CoreLogic® recently released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2020. On a national basis, home prices jumped 5.9 percent in August 2020, compared with August 2019. The increase was up almost 1 percent compared to the last month, when home prices increased 5.1 percent year-over-year.

Consumer home-purchasing power has stayed strong due to record-low mortgage rates despite continued pressures caused by the coronavirus pandemic. Meanwhile, for-sale inventory has continued to dwindle, decreasing 17 percent YoY in August. This created upward pressure on home price appreciation, according to CoreLogic, “as buyers compete for the limited supply of homes.”

“Consumers who have not been as financially impacted by the ongoing economic pressures are taking advantage of low mortgage rates to either break into the market, upgrade their living situations or purchase second homes and investment properties,” said Frank Martell, president and CEO of CoreLogic. “With heightened activity putting a strain on the current for-sale inventory, strong demand should help spur new homebuilding activity.”

CoreLogic expects home price growth to slow as more new and existing homes become available for sale in 2021 and elevated unemployment “saps buyer demand.” The HPI forecast shows prices will start to downshift in early 2021, with annual U.S. HPI gains slowing to just 0.2 percent by August 2021 and many locations experiencing declining prices.

“The imbalance between homebuyer demand and for-sale inventory is particularly acute for lower-priced homes,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Because of this imbalance, homes priced more than 25 percent below the median were up 8.6 percent in price over the last year, compared with the 5.9 percent price increase for all homes.”

Despite the rapid acceleration of national home price growth, local markets continue to vary. For instance, in Phoenix, where there is a severe shortage of for-sale homes, prices increased 9.8 percent in August. Meanwhile, the New York-Jersey City-White Plains metro recorded an annual decline in home prices of 0.1 percent, as residents opt for more space and privacy in less densely populated areas. By state, Idaho, Arizona and Maine experienced the strongest price growth in August, up 10.8 percent, 9.7 percent and 9.6 percent, respectively.

The HPI Forecast also reveals the disparity of home price growth across metros. In markets like Las Vegas, where the local tourism economy and job market continue to struggle, CoreLogic expects home prices to decrease 6.5 percent by August 2021. And in San Francisco, CoreLogic predicts home prices will rise 7.8 percent over the next 12 months as low inventory continues to drive prices higher.

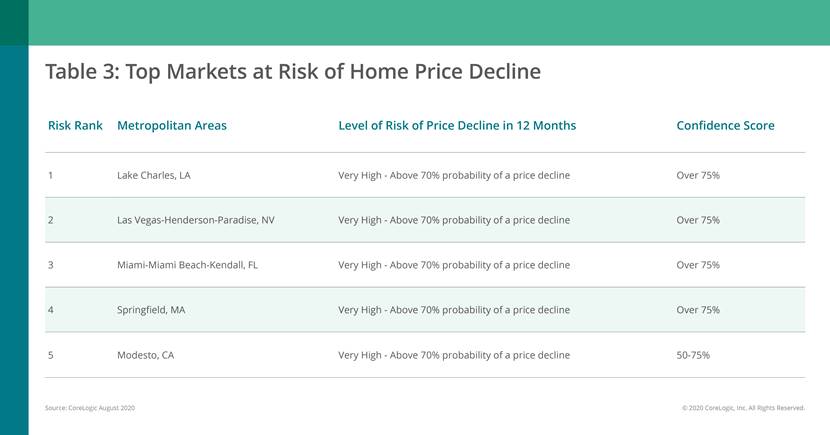

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that metros such as Las Vegas and Miami—areas hard hit by the collapse of the tourism market—are at the greatest risk (above 70 percent) of a drop in home prices over the next 12 months. Other metro areas with a high risk of price declines are Lake Charles, La.; Springfield, Ma.; and Modesto, Calif.

For more information, please visit www.corelogic.com.