CoreLogic® recently released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across more than 20 metropolitan areas. Data collected for September 2020 shows a national rent increase of 2.5 percent year-over-year, down from a 3 percent year-over-year increase in September 2019.

The rental market faced a tumultuous journey this year, experiencing the lowest annual growth rate this June for single-family rent prices in 10 years. While national rent prices picked up pace in the late summer, September data shows a divide in recovery across price tiers. Compared to a year ago, lower-priced rentals continued to show declines while higher-priced rentals began to match last year’s growth rates. Those in higher-paying positions that easily transitioned to remote work were able to continue renting in higher price tiers, or even upgrade to new rentals with more space to accommodate working from home. Meanwhile, renters among the lower-priced tier have faced greater job market instability, which by extension has negatively impacted rent price growth.

“Single-family rent prices regained strength in September and were just half a percentage point shy of their pre-pandemic national growth rate,” said Molly Boesel, principal economist at CoreLogic. “The strength in rent growth was driven primarily by mid-to-high priced rentals, which have regained their lost momentum in late-spring. Lower-priced rentals are still the furthest below their early 2020 growth rates, which is a sign that many lower-income households may be struggling to meet rent payments.”

To gain an accurate view of single-family rental prices, CoreLogic examines four tiers of rental prices. In September 2020, the national single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

– Lower-priced (75 percent or less than the regional median): 2.4 percent, down from 3.7 percent in September 2019

– Lower-middle priced (75 percent to 100 percent of the regional median): 2.5 percent, down from 3 percent in September 2019

– Higher-middle priced (100 percent to 125 percent of the regional median): 2.6 percent, unchanged from September 2019

– Higher-priced (125 percent or more than the regional median): 2.3 percent, down from 2.7 percent in September 2019

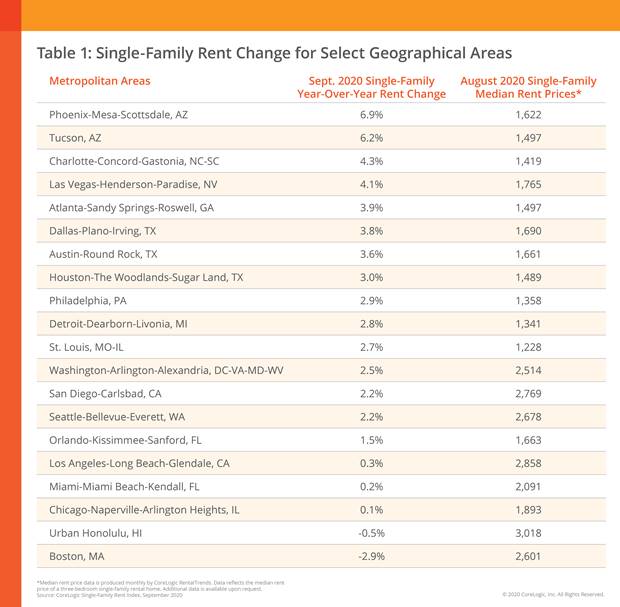

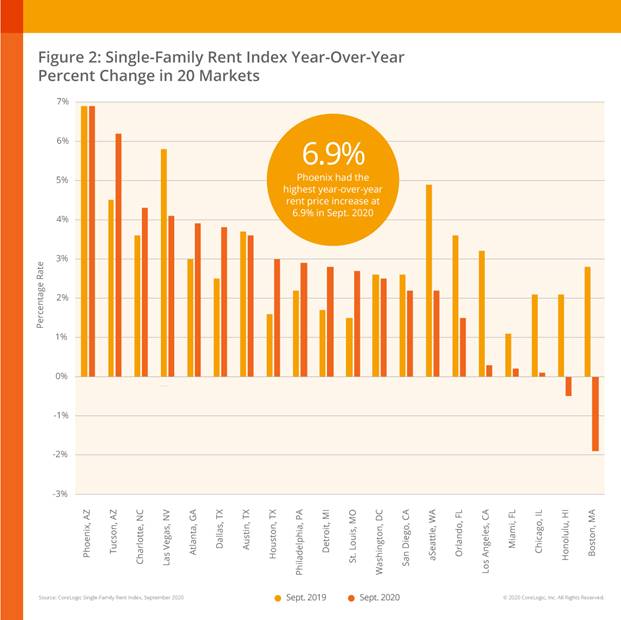

For 22 consecutive months, Phoenix had the highest year-over-year increase in single-family rents in September 2020 at 6.9 percent. Tucson, Ariz., had the second-highest rent price growth in September 2020 with a gain of 6.2 percent, followed by Charlotte, N.C., at 4.3 percent. Conversely, Honolulu and Boston posted an annual decline in rent prices, with the latter experiencing the most significant decline at -2.9 percent. The drop in Boston could be attributed to the decline of the higher-education population, as students opt to continue virtual learning in their hometowns, and employees leave high-cost, densely populated urban areas to work remotely.

Unemployment rates remained elevated across the country, with some regions and metros experiencing higher rates of job loss, and therefore downward pressure on rent prices, than others. For example, in September, year-over-year employment decreased by just 2.9 percent in Phoenix, a popular destination for those seeking warmer weather during winter months. Subsequently, rent prices have stayed comparatively strong here. Meanwhile, popular tourist destinations like Honolulu posted an employment decrease of 16.3 percent, compared to September 2019, which has contributed to a decline in rent prices. As the economy slowly recovers from the initial impact of the pandemic and contends with the resurgence of coronavirus (COVID-19) cases, we may see continued fluctuation of rent prices in metros across the nation.

For more information, please visit www.corelogic.com.