Looking to recent years, the housing market was on a stanch trajectory: dried-up listings, mounting prices…and sales that struggled to take off.

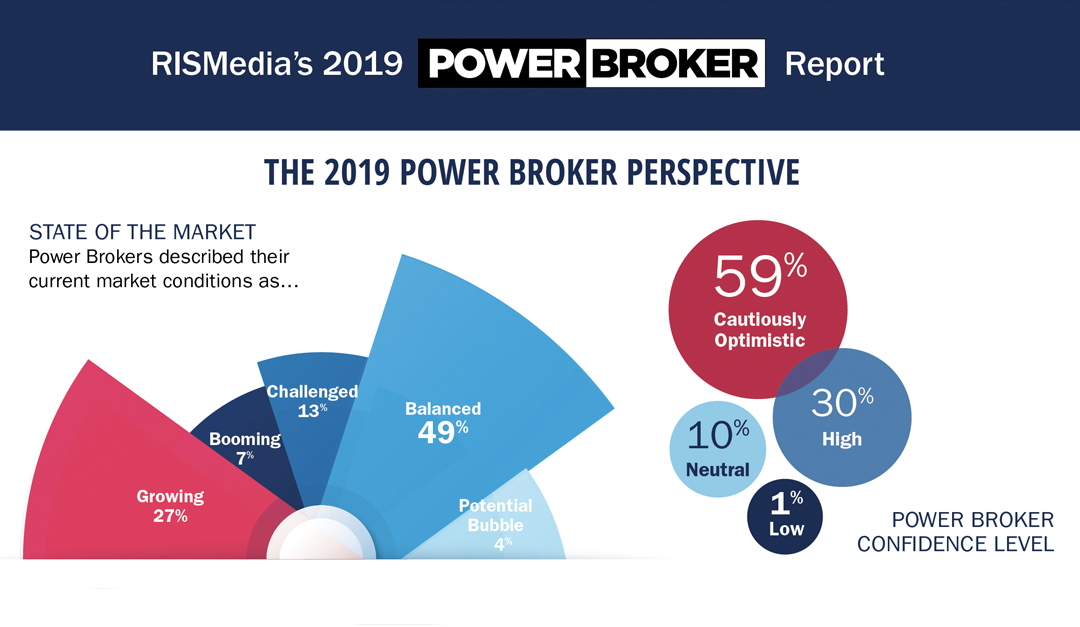

Now, as 2019 begins to crystalize, the market outlook is shifting, and Power Brokers have a decidedly different perspective. According to RISMedia’s 2019 Power Broker Report, 49 percent of Power Brokers are in a “balanced” market, and 27 percent are in a “growing” market. Their chief concern is inventory—again the No. 1 challenge, as in past years—but also a degree of economic uncertainty. In 2018, 1 percent of Power Brokers were contending with economic unknowns; in 2019, that share shot up to 25 percent.

On the Housing Market: Power Brokers Sound Off

“I believe there will be greater balance in U.S. housing in 2019 with home prices leveling off and home sales ticking up. I believe housing demand will remain firm across the U.S., as the employment picture is about as strong as it’s ever been, and wages are finally moving forward. Housing inventory remains a key issue. I believe help may be on the way. With wages growing and U.S. homeowners sitting on roughly $14.5 trillion in real estate equity—an all-time high—the time may be right for more people to list their homes and make their next real estate move. More homes coming to market this spring would help ease the supply challenge and ease upward pressure on home prices.”

– Gino Blefari, CEO, HomeServices of America, No. 1 in transactions

“Nationally there could be a potential bubble in most markets. In our local market however, the growth of our city, increasing population, increasing wages and various other factors should contribute to a steady, yet appreciating local real estate market.”

– Corey Carter, Broker/Owner, RE/MAX Professionals, No. 789 in sales volume

“I’ve been keeping track of inventory since 2005, and when I looked at the 2018 numbers for our marketplace, it was half of what it was then. It’s really frustrating for buyers. When they finally find a home, there’s likely to be multiple offers. They will have to pay top dollar or risk losing the home of their dreams. It is also frustrating for sellers, especially older baby boomers who are having trouble downsizing because they can’t find a home to purchase.”

– Joan Docktor, President, Berkshire Hathaway HomeServices Fox & Roach, REALTORS® (HomeServices of America, No. 1 in transactions)

“The upside is that we continue to see robust trends for people and companies moving to our area. Our corporate relocation team is very active with major group moves. There is also pent-up demand for first-time buyers. As this segment improves their finances and begins to grow families, we expect more to buy houses. Another segment of pent-up demand is downsizers. We have many baby boomers who want to move to smaller and more efficient living. Overall, we expect to see 1-2 percent unit growth and 5-7 percent volume growth in our market for 2019.”

