Editor’s note: RISMedia is proud to release the first edition of our Broker Confidence Index (BCI) Report. On a monthly basis, we will be checking in with more than 3,000 of the U.S.’s top residential real estate brokers to gauge their confidence in their own business and the overall market, on a scale from 1-10. Here, and on a quarterly basis, we will take a deeper dive and ask a handful of additional questions to flesh out more context in order to better understand the “why” behind the index score. We are confident that this report will not only keep real estate professionals up to date on the current conditions of our industry, but it will also serve as a critical indicator of where it’s headed in the coming month, quarter and year.

As 2021 is rapidly nearing its end, real estate in 2022 shows no significant signs of slowing down. In fact, of the more than 3,000 residential brokers RISMedia surveyed in November, the respondents say they are extremely confident about the state of their businesses and the industry.

RISMedia’s Broker Confidence Index (BCI), yielded a score of 8.2 (on a 1-10 scale) in its first polling, which clearly suggests that real estate professionals are expecting more success in the new year. It’s worth noting that one-third of those surveyed shared a maximum confidence score of 10, but a significantly smaller pool of less confident respondents drove the index down to the still-high, yet more realistic mean score.

Outliers in either direction are notable because they’re a sound reminder that real estate is a hyperlocal industry, and despite the strength of the national market, not everyone is celebrating the same levels of success. And likewise, not everyone is dealing with the same set of challenges.

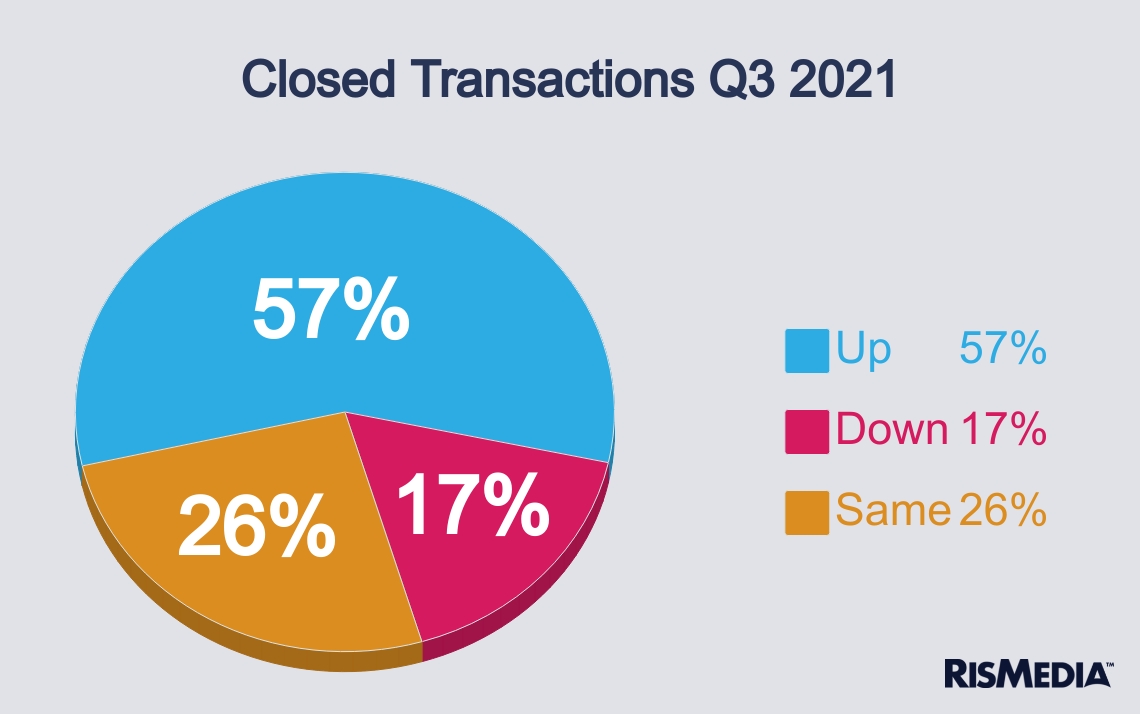

To understand our respondents’ businesses more and extract additional context from our index score, we asked more questions. We inquired if transactions in Q3 2021 were up, down or roughly the same. Only 16.6% of those surveyed said transactions were down. Whereas more than half (57%) saw the number of transactions rise in Q3 versus the previous quarter.

Sales volume generated even more positive results. Nearly three-quarters (74%) of brokers said they saw an increase in volume in Q3, and fewer than 10% experienced a dip. This mirrors traditional supply and demand principles, where prices elevate more steeply on the curve when supply is extremely low and demand is extremely high.

