Industry Firms Collaborate to Help Expedite Application Process for Independent Contractors

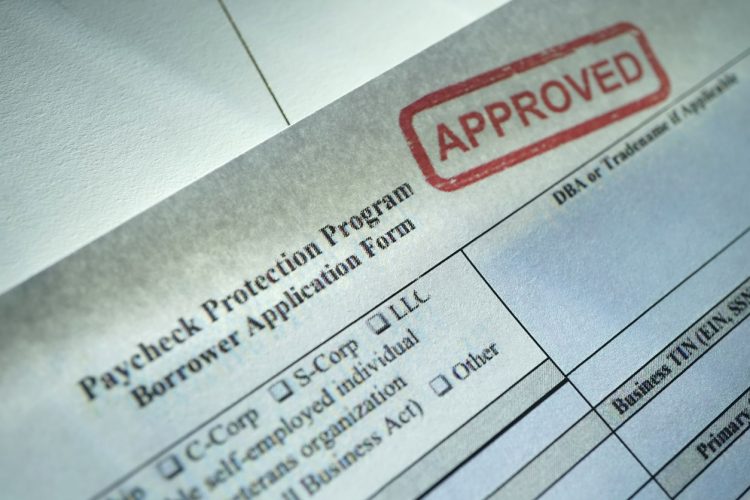

Three industry firms are collaborating to help streamline the process for agents to apply for Paycheck Protection Program (PPP) loans in the coming weeks, urging independent contractors to apply immediately before the March 31 deadline, or before funding for the program could potentially run out.

The three companies—Small Business Administration (SBA) banker Capital Plus Financial, Blue Acorn, which offers a system for submitting applications, and MooveGuru, providing a concierge team to help agents along the way—have created a 15-minute streamlined application process for the real estate industry.

The second round of federal loan funding to small businesses included $250 billion, and of that, about $128 billion is currently still available. Last week, the Biden Administration softened the requirements for PPP loans to include independent contractors, opening the opportunity to about 90% of the 1099 agents to qualify for the forgivable government PPP loan. The program is set to expire on March 31, unless it is extended.

“Agents need to submit their applications immediately,” a joint statement from the companies urged. “There’s also a chance that the $128 billion could run out. Take action today.”

Since the announcement last Wednesday, 90% of the real estate agents and mortgage loan officers that are 1099 independent contractors have qualified for between $5,000 and $20,833, even if their income did not decrease in 2020, the companies stated, highlighting the program’s simple underwriting terms: As long as the agent received a commission check in February 2019 as an independent contractor, did not draw any PPP loans in the first round of PPP and has a real estate license, they qualify.

According to the companies, once the application is submitted, the review time is about 5 – 7 business days. When successfully approved, funds are direct deposited into the agent’s bank account, straight from the SBA and Capital Plus Financial.