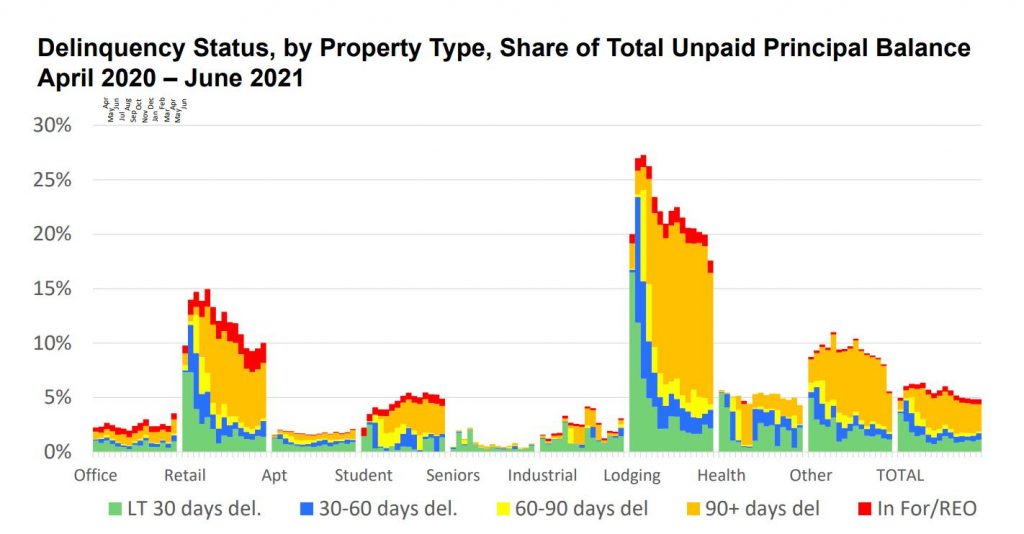

Mortgage delinquencies for commercial and multifamily properties held firm in June, according to the Mortgage Bankers Association’s (MBA) monthly CREF Loan Performance Survey. MBA created the survey to better understand how the COVID-19 pandemic is impacting commercial mortgage loan performance.

The details:

– 95.2% of outstanding loan balances were flat since May

– 3.0% were 900-plus days delinquent or in REO, down from 3.1% the previous month

– 0.2% were 60-90 days delinquent, unchanged from the previous month

– 0.6% were 30-60 days delinquent, up from 0.5% the previous month

– 1.1% were less than 30 days delinquent, up from 1.0% the previous month

What it means:

“Commercial and multifamily mortgage delinquencies continue to be driven by loans backed by hotel and retail properties that ran into trouble during the pandemic and are now more than 90 days late,” said Jamie Woodwell, MBA’s vice president of Commercial Real Estate Research. “We expect these late-stage delinquencies to wane as the economy continues to open and there is less uncertainty surrounding the prospects of these and many other property types.”