Earlier this year, lawmakers attempted to impose a pied-à-terre tax on second homes as a way to raise funds to support the city’s much-needed infrastructure upgrades. Facing strong opposition from real estate leaders who argued the tax would deter wealthy consumers from investing in luxury second homes, the proposal fell flat. In its place came a “mansion tax,” which took effect on July 1.

What Is the Mansion Tax?

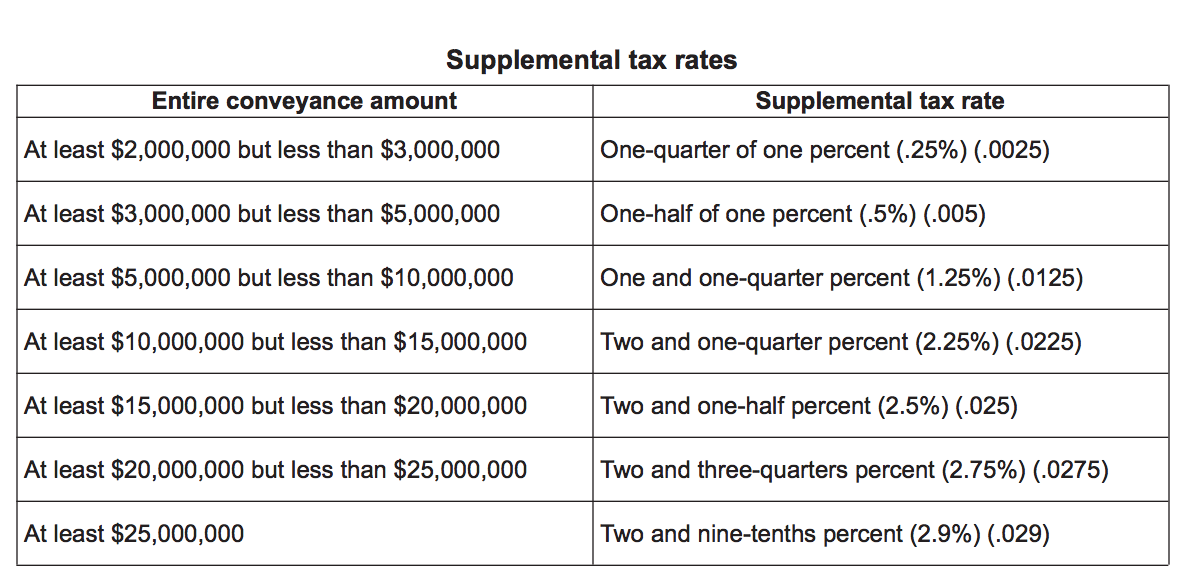

A supplement to the state’s real estate transfer tax (RETT), the mansion tax is a one-time fee charged upon the sale of residential property. Working on a graduated scale, the mansion tax charges 0.25 percent for residential properties that sell for between $2 million and $3 million. The tax caps at 2.9 percent for properties that sell for over $25 million. Previously, the RETT charged a flat 1 percent on home sales of $1 million or more.

The revenue from these increased taxes will be set aside for New York’s Metropolitan Transportation Authority’s Central Business District tolling capital lockbox, as well as to fund up to $5 billion in financing for MTA projects, according to the New York State of Opportunity FY 2020 Enacted Budget Financial Plan. Typically, the mansion tax will be paid for by the buyer. In the case the buyer is exempt or does not pay, the seller would be liable.

“Source: The New York State Department of Taxation and Finance)

According to the New York Times, June saw a flurry of closings throughout the city, despite a luxury market slowdown as buyers rushed to close before the tax took effect. Contract signings were up 29 percent before the new mansion tax implementation, according to Compass’ Q2 Manhattan market report, which considers all contract, sales and inventory activity across Manhattan.

“As a result of the State budget just adopted in Albany, hundreds of millions of dollars on an annual basis will flow from the City’s real estate sector toward supporting the region’s mass transit network. It is now critically important that such funds be deployed in the most effective manner possible, producing a 21st century mass transit system that a global city like New York deserves,” said Real Estate Board of New York President John H. Banks. “We also need to continue to monitor the impact these tax changes and other tax and policy changes on the federal, state and city level will have on investment in New York City moving forward. We are appreciative that State leaders did not move forward with a misguided recurring pied-à-terre tax that was not well thought out and had the potential to have significant adverse impacts on job creation and property taxes.”

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s associate content editor. Email her your real estate news ideas at ldominguez@rismedia.com.