In fact, nearly half of the respondents (47.7%) said the main driver for their business’s performance in Q3 was due to high levels of demand. Price appreciation and inventory were also cited by 16.6% of respondents. Another 12.4% cited the catalyst for success was agent/company growth. Despite an objectively booming economy, only 3.1% of brokers cited this as a key performance driver.

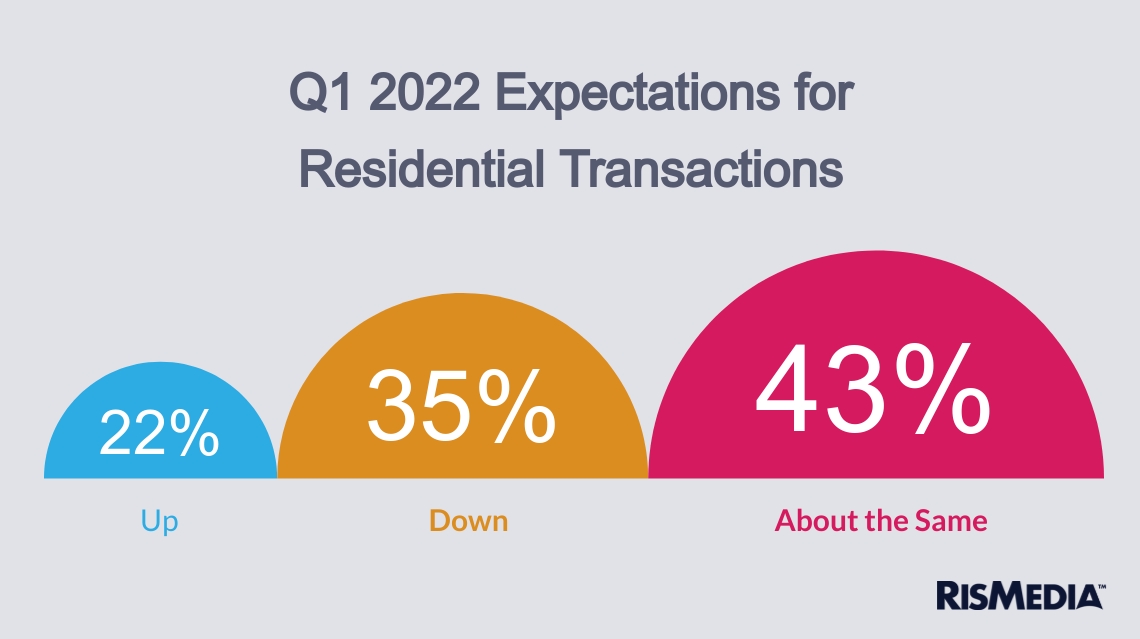

When turning our focus to Q1 2022, most brokers are looking forward to another stable quarter ahead, yet only 22.4% expect transactions to increase, whereas 43.2% expect them to remain flat. Flat or downward projections are, of course, correlated to inventory challenges and uncertainties. There are myriad reasons behind the inventory shortage, but the bottom line is simple: barring an unforeseen market shift, an increase in listings will be unlikely in most markets in the near future.

When turning our focus to Q1 2022, most brokers are looking forward to another stable quarter ahead, yet only 22.4% expect transactions to increase, whereas 43.2% expect them to remain flat. Flat or downward projections are, of course, correlated to inventory challenges and uncertainties. There are myriad reasons behind the inventory shortage, but the bottom line is simple: barring an unforeseen market shift, an increase in listings will be unlikely in most markets in the near future.

