“Pied-à-terre” translated roughly from French is “foot on the ground.” They are properties, primarily condos and apartments, separate from an individual’s primary residence—think second, part-time homes. Since 2014, New York has been floating around a proposal to tax wealthy non-permanent residents on these properties—only those worth more than $5 million—in order to support the city’s increasing need for infrastructure upgrades.

Regardless of a recent maneuver out of Albany to rekindle the proposal, the real estate industry has repeatedly slammed down the idea of taxing pied-à-terre owners who do not primarily live in New York State and do not pay income taxes to the state or New York City.

LP Finn, operating officer of Coach REALTORS®, believes this type of proposal is “simply taxation without representation” and could hurt the second-home market.

“Second-home owners are drawn to a city for leisure or business and experience a deeper connection and familiarity with the area than a casual visitor,” says Finn, whose N.Y.-based brokerage serves residents who typically purchase second homes in other areas. “It is not uncommon for our local upper-tier residents to own multiple vacation homes. These residents are still actively seeking places to experience and areas to purchase in.”

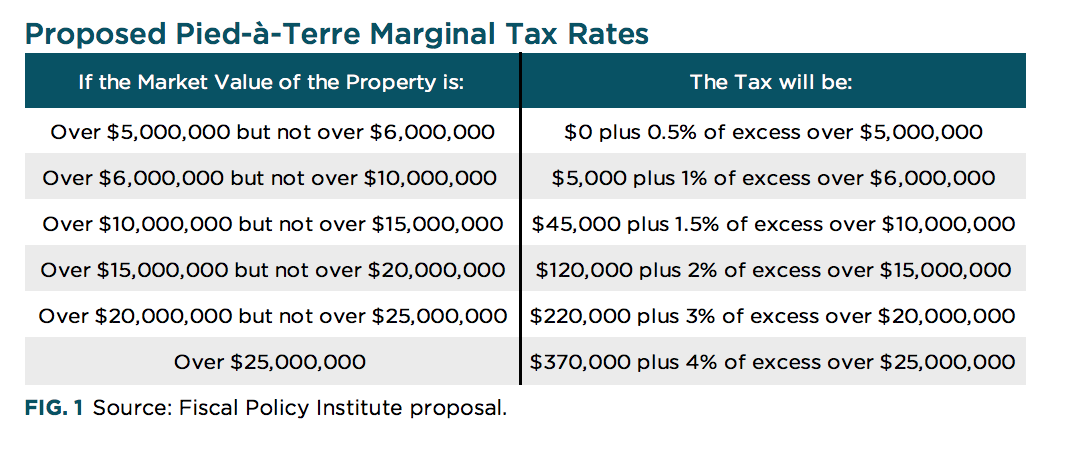

According to the Fiscal Policy Institute (FPI), this type of tax is gaining popularity around the world to ensure that wealthy individuals pay their fair share of taxes. The FPI analysis showed that for second-home properties valued between $5 million and $6 million, out-of-state second-home owners would incur a 0.5 percent tax on the excess over $5 million. For properties valued between $20 million and $25 million, the tax would skyrocket to 3 percent of the excess of $20 million, with an additional $220,000 charged.

The New York bill expected to garner between $490 million and $650 million in new revenue, according to the FPI. These predictions, however, were much higher than those projected by other real estate groups, including the Real Estate Board of New York, which estimated the profits would be closer to $370 million, according to the New York Times.

Ron Deutsch, executive director of the Fiscal Policy Institute, said in a statement that he expected the tax would “likely have a small impact on the market overall,” but that the impact would have been positive for the city.

Finn believes, however, that had the tax could have been significant and harmful to the industry, deterring wealthy consumers from investing in luxury second homes.

“Any time you have uncertainty in any part of the economy, investments and purchases slow down,” says Finn. “Ultra-wealthy individuals do not need to buy today. They have many options (e.g., renting, increased back/forth travel, luxury hotels) and can wait or purchase elsewhere.”

Luxury sales in second-home markets are on the rise, according to Luxury Defined 2018, a report by Christie’s International Real Estate which described a 19 percent increase year-over-year in 2017. A tax on these wealthy investors could dramatically change the landscape of this currently healthy real estate segment.

If similar proposals make their way to the country’s biggest secondary home markets, these would be the areas to zone in on. The Top 5 markets, according to a recent SmartAsset report:

1. Ocean City, N.J.

Number of Mortgages for Secondary Residences: 2,865

Percentage of Mortgages for Secondary Residences: 79.38%

2. Salisbury, Md.

Number of Mortgages for Secondary Residences: 4,354

Percentage of Mortgages for Secondary Residences: 54.3%

3. Crestview-Fort Walton Beach-Destin, Fla.

Number of Mortgages for Secondary Residences: 2,912

Percentage of Mortgages for Secondary Residences: 53.16%

4. Barnstable Town, Mass.

Number of Mortgages for Secondary Residences: 2,648

Percentage of Mortgages for Secondary Residences: 51.63%

5. Panama City, Fla.

Number of Mortgages for Secondary Residences: 1,710

Percentage of Mortgages for Secondary Residences: 50.25%

Because of the industry’s quick response in petitioning against the proposal, however, Finn believes legislators will be hard-pressed to try and pass similar bills in other areas across the country.

“I highly doubt that this type of taxation will be seen elsewhere,” says Finn. “I feel local and state government outside of the New York State will make better decisions about resort and second-home regions, welcoming the investment and growth instead of scaring it away.”

According to Finn, the bill gained traction in the political sphere only because the state is looking to fill a budget gap after multiple failed investment decisions.

“This seems to be a sad trend in the New York metro area,” Finn says. “First the politicians scared off Amazon and the HQ2 project, and now they are, once again, saying ‘Don’t invest here.’ Investments should be welcomed, not turned away.”

With the overwhelmingly negative reaction from the industry, the proposal lost momentum and legislators are currently seeking a workaround to bridge the budget deficit. Now, the pied-a-terre tax could be replaced with a real estate transfer tax for all high-end sales, according to Newsday. The target—apartments and condos valued at $5 million or more—would remain the same, but the transfer tax would only impact the sale of these properties.

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com.