Amid declining economic gains globally in the past year, the amount of foreign investor money in the nation’s real estate sank, with collective dollars diving 36 percent, according to the National Association of REALTORS® (NAR) Profile of International Transactions in U.S. Residential Real Estate, newly released.

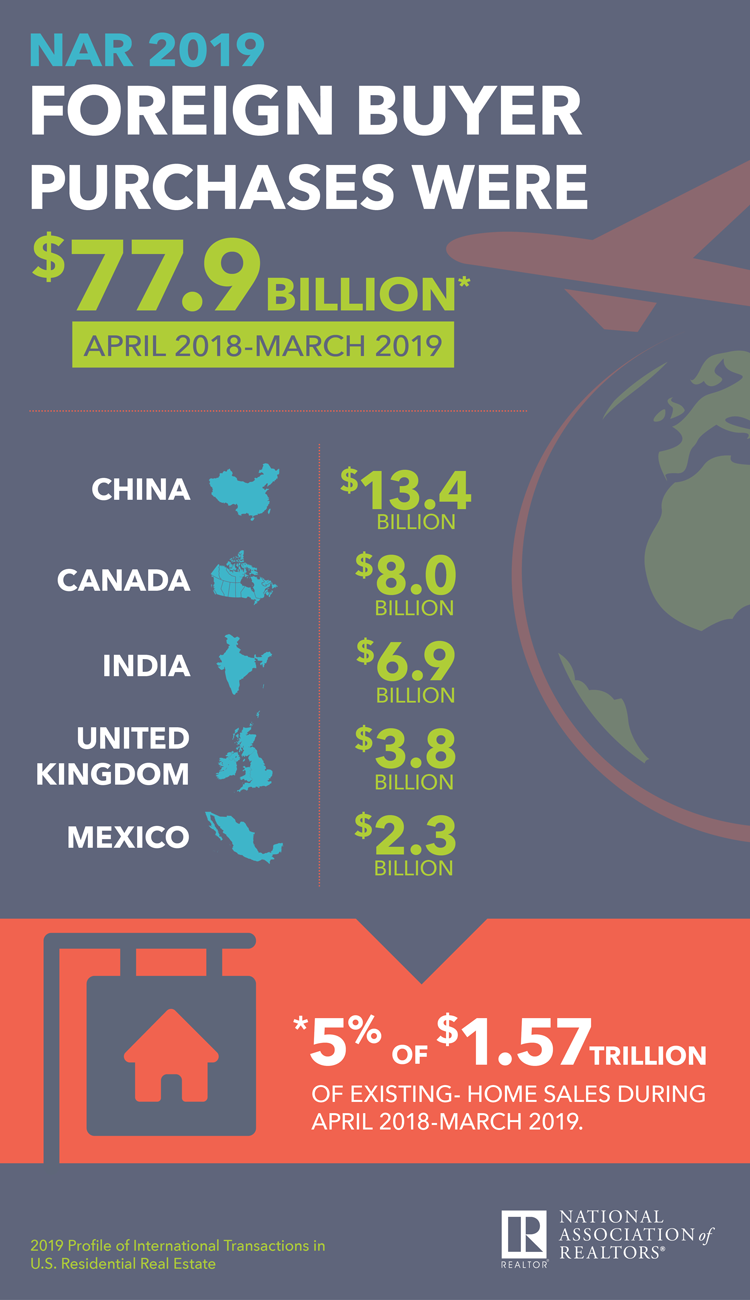

From April 2018 to March 2019, foreign investment in real estate shrunk to $77.9 billion, the research shows, an abrupt fall from $121 billion the prior year. According to NAR, economic gains globally slowed to 3.6 percent, driving the losses, along with fewer homes on the market. In the 2018-2019 period, foreign homebuyers purchased 183,100 units, compared to 266,800 the prior year.

In a repeat trend, Chinese homebuyers made the most purchases in terms of volume, at $13.4 billion, but dialed down spending by a steep 56 percent. According to NAR, Chinese economic growth has slowed to 6.3 percent. Additionally, the country enacted outflow restrictions in 2016, which impacted investors.

“A confluence of many factors—slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale—contributed to the pullback of foreign buyers,” says Lawrence Yun, chief economist at NAR. “However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.”

However, in perspective, foreign investment in real estate is still strong, according to John Smaby, NAR president.

“Even though numbers were lower this year than during the previous 12 months, international investors and buyers still spent and invested a great deal of money in U.S. real estate,” says Smaby. “Homebuyers from across the globe know that the U.S. market is still a safe, secure and promising place to invest.”

According to Carrie Law, CEO of Juwai.com, China’s largest property site, certain factors have influenced the market, but concerns were largely overridden by the stability in the U.S.

“It turns out that Chinese demand for U.S. real estate cannot be killed—not by the trade war, not by ‘the Trump Effect,’ not by visa restrictions and not by capital controls,” Law said in a statement. “There is very little chance that Trump will spell the end of Chinese investment. In fact, Chinese buyers are probably more likely to maintain strong levels of buying despite the Trump Effect than are buyers from India, Mexico and the UK. For many Chinese buyers, U.S. real estate is not a luxury, but a necessity. They are highly motivated to hedge the risks to their wealth by owning real estate in the world’s most developed economy.”

Of the $77.9 billion foreign homebuyers parked in real estate, $44.7 billion came from immigrants new to the U.S., and $33.2 billion came from non-residents, NAR’s research shows. Both demographics dropped off significantly year-over-year, with deficits of 37 percent and 34 percent, respectively.

After China, the biggest foreign home-buying nations were: Canada ($8 billion); India ($6.9 million); the United Kingdom ($3.8 billion); and Mexico ($2.3 billion). Overall, foreign homebuyers looked to the Sunshine State, with Florida garnering 20 percent of purchases.

“Many Canadians and other foreigners found Florida so enticing because of its lenient tax laws,” Yun says. “Additionally, many Florida metro areas have an inventory of cheaper properties, relatively speaking—a combination which makes the state a very popular destination.”

California came in second, with 12 percent of purchases, followed by Texas at 10 percent, Arizona at 5 percent and New Jersey at 4 percent, the research shows.

Of foreign homebuyers in the past year, 76 percent purchased single-family or townhouses, and 44 percent purchased in the suburbs. Their median price was $280,600, and all-cash was common, at 41 percent of investors.

For more information, please visit www.nar.realtor.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.