With Zillow flexing its muscle this week and brands like Keller Williams after a piece of the pie, iBuyers are growing in scale and sophistication—but how deep is their reach, and how extensive will it grow?

According to Todd Teta, chief technology officer at ATTOM Data Solutions, the foremost iBuyers haven’t strayed from their wheelhouse, and likely won’t for the foreseeable future.

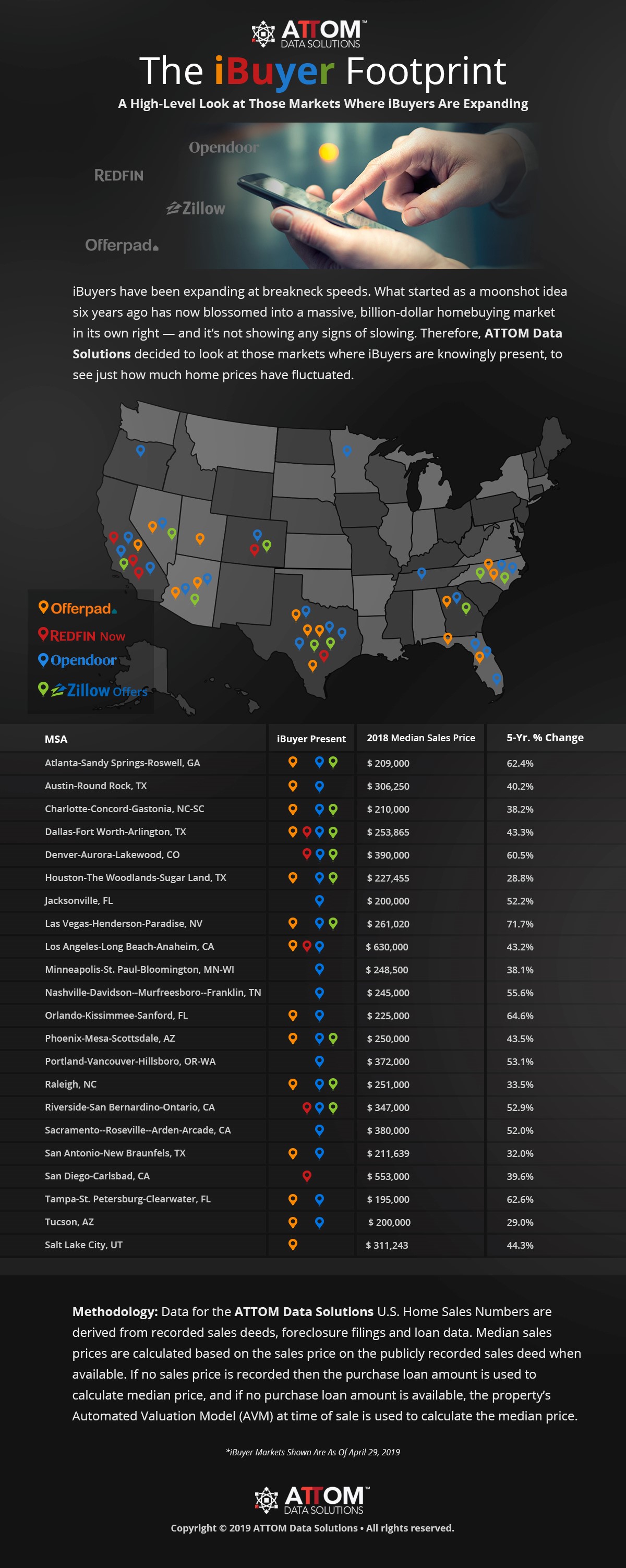

“iBuying is going to be much of the same this year: more Southern and suburban markets with largely affordable housing inventory,” says Teta, who examined the footprints of four iBuyers—Offerpad, Opendoor, Redfin Now and Zillow Offers—in a recent study.

Because data drives profit, iBuyers are concentrated in markets with predictable supply, according to Teta.

“iBuyers rely heavily on data and algorithms when evaluating potential properties,” says Teta. “Areas with inconsistent and highly unique housing makes this approach less reliable and less profitable.”

This means the Northeast, with its historic and older stock, is unviable—at least for now.

“With the number of investments being made into movement…we can likely expect some serious growth on the horizon,” says Teta.

In the study, ATTOM analyzed 22 iBuyer markets—areas where the four iBuyers were operational, at press time—and assessed changes in median price from 2013-2018. The biggest gain over that period, 71.7 percent, was in Las Vegas—an early iBuying market. Comparing all 22 markets, the median price rise was 43.9 percent—closer to the 43.5 percent gain in Phoenix, another beta iBuying market.

Many of the four iBuyers’ markets are past their peak, according to Teta, including Atlanta, Charlotte, Dallas-Ft. Worth and Denver, where home prices topped out in 2018.

The complete findings of the study:

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.