Due to the coronavirus pandemic, millions of Americans filed for unemployment benefits over the past several months. This aid was helping residents pay their rents, but with the added COVID-related benefits ending, and no extension yet announced, it could spell trouble for the industry. According to a new Zillow report, during the first week of July, 22.6 percent of U.S. apartment households did not pay any rent—up from 19.2 percent the first week of June and higher than any month since at least March.

“The rental market has been more affected by the coronavirus pandemic than the for-sale side appears to have been. The steady climb of the past few years has come to an end as rent growth has slowed nationally and prices have outright fallen in a few markets,” said Zillow economist Joshua Clark. “The saving grace has so far been government aid and eviction freezes, which have provided a lifeline for those who are out of work. But much of that aid has expired, putting many renters and workers who rely on the rental market continuing apace in a vulnerable position.”

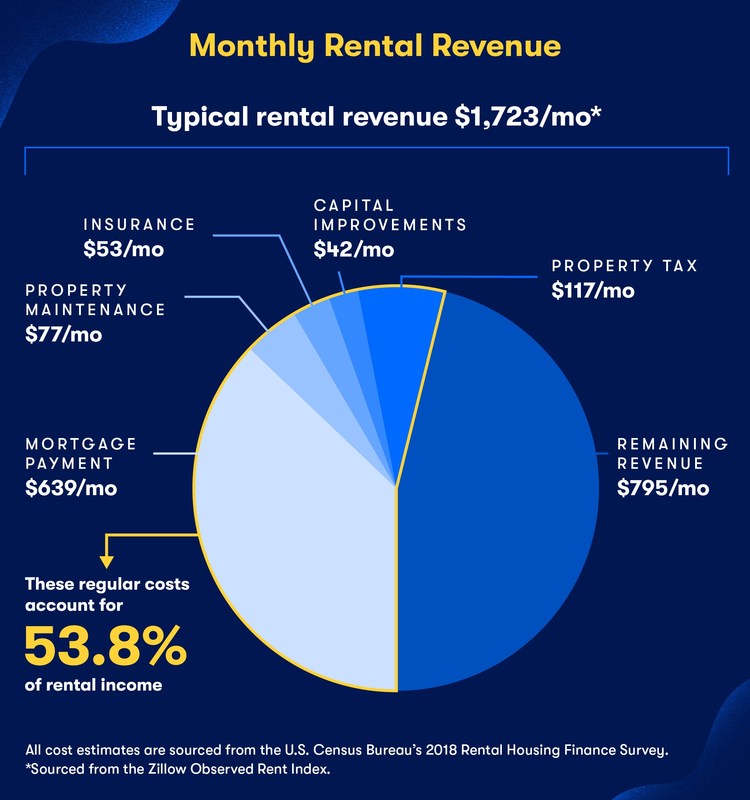

But the end of aid won’t just affect renters—property managers and landlords are at risk as well. According to Zillow, of the potential rental income, more than half (53.8 percent) typically goes toward fixed costs associated with property ownership, including staff wages, business taxes, legal and accounting services, landscaping, and more.

For property managers, it gets even more complicated in terms of the financials—they must also support wages for team members, maintenance, unit and amenity upgrades, and operations systems. The profit margins are tight as it is, according to Zillow, which reports that the total annual return on a rental unit is currently 6.4 percent, down from 13.3 percent in 2015.

“For property management companies, rental payments support things like wages for team members, maintenance, unit and amenity upgrades, all the way down to the systems that allow a business to manage their operations,” said Brian Miller, director of marketing at Berger Rental Communities. “Tenants and landlords are of course affected when payments are missed; taking it a step further ,the partners we work with all have individuals that rely on companies like ours operating as we have been. So there are plenty of pieces of a larger ecosystem that are feeling an impact.”

“This is an incredibly stressful time for so many, especially when it comes to people’s homes, the place we go to be safe,” said Rachel Briseño Bruno, a San Antonio-based REALTOR® who also owns rental properties and a property management company. “Many landlords we work with own one or two properties as an investment for retirement or a child’s college fund, and they are on the hook for mortgage payments on those homes. Losing just one tenant who may have lost a job and moved back home or in with a friend can have an enormous impact.”

For more information, please visit www.zillow.com

Here’s a novel idea, give people who have been patient and have saved money a chance to buy real estate at a good price! More stimulus would just reward people who were over-leveraged and/or not living within their means. When you protect the “hanging by a thread” renters and homeowners, supply dries up even further which makes renting and home asset prices even more competitive and expensive to those of us who have done things the right way. It’s not our job to bail you out, it’s your job to bail yourselves out!