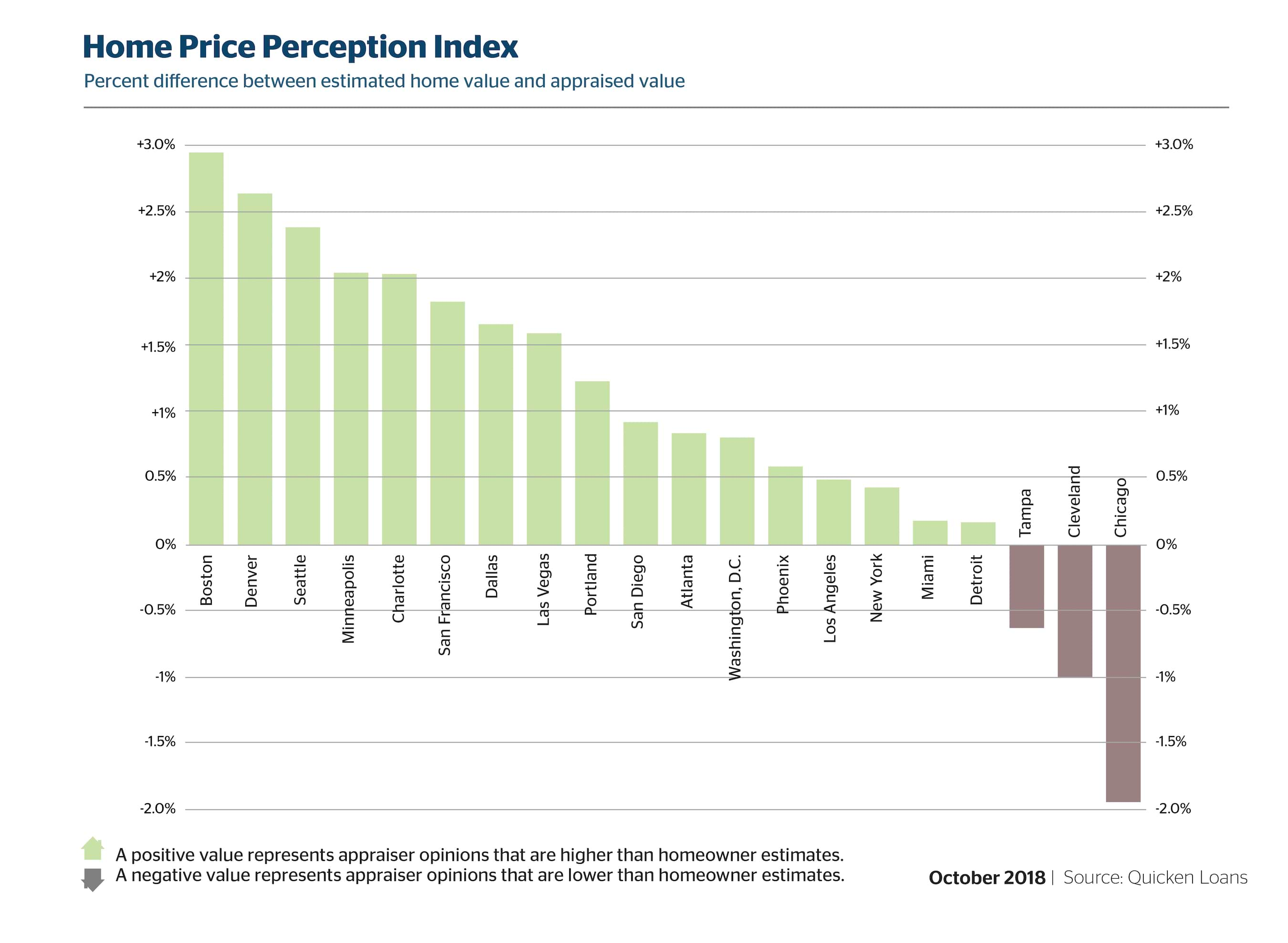

Appraisals came in 0.29 percent shy of what homeowners perceived in terms of value, according to the Quicken Loans National Home Price Perception (HPPI). Appraised home values rose 5.69 percent year-over-year, according to the Quicken Loans National Home Value Index (HVI).

“A wide gap between the estimated home value and the appraised value can cause a mortgage to be reworked, or, in some cases, scrapped altogether,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “All the more reason for homeowners to be realistic when their mortgage banker asks them what they think their home is worth when they start the financing process. Our hope is that the HPPI data on past neighbor transactions can help a homeowner better estimate the value of their home in order to set their financing up for success.

“Rapid price increases that have spanned more than half a decade have started to affect affordability as average wage increases struggle to keep up,” Banfield says. “While home values are still rising, especially with solid annual jumps, a slowdown in monthly growth is expected to allow the market balance with the more moderate inflation.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.