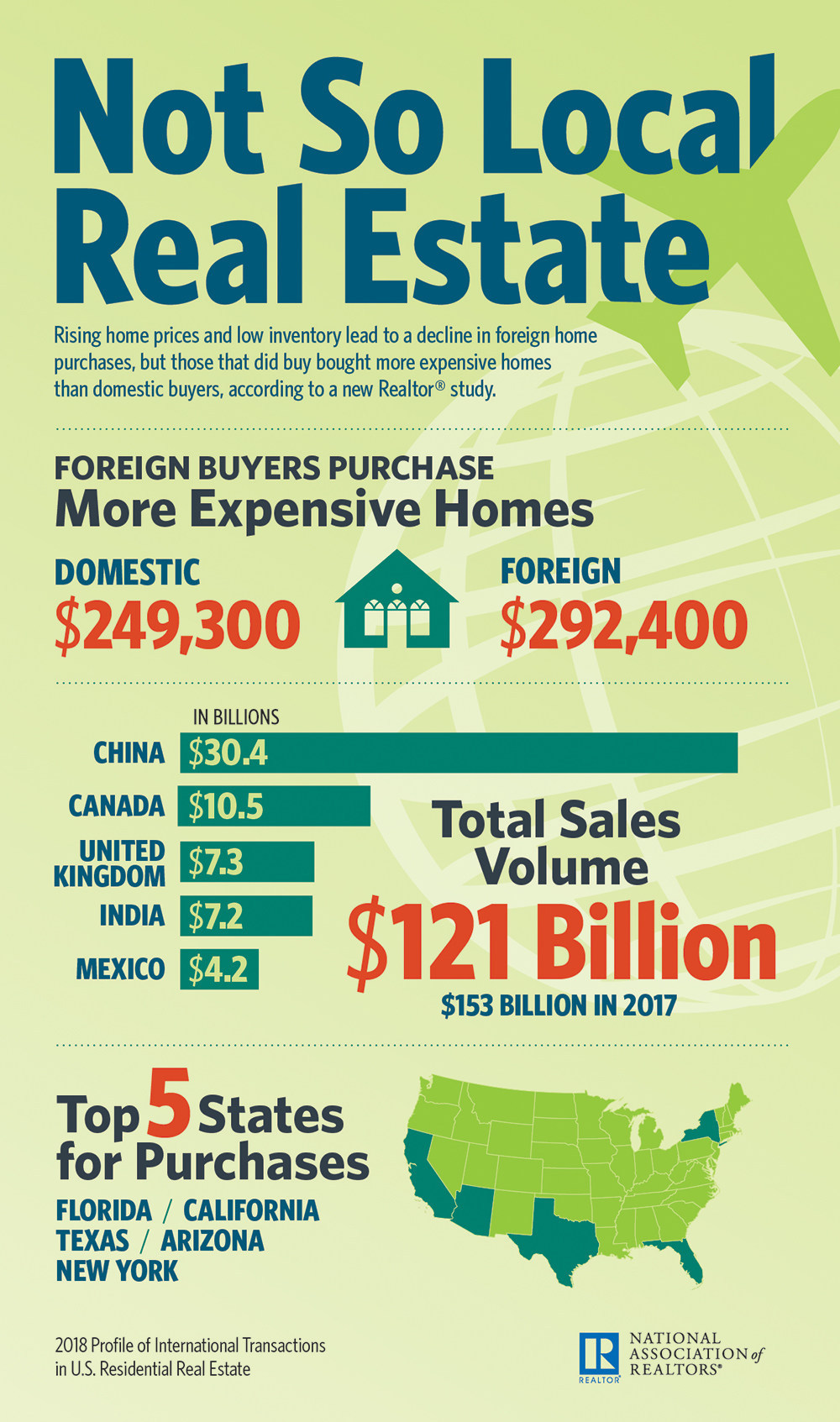

Foreign home purchases sank 21 percent from April 2017 to March of this year, and, a considerable share of those surveyed “don’t know” what the future holds for the international segment. Comprising 8 percent of existing-home sales, there was $121 billion in international sales in that time—a decline from a 10 percent piece of the pie the prior year.

“After a surge in 2017, we saw a decrease in foreign activity in the housing market in the latest year, bringing us closer to the levels seen in 2016,” says Lawrence Yun, chief economist at NAR. “Inventory shortages continue to drive up prices, and sustained job creation and historically low interest rates mean that foreign buyers are now competing with domestic residents for the same, limited supply of homes.”

Forty-four percent of those surveyed “don’t know” what the international outlook is, while 25 percent expect foreign home purchases to remain the same, or shrink. According to Yun, the cause is the current haziness on immigration and trade.

“The saying goes that all real estate is local, but that does not mean that all buyers are,” says NAR President Elizabeth Mendenhall. “Even in this current global environment of political uncertainty, the U.S. real estate market continues to be seen as a safe, secure and profitable place to invest in property.”

Again, buyers from China had the most dollars invested, and by a landslide, at $30.4 billion, followed by Canada at $10.5 billion, the UK at $7.3 billion, India at $7.2 billion, and Mexico at $4.2 billion, the Profile shows. Buyers from China also made the most expensive purchases, at a median $439,100, and the highest investment in terms of units.

According to the survey, the motivation to purchase varied, but the majority were primary residences (52 percent), and likely detached, single-family properties. All-cash comprised 47 percent of sales.

Approximately 10,300 REALTORS® responded to the survey.

For more information, please visit www.nar.realtor.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.