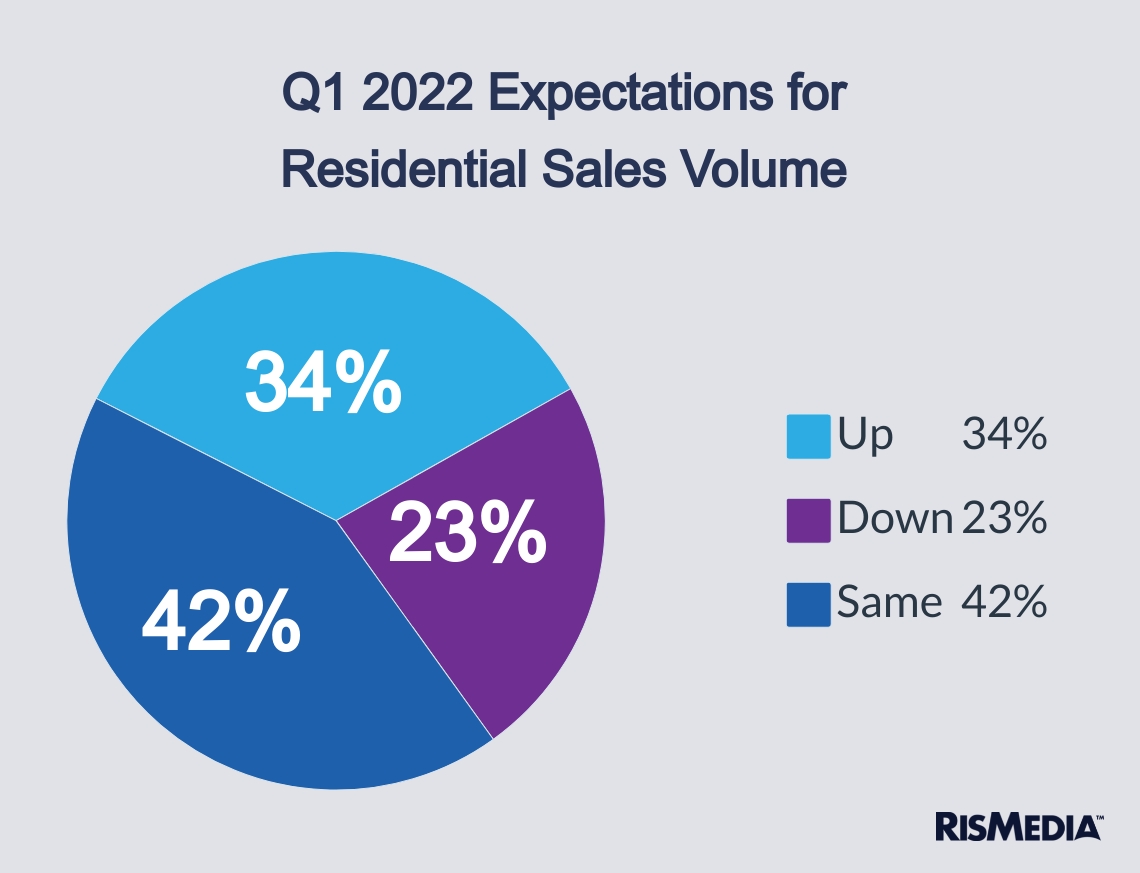

Unsurprisingly, we see a similar forecast from respondents when asking about sales volume in Q1 2022, with most respondents (42%) stating they expect volume to remain the same. Given rising prices, it’s not unusual that we also see a slight uptick of those who think volume will increase (34.2%), despite potentially fewer transactions. Still, even with soaring prices, if transactions fall too sharply, higher volume may not make up the difference in some markets.

Unsurprisingly, we see a similar forecast from respondents when asking about sales volume in Q1 2022, with most respondents (42%) stating they expect volume to remain the same. Given rising prices, it’s not unusual that we also see a slight uptick of those who think volume will increase (34.2%), despite potentially fewer transactions. Still, even with soaring prices, if transactions fall too sharply, higher volume may not make up the difference in some markets.

Finally, we asked our respondents, in their own words, to share what their biggest concerns were coming into Q1 2022. Overwhelmingly, it was a lack of inventory that most brokers cited.

Here are what a few had to say:

“Winter will be slow again due to excessively low inventory, which is actually lower than last year,” said Anthony Lamacchia, broker/owner of Lamacchia Realty, Waltham, Massachusetts.

“There are not enough houses to sell and too many new agents diluting the business,” said Amy Hudson, broker/owner, The Hudson Team, RE/MAX 8, Blacksburg Virginia.

“The ongoing lack of resale inventory is, and has been, the story of 2021. We don’t see a correction for this anytime soon. At the end of Q3 Metro Atlanta had 1.4 months of available inventory, compared to 2.2 at the same time in 2020,” said Carson Matthews, SVP and broker, Dorsey Alston REALTORS®, Atlanta, Georgia.

Interest rates were also noted as a point of concern by several respondents, and succinctly summed up by two brokers:

“Interest rates increasing could be challenging, but it’s inevitable they will be going up,” said David Winans, broker/owner, Better Homes & Gardens Real Estate Winans, Dallas Texas.

“If rates climb, things will slow. Our agents had such a good 2021; if they don’t work on their business, that will cause issues as well,” said Abbey Wostal, broker/owner, Better Homes & Gardens Real Estate, Topeka, Kansas.

Other challenging factors brokers said worried them included the ongoing pandemic and the potential of new COVID strains and restrictions, in addition to inflation, weather events, government policies and the overall state of the economy. All these concerns are warranted and something RISMedia will be closely monitoring in the coming days, weeks and months.

Still, as things stand today, the BCI points to brokers having an optimistic outlook as they barrel towards the first quarter of a new year. The winter months could show slight volatility in the monthly index score, but our next BCI Quarterly Report in March 2022, should offer a clearer picture of how hot the market could get during the spring and summer months.

Caysey Welton is RISMedia’s content director. Email him your real estate news ideas to cwelton@rismedia.com.

Caysey Welton is RISMedia’s content director. Email him your real estate news ideas to cwelton@rismedia.com.