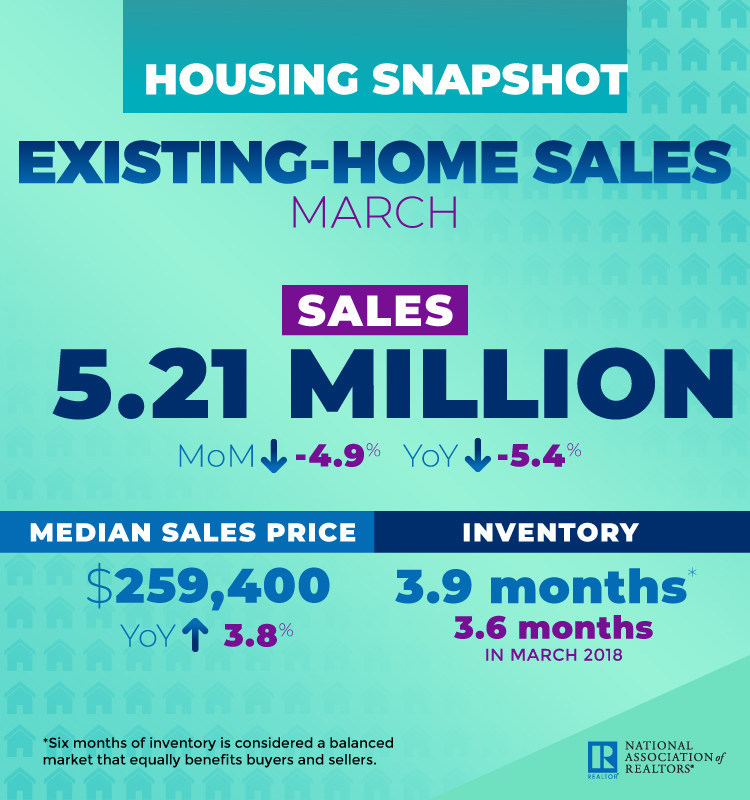

Existing-home sales in March tumbled 4.9 percent, coming off a February surge, the National Association of REALTORS® reports. At 5.21 million, existing-home sales last month underwhelmed by 5.4 percent year-over-year.

“It is not surprising to see a retreat after a powerful surge in sales in the prior month,” says Lawrence Yun, chief economist at NAR. “Still, current sales activity is underperforming in relation to the strength in the jobs markets. The impact of lower mortgage rates has not yet been fully realized.”

Encouragingly, however, 1.68 million existing homes were on the market, an increase from 1.63 million in February and 1.64 million the prior year.

“We had been calling for additional inventory, so I am pleased to see that there has been a modest increase on that front,” says John Smaby, NAR president. “We’re also seeing very favorable mortgage rates, so now would be a great time for those buyers who may have been waiting to make a purchase.”

“Further increases in inventory are highly desirable to keep home prices in check,” Yun says. “The sustained steady gains in home sales can occur when home price appreciation grows at roughly the same pace as wage growth.”

Across all house types (single-family, condo, co-op and townhome), the median price was $259,400, a 3.8 percent increase year-over-year. The median price for sales in the single-family space was $261,100; the condo median was $244,400. By region:

Midwest

Existing-Home Sales: 1.17 million (-8.6% YoY)

Median Price: $200,500 (+4.6% YoY)

Northeast

Existing-Home Sales: 670,000 (-1.5% YoY)

Median Price: $277,500 (+2.5% YoY)

South

Existing-Home Sales: 2.28 million (-2.1% YoY)

Median Price: $227,400 (+2.4% YoY)

West

Existing-Home Sales: 1.09 million (-10.7% YoY)

Median Price: $398,300 (+3.1% YoY)

Currently, inventory is at a 3.9-month supply. In March, the average listing was on the market for 36 days, or six days longer than the prior year. Forty-seven percent of homes were on the market for less than one month.

Of the existing-home sales in March, 4.67 million were single-family—a dip from 4.91 million in February, and from 4.9 million year-over-year. Condo and co-op sales totaled 540,000, an 11.5 percent drop year-over-year.

Twenty-one percent of sales were all-cash, and 18 percent by individual investors. Three percent were distressed. First-time homebuyers comprised 33 percent of sales.

The hottest markets, according to realtor.com®’s Market Hotness Index, which is included in NAR’s report, were Columbus, Ohio; Boston-Cambridge-Newton, Mass.; Midland, Texas; Sacramento-Roseville-Arden-Arcade, Calif.; and Stockton-Lodi, Calif.

For more information, please visit www.nar.realtor.