– Dan Forsman, CEO/President, Berkshire Hathaway HomeServices Georgia Properties (HomeServices of America, No. 1 in transactions)

“Inventory challenges continue into 2019 for homes at or near median sales prices. Buyer demand remains robust. Economic conditions are strong with minimal new inventory being provided to the marketplace. We expect continued sales-price appreciation, but at a slowing rate compared to 2016 and 2017.”

– Dereck Fritz, Vice President, Berkshire Hathaway HomeServices Homesale Realty (HomeServices of America, No. 1 in transactions)

“Our market is going through some much-needed normalization, which I think will provide us with a more sustainable growth market for years to come.”

– Michael Killmer, Broker/Owner, CENTURY 21 North Homes Realty Inc., No. 810 in sales volume

“While the markets we’re doing business in are facing inventory constraints, the bigger-picture concern is the affordability piece. As median sales prices continue to rise, we’re going to hit the tipping point in terms of affordability—and, if we see rate increases in 2019 (at press time), we’ll ultimately get to the point of buyer demand lessening because of the concern surrounding affordability.”

– Dan Kruse, CEO/President, CENTURY 21 Affiliated, No. 16 in transactions

“We have a thriving economy and job market, which both drive a flourishing real estate market.”

– Craig McClelland, COO, Better Homes & Gardens Real Estate Metro Brokers, No. 57 in transactions

“I’m hopeful that first-time buyers are going to be coming back into the market because rents have been rising so much. People are looking at whether they should spend $4,500 a month for a two-bedroom, or does it make more sense to go buy a $600,000 property. With the stabilizing interest rates, I believe that will happen more.”

– Charlie Oppler, COO, Prominent Properties Sotheby’s International Realty, No. 113 in sales volume

“I think 2019 will be a year of pause. For us, builders are still way behind demand, appreciation rates are sliding back to normalcy, days on market are increasing, boomers are squatting, and first-time homebuyers are having a tough time getting out of their leases financially. What this all adds up to is an adjusting market, which means cautious optimism and a return from a seller’s market to a balanced market.”

– Pat Riley, CEO, Allen Tate Companies, No. 15 in transactions

“We are expecting a decrease in the rate of home appreciation and an increase in inventory resulting in a more balanced market.”

– Donald Sarno, CEO, Keller Williams Preferred Realty Denver North, No. 446 in sales volume

“Florida is one of the lowest tax states; and equally appealing, Florida does not burden its residents with a state income tax. In addition, the Sarasota area and its reputation as Florida’s cultural capital with stunning beaches and recreational opportunities is another major draw. All these factors combined are having an extremely positive effect on our market.”

– Michael Saunders, CEO/Founder, Michael Saunders & Company, No. 70 in sales volume

“If we experience any headwinds, it will likely come as a result of declines in the stock market. Given our high density of second-home markets, any significant losses in the stock market can cause potential buyers to retreat to the sidelines until they feel that their portfolio is secure.”

– Mike Schlott, Randall Family of Companies, No. 161 in sales volume

“In Silicon Valley, home prices have increased incredibly over the past eight years. While we remain at relatively inventory-deprived levels, we have sensed a slowing sales pace since mid- to late 2018. As we move into the first quarter of 2019 (at press time), we are experiencing increased multiple offers, but the market is more price, location and condition sensitive. We expect an inventory surge over the next few months that will provide supply relief, but where that drives the market is uncertain. We do feel positively that we may have a more healthy and balanced market in 2019.”

– Chris Trapani, CEO/Founder, Sereno Group, No. 41 in sales volume

“This is the year of uncertainty. The inventory crisis seems to be ending, but what will the Fed do? I would not be surprised if market volume was down 15 percent or up 10 percent.”

– Janelle Wohlfeil, Manager, Real Living Kee Realty, No. 330 in transactions

“Add to the mix Houston’s economy adding 70,000-plus new jobs this year and the comeback of oil and gas exports, and it makes the greater Houston area poised for a great outcome.”

– Mark Woodroof, Partner, Better Homes & Gardens Real Estate Gary Greene, No. 55 in transactions

RISMedia’s 2019 Power Broker Report is sponsored by American Home Shield, Homes.com, HSA Home Warranty, Leading Real Estate Companies of the World® and Pillar To Post Home Inspectors. The 2019 Power Broker Report ranks brokerages by residential sales volume and transactions in 2018. The complete ranking of the Top 1,000 will be released shortly, along with an interactive online Power Broker directory.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.