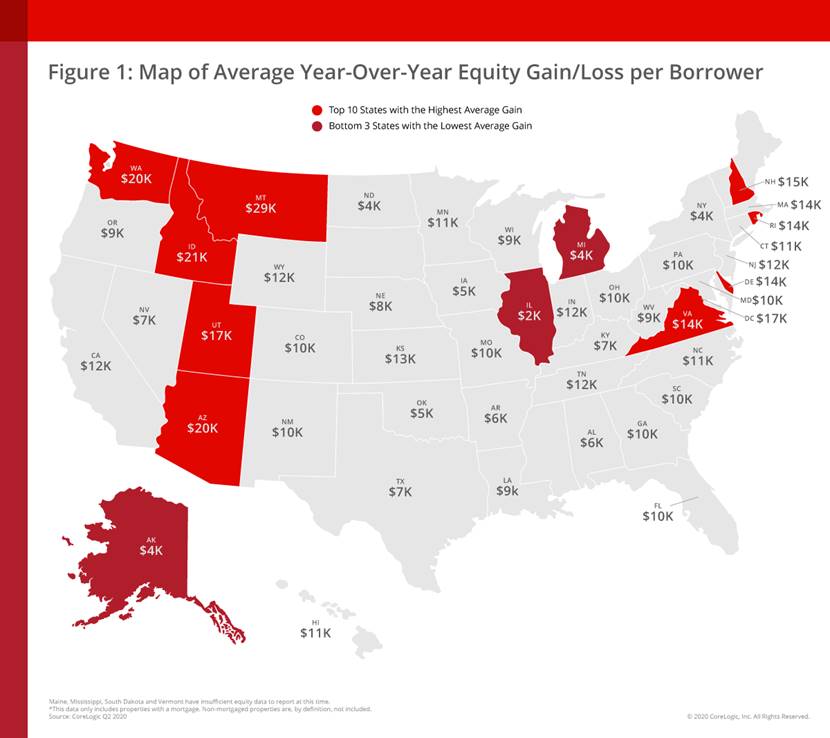

CoreLogic® recently released the Home Equity Report for the second quarter of 2020. The report shows U.S. homeowners with mortgages (which account for roughly 63 percent of all properties) have seen their equity increase by 6.6 percent year-over-year. This represents a collective equity gain of $620 billion, and an average gain of $9,800 per homeowner, since the second quarter of 2019.

Despite a cool off in April, home-purchase activity remained strong in the second quarter of 2020 as prospective buyers took advantage of record-low mortgage rates. This, coupled with constricted for-sale inventory, helped drive home prices up and add to borrower equity through June. However, with unemployment expected to remain elevated throughout the remainder of the year, CoreLogic predicts home price growth will slow over the next 12 months and mortgage delinquencies will continue to rise. These factors combined could lead to an increase of distressed-sale inventory, which could put downward pressure on home prices and negatively impact home equity.

“The CoreLogic Home Price Index registered a 4.3 percent annual rise in prices through June, which supported an increase in home equity,” said Dr. Frank Nothaft, chief economist for CoreLogic. “In our latest forecast, national home price growth will slow to 0.6 percent in July 2021 with prices declining in 11 states. Thus, home equity gains will be negligible next year, with equity loss expected in several markets.”

“Homeowners’ balance sheets continue to be bolstered by home price appreciation, which in turn mitigated foreclosure pressures,” said Frank Martell, president and CEO of CoreLogic. “Although the exact contours of the economic recovery remain uncertain, we expect current equity gains, fueled by strong demand for available homes, will continue to support homeowners in the near term.”

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. As of the second quarter of 2020, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

Quarterly Change: From the first quarter of 2020 to the second quarter of 2020, the total number of mortgaged homes in negative equity decreased by 5.4 percent to 1.7 million homes or 3.2 percent of all mortgaged properties.

Annual Change: In the second quarter of 2019, 2.1 million homes, or 3.8 percent of all mortgaged properties, were in negative equity. This number decreased by 15 percent in the second quarter of 2020 to 1.7 million mortgaged properties in negative equity.

National Aggregate Value: The national aggregate value of negative equity was approximately $284 billion at the end of the second quarter of 2020. This is down quarter over quarter by approximately $0.7 billion, or 0.2 percent, from $285 billion in the first quarter of 2020, and down year over year by approximately $20 billion, or 6.6 percent, from $304 billion in the second quarter of 2019.

Because home equity is affected by home price changes, borrowers with equity positions near (+/-5 percent) the negative equity cutoff are most likely to move out of or into negative equity as prices change. Looking at the second quarter of 2020 book of mortgages, if home prices increase by 5 percent, 270,000 homes would regain equity; if home prices decline by 5 percent, 380,000 would fall underwater.

For more information, please visit www.corelogic.com.