Much has changed since the start of the health crisis at the beginning of 2020. The pandemic has flooded every industry, including real estate, and the after-effects are being noticed in several ways, including millennial home-buying trends and motivation, according to a new survey from realtor.com® and HarrisX.

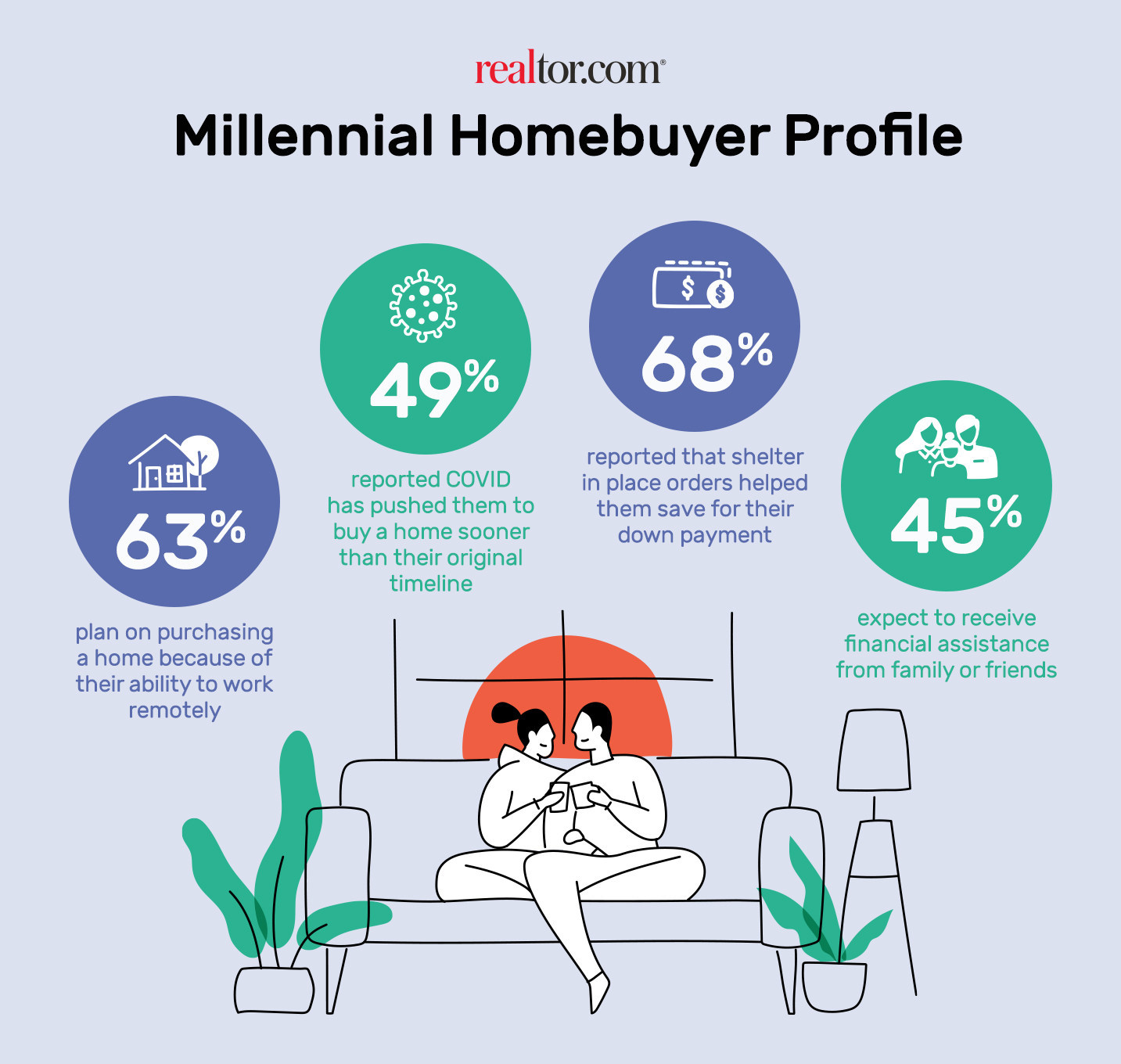

The biggest change? COVID accelerated millennials’ plans to purchase. Of all survey respondents, 75 percent said they have been working remotely since the COVID pandemic hit. Because of this newfound ability to work from home, 63 percent said they plan on purchasing a home. Also, nearly half of millennial respondents (49 percent) said that COVID pushed them to purchase sooner than they originally planned.

The way they search for a home has changed as well, at least for 59 percent of respondents. Thirty-seven reported spending more time researching properties online, while 35 percent are putting more emphasis on looking at listing photos and 32 percent are paying more attention to listing videos. Additionally, 31 percent are being more selective about choosing which homes to tour and 27 percent like to drive by the home to check out the neighborhood.

Due to low interest rates and low inventory, the markets have been competitive—something millennial buyers expect. According to the survey, 71 percent expect “some or a lot of competition” when shopping for a home, but they’ve found ways to help lighten the load of increasing home prices. Sixty-eight percent said shelter-in-place orders helped them save for their down payment, while 45 percent expect to receive financial help from friends or family.

What’s currently motivating millennial buyers? Twenty-six percent are just tired of their current home, 23 percent are ready to grow their family and 22 percent are attracted by the favorable home prices and interest rates. Meanwhile, 18 percent are searching for a safer neighborhood.

Most millennials, however, are hoping to stay close to what they currently consider “home.” Forty-nine percent said they want to move within their current city, while 31 percent want to move to nearby suburbs. Thirteen percent want to stay within the same state but are looking at other cities, while 8 percent want to move to another state entirely.

In terms of price, millennials are mostly trying to stay below the $350,000 mark. Thirty-six percent are looking at or under $200,000, 28 percent want to purchase a home that’s between $200,000 and $350,000, and 37 percent are looking at properties over $350,000. Fifty-four percent of millennial homebuyers believe home prices have hit their peak, according to the survey.

“If there is any silver lining to the current economic landscape, it’s that mortgage rates are hanging around record lows. With little to no equity to leverage, millennial homebuyers tend to take out larger loans. Historically low rates are making this more manageable, even with rising home prices,” said Danielle Hale, chief economist at realtor.com®. “Additionally, shelter-in-place orders helped many who were fortunate enough to keep their jobs save for a down payment‑one of the largest hurdles of buying a home. The combination of low rates and the opportunity to save is enabling many millennials to move up their home buying timeline.”