College debt is hindering homebuyers, draining more than $92,000 from a potential purchase, according to recently released research from Zillow.

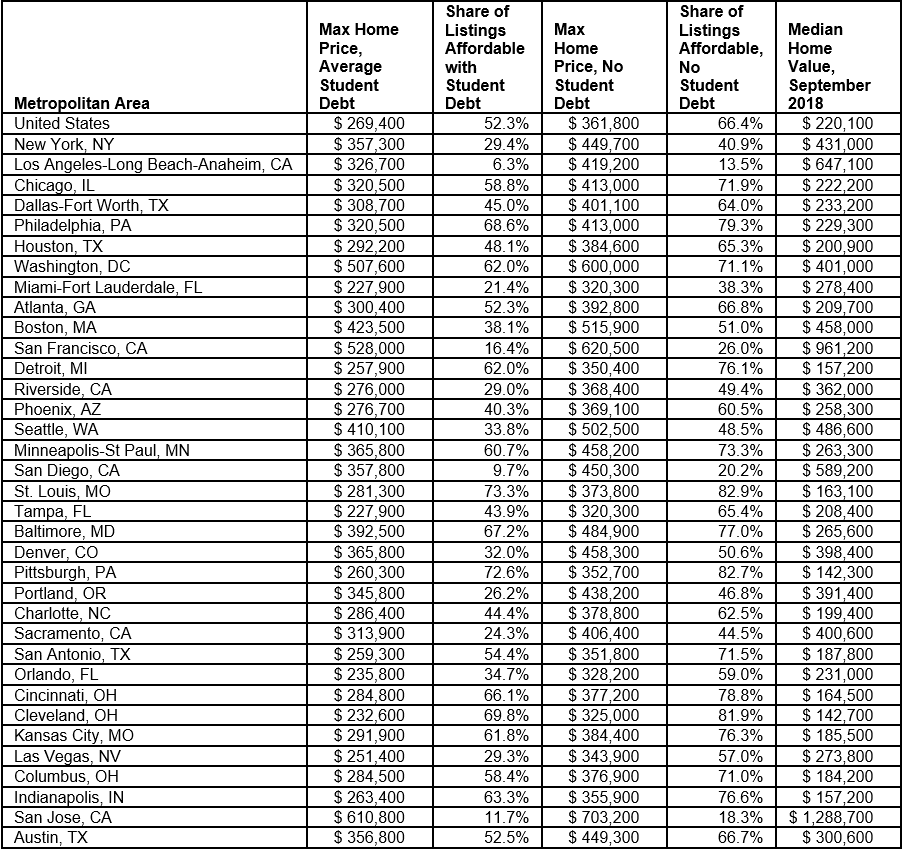

In the average scenario, an aspiring buyer with college debt has $388 in monthly payments, according to Zillow. Assuming the buyer observes the “30 percent” standard—that is, not exceeding 30 percent of their income on housing and their loans—he or she can afford a home priced up to $269,400. Approximately half (52.3 percent) of listings on the market now are in that range.

By comparison, a buyer without college debt can spend up to $361,800, which broadens the pool significantly: 66.4 percent of listings. The difference is a staggering $92,400.

With the bite out of the budget, buyers have less options—a challenge compounded by already low inventory in the starter tier, where many are looking to purchase.

“Higher education pays off when it comes to lifetime earnings and the long-term odds of homeownership, but carrying any kind of debt limits how much homebuyers can afford,” says Aaron Terrazas, senior economist at Zillow. “For today’s generation of young homebuyers, who came of age in a period of rapidly rising education costs, student debt payments can delay the pace of down payment savings and put a dent in their max price point once they do decide to buy.

“With for-sale supply still tightest for the most affordable homes but increasingly available at higher prices, even a small reduction in a buyer’s target price point can result in substantially fewer options,” Terrazas says.

Thirty-four percent of aspiring buyers have college debt, either for themselves or for someone else, the research shows.

By market:

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.