Earlier this month, Hurricane Florence blasted through the Carolinas and Virginia, leaving a path of flood and wind damage in its wake.

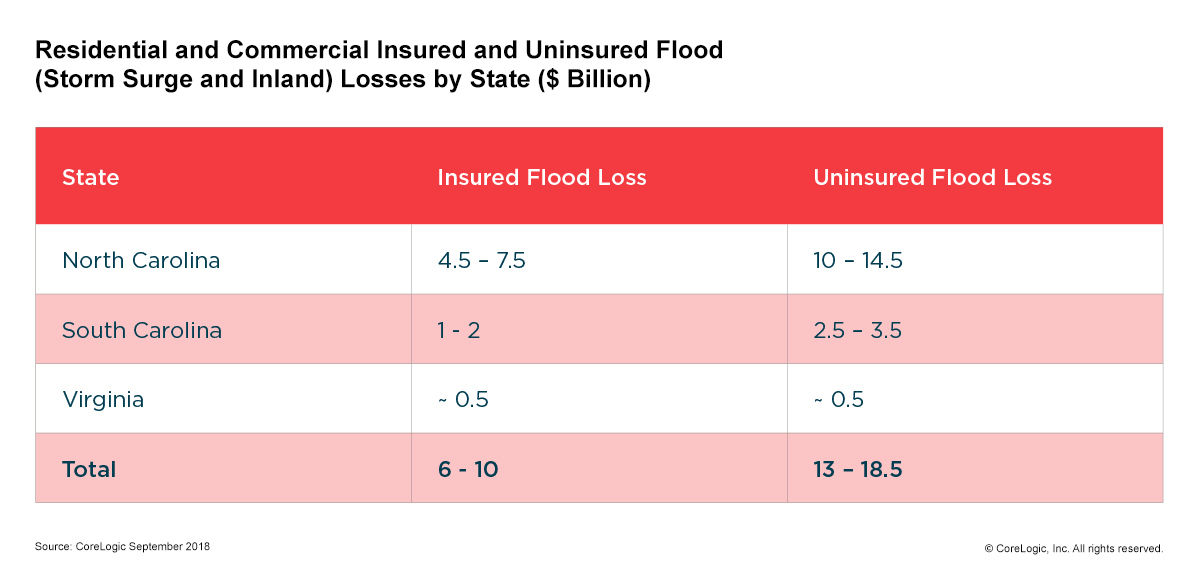

According to an analysis by real estate data provider CoreLogic, residential properties in the Carolinas and Virginia sustained between $19-$28.5 billion in damage, which includes impact from both inland flooding and storm surge. Of that amount, an estimated $13-$18.5 billion is in uninsured losses. Flood losses insured by the National Flood Insurance Program (NFIP) are estimated to be $2-$5 billion, and wind losses are estimated to be an additional $1-$1.5 billion.

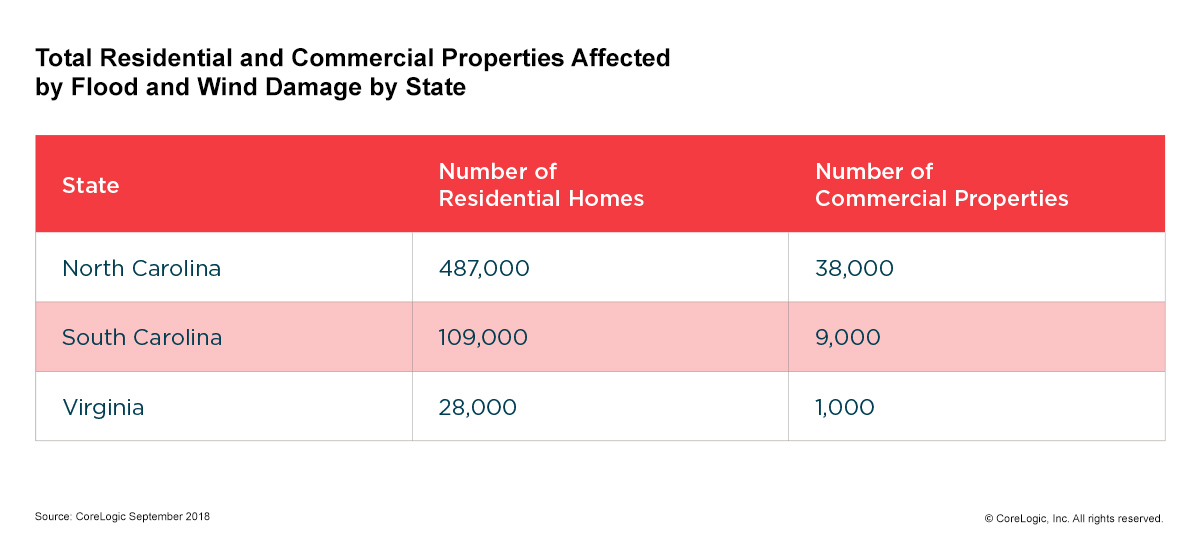

In total, CoreLogic estimates that flooding and wind damaged 487,000 residential homes in North Carolina, 109,000 in South Carolina and 28,000 in Virginia.

The House recently passed a five-year FAA reauthorization with a bill—the Aviation, Transportation Safety, and Disaster Recovery Reforms and Reauthorization—that includes relief funding designed to expedite recovery efforts for Florence-impacted areas. The FAA’s current authorization was set to expire on September 30; however, the House approved a one-week extension and the Senate is expected to vote shortly (at press time), according to Aviation International News.

“…Even today, over a week after the storm made landfall, flooding remains a significant concern for families in both North and South Carolina,” said NAR President Elizabeth Mendenhall in a statement. “In these times, we are reminded of the importance of peace of mind for property owners with access to quality and affordable flood insurance, and maintain our call for Congress to pass responsible, long-term NFIP reauthorization. We commend the House for passing H.R. 302, and urge the Senate to take up this important legislation quickly.”

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.