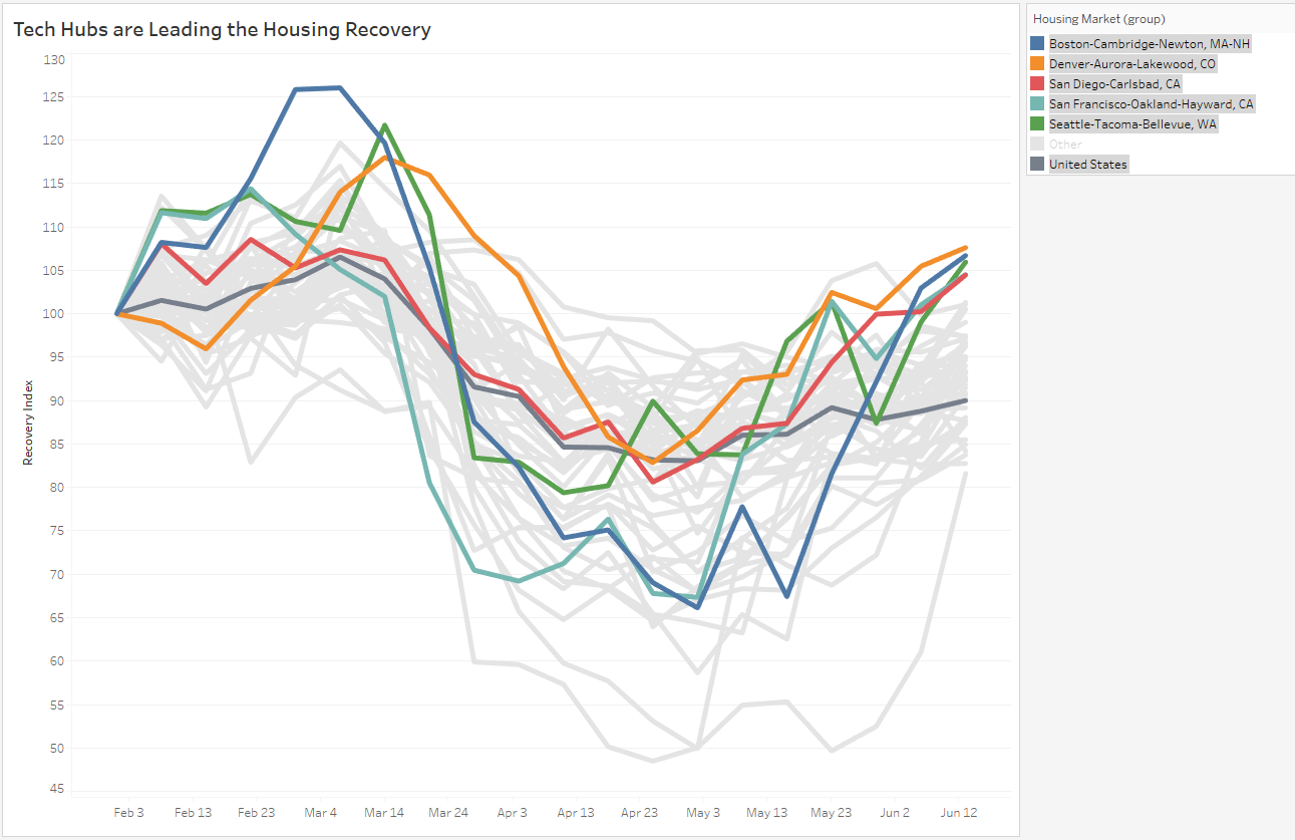

Realtor.com® released its latest weekly Housing Market Recovery report, showing that for the week ending June 13, local markets with strong job creation pre-COVID are already on the rebound compared to other markets. Five tech hubs—Denver, Boston, Seattle, San Francisco and San Diego—have pushed past their January 2020 pace, leading the way toward recovery, according to the report.

On a national level, the realtor.com® Housing Market Recovery Index measured 90 for the week ending June 13 (or halfway recovered to January 2020 levels). This week, the reading is 1.2 points higher, 10 points below the January trend baseline.

Here’s a bird’s-eye view for the week ending June 13:

Total Listings: -27 percent YOY

Time on Market: 16 days slower YOY

Median Listing Prices: +4.6 percent YOY

New Listings: -20 percent YOY

Locally, four more markets crossed over into recovery: Seattle, Rochester, Las Vegas and Los Angeles, culminating in eight total markets that currently rank above the January baseline.

“As the market heads into the summer, growth in online home searches and asking prices has surpassed pre-COVID levels, but movement in supply and time on market remains well below seasonal pace,” said Javier Vivas, director of economic research for realtor.com®. “But locally, the story is much more nuanced. Markets with stronger job creation pre-COVID are proving to have the crucial edge for real estate activity, particularly those with a strong technology sector. As more tech companies weather the storm, the stable jobs and incomes they offer will continue to power demand for homes in these areas, enabling home sales to bounce back faster than the rest of the country this summer.”

For more information, please visit www.realtor.com®.

40 years in industry

first time-Home sales 0

listings 0

engaged buyers 0

25%+ unemployment

how many milenials buying homes….

65 and up moving into retirement communities?

buying investment properties?

this is fake news to keep agents enthusiastic! How about some real truth about how the industry changed overnight…We all have Zoom and FB.