While there’s been a slight slowdown in the markets due to reappearing fall seasonal trends following last year’s year-long competitive environment, in August, home prices continued to grow, with annual gains reaching a record high of 18.1%.

According to the CoreLogic Home Price Index (HPI™), this is the largest 12-month growth in the U.S. index since the series began in January 1976. Home prices increased month-over-month by 1.3% compared to July 2021.

Key takeaways:

– Appreciation of detached properties (19.8%) was the highest measured since the start of the index—7.8-percentage points higher than attached properties (12%).

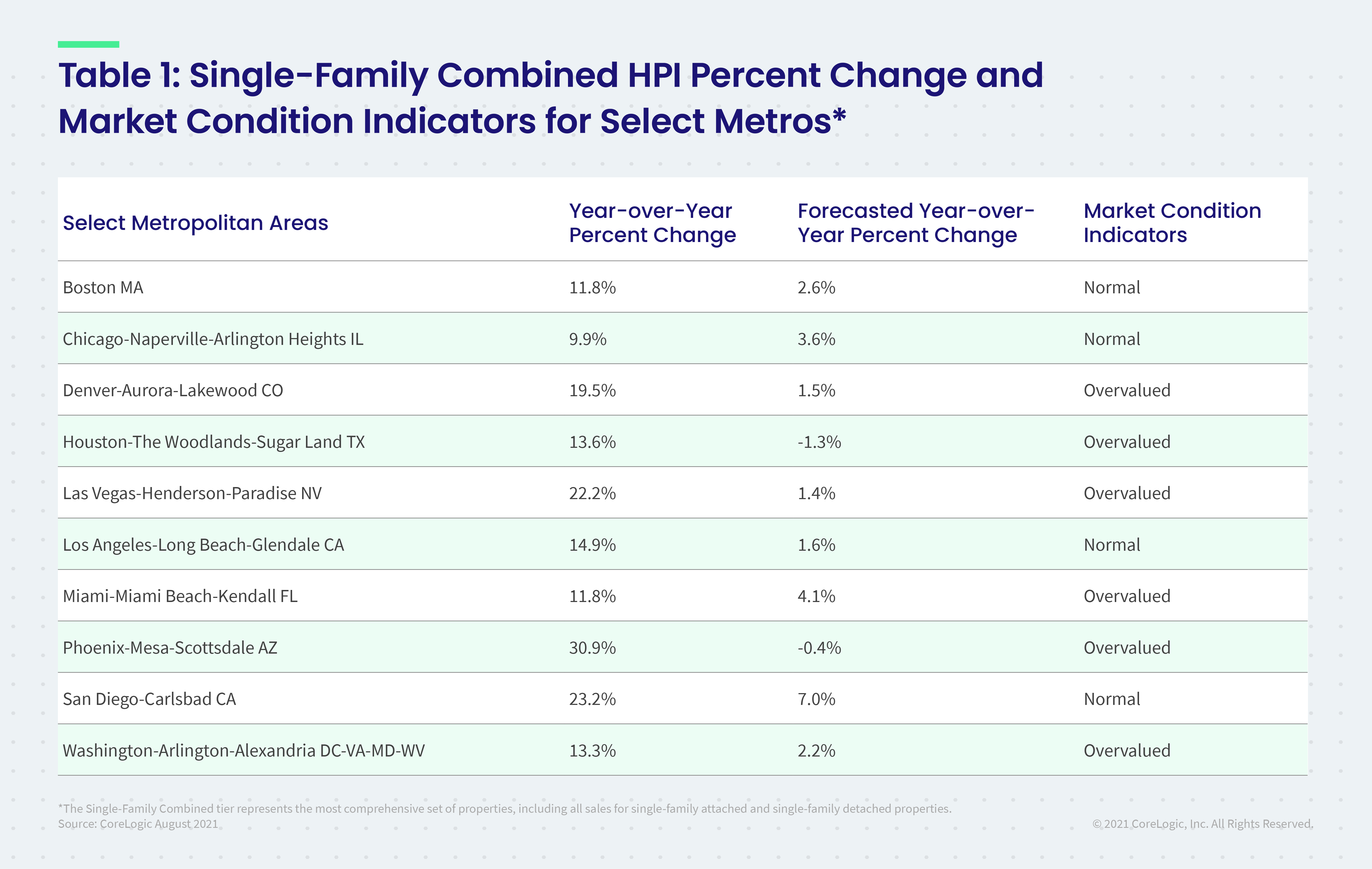

– CoreLogic predicts that home price growth will slow to a 2.2% increase by August 2022 due to ongoing affordability challenges.

– For the month, home prices increased significantly in the Pacific Northwest with Bend, Oregon, experiencing the highest YoY increase at 37.2%. In second place was Twin Falls, Idaho, with a YoY increase of 35.8%.

– Idaho and Arizona again led the way with the strongest price increase at 32.2% and 29.5%, respectively.

What CoreLogic has to say:

“Home prices continue to escalate at a torrid pace as a broad spectrum of buyers drive demand for a limited supply of homes,” said Frank Martell, president and CEO of CoreLogic, in a statement. “We expect to see the trend of strong price gains continue indefinitely with large amounts of capital chasing too few assets.”

“Single-family detached homes continue to be in high demand,” said Dr. Frank Nothaft, chief economist at CoreLogic, in a statement. “These properties offer more living space and distance from neighboring homes than that of attached properties. On average, detached homes have 28% more inside space compared to single-family attached properties and about twice as much space as apartments in multifamily structures.”