Despite reports of a deceleration, experts indicated that November’s busy housing market continued to drive up price-tags homes by double digits, according to the most recent S&P CoreLogic/Case-Shiller Indices.

The organization reported that home prices climbed 18.8% in November, down from 19.0% the prior month.

The 10-City Composite increased by 16.8%—down from 17.2% in the previous month— while the 20-City Composite recorded an 18.3% price gain compared with the 18.5% seen in October.

Only eleven of the 20 cities reported higher annual price gains in November. Phoenix, Tampa and Miami reported the highest YoY price gains, recording 32.3%, 28.1% and 25.7%, respectively.

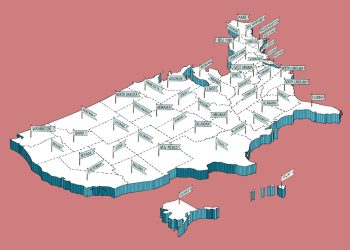

The complete data for the 20 markets measured by S&P:

Atlanta, Ga.

November/October: 1.4%

Year-Over-Year: 21.6%

Boston, Mass.

November/October: 0.0%

Year-Over-Year: 13.5%

Charlotte, N.C.

November/October: 1.4%

Year-Over-Year: 22.9%

Chicago, Ill.

November/October: 0.5%

Year-Over-Year: 11.6%

Cleveland, Ohio

November/October: 0.6%

Year-Over-Year: 14.0%

Dallas, Texas

November/October: 1.2%

Year-Over-Year: 25.0%

Denver, Colo.

November/October: 0.8%

Year-Over-Year: 20.1%

Detroit, Mich.

November/October: 0.7%

Year-Over-Year: 14.4%

Las Vegas, Nev.

November/October: 0.9%

Year-Over-Year: 25.7%

Los Angeles, Calif.

November/October: 1.2%

Year-Over-Year: 19.0%

Miami, Fla.

November/October: 2.0%

Year-Over-Year: 26.6%

Minneapolis, Minn.

November/October: 0.3%

Year-Over-Year: 11.2%

New York, N.Y.

November/October: 1.0%

Year-Over-Year: 13.8%

Phoenix, Ariz.

November/October: 1.2%

Year-Over-Year: 32.2%

Portland, Ore.

November/October: 0.5%

Year-Over-Year: 17.4%

San Diego, Calif.

November/October: 1.0%

Year-Over-Year: 24.4%

San Francisco, Calif.

November/October: 0.6%

Year-Over-Year: 18.2%

Seattle, Wash.

November/October: 1.4%

Year-Over-Year: 23.3%

Tampa, Fla.

November/October: 2.1%

Year-Over-Year: 29.0%

Washington, D.C.

November/October: 0.5%

Year-Over-Year: 11.1%

What the Industry Is Saying:

“For the past several months, home prices have been rising at a very high, but decelerating, rate. That trend continued in November 2021. Despite this deceleration, it’s important to remember that November’s 18.8% gain was the sixth-highest reading in the 34 years covered by our data—the top five were the months immediately preceding November.

“We continue to see very strong growth at the city level. All 20 cities saw price increases in the year ended November 2021, and prices in 19 cities are at their all-time highs. November’s price increase ranked in the top quintile of historical experience for 19 cities and in the top decile for 16 of them.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a change in locational preferences as households react to the COVID pandemic. More data will be required to understand whether this demand surge represents an acceleration of purchases that would have occurred over the next several years or reflects a more permanent secular change. In the short term, meanwhile, we should soon begin to see the impact of increasing mortgage rates on home prices.” — Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices

“Today’s S&P Case-Shiller Index highlights a still-busy housing market in late fall 2021, with buyers seeking to leverage low mortgage rates—which stayed around 3.1% in November—in their home purchase. Home prices rose at 18.8% in November, but the pace of appreciation continued to moderate as rising inflation and approaching winter holidays siphoned purchasing power from many home shoppers’ budgets.

We are now in the early days of 2022, and real estate markets remain unseasonably active as buyers continue to pursue a relatively small number of for-sale homes in an effort to get ahead of sharply rising mortgage rates—up 46 basis points since the end of November 2021. As a result, many first-time buyers are seeing their potential monthly payments soar by several hundred dollars, reducing their overall budget and limiting the number of available homes they can afford.

Looking at the next few months, we expect the inventory of available homes to improve, especially once the spring season gets underway. While listing prices will continue riding an upward trajectory, higher rates and more supply should further moderate the steep price growth seen last year.” — George Ratiu, Manager of Economic Research, realtor.com®

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news to jgrice@rismedia.com.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news to jgrice@rismedia.com.