New data from the National Association of REALTORS® (NAR) shows that contract signings decreased in June, following a slight rebound in May, providing further evidence that the 2022 housing market is beginning to cool.

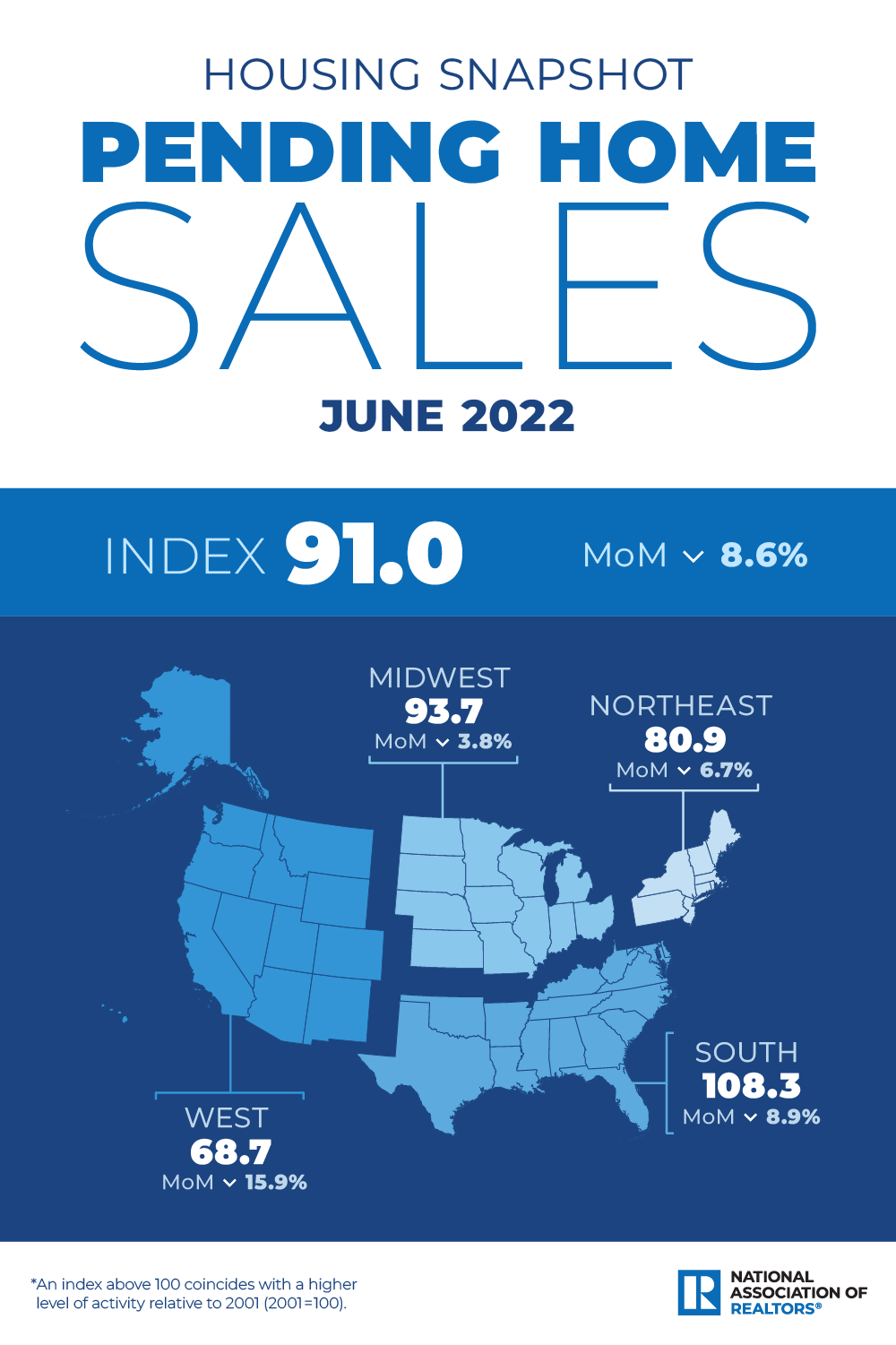

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 8.6% to 91 last month, and year-over-year sales decreased by 20%. An index of 100 is equal to the level of contract activity in 2001.

All four major regions saw double-digit year-over-year downturns, the largest of which occurred in the West, where pending sales were down by almost a third.

Buying a home in June was nearly 80% more expensive than in June 2019, according to NAR. Nearly a quarter of buyers who purchased a home three years ago would be unable to do so now because they no longer earn the qualifying income to buy a median-priced home today

The across-the-board monthly decrease in contract signings, along with a host of other indicators, signal a period of stabilization on the heels of two years of red-hot housing market activity, according to experts.

Regional breakdown:

Northeast

-6.7% MoM — Now 80.9 PHSI

-17.6% YoY

Midwest

-3.8% MoM — 93.7 PHSI

-13.4% YoY

South

-8.9% MoM — 108.3 PHSI

-19.2% YoY

West

-15.9% MoM — 68.7 PHSI

-30.9% YoY

The takeaway:

“Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date,” said NAR Chief Economist Lawrence Yun. “There are indications that mortgage rates may be topping or very close to a cyclical high in July. If so, pending contracts should also begin to stabilize.”

“Home sales will be down by 13% in 2022, according to our latest projection,” Yun added. “With mortgage rates expected to stabilize near 6% and steady job creation, home sales should start to rise by early 2023.”

“With rising mortgage rates compounding record-high prices to make a home purchase a much more expensive proposition, homebuyers are taking a harder look at their plans,” said George Ratiu, senior economist and manager of economic research at realtor.com®. “At the same time, in the wake of two years of travel restrictions and limitations, Americans are embracing summer vacations and ready for a post-pandemic normal. These factors are pulling prospective buyers’ budgets in multiple directions and taking the wind out of the sails of market transactions, with sales of both new and existing homes declining in the first half of this year…The affordability crunch is the main concern for many families this summer.”

Ratiu concluded, “The bottom line is that we are seeing a welcome shift for a housing market in need of a refresh. The past two years’ overheated pace of home sales activity is giving way to a transition toward much-needed balance.”

Brendan Rascius is RISMedia’s associate editor. Email him your story ideas at brascius@rismedia.com.