How This Mortgage Franchise Option Is Changing the Game

How This Mortgage Franchise Option Is Changing the Game

It was 2016 and I was an executive at one of the most successful real estate franchisors on the globe. We were in the thick of the post-recession real estate boom, which meant “idle time” had left my vocabulary. Dave Liniger, real estate titan and co-founder of the brand that employed me, called his team of executives to the polished conference room on the twelfth floor of our headquarters building. We shuffled into the room, taking a seat to face our well-respected leader at the head of the 10-foot table. He reclined comfortably just in front of the room’s sweeping floor-to-ceiling windows, the Rocky Mountains serving as backdrop. Dave’s jaw was set…no hint of a smirk crossed his lips, but his eyes flashed with the unmistakable fire of excitement.

“I’m going to cut to the chase. We’re starting our own mortgage company, and you’re all going to be on the frontline of it,” he said. And at that, Dave’s stoic expression broke into an infectious smile. The room buzzed with excitement at the prospect. He explained the need for additional revenue opportunities in real estate, given the commission challenges that industry entrepreneurs faced.

Dave, in his infinite wisdom, believed that brokerage owners and real estate team leaders needed another business opportunity that could complement their current homeownership ventures. Like today, 2016 saw extreme competition between real estate brokerages to recruit top agent talent, accepting smaller and smaller commission splits in return. As a result, many faced—and continue to face—slimming profit margins. Brokerage owners and team leaders needed a potential expansion option where they were at the heart of each deal…a business addition where they could be the architects of their own destinies. And so, we were going to venture into uncharted territory. We would package a mortgage brokerage franchise option that could serve as their potential secondary revenue stream.

“This is something our people need,” Dave explained, “so we’re going to build it for them. We’re going to build it for all real estate leaders, in our network or outside of our network. And we’re going to launch it in three months.”

– Ward Morrison

President and CEO,

Motto Franchising, LLC

The broker/owner need for market differentiation

Fast forward to 2022 and real estate inventory volumes seem to be headed in a more favorable direction again. During the past several years, the housing market has been out of balance. Available inventory has lagged behind demand for housing, but recent signs point to coming stabilization in the housing market.

“The day Dave shared his idea of building a mortgage brokerage franchise model, I was captivated. The industry was hungry for something like this, and it didn’t exist yet. We were on the ground level of something big,” reminisced Ward Morrison, president and CEO of Motto Franchising, LLC, “and right now, the need among brokerage owners and team leaders for alternative business expansion may be stronger than ever.”

While the current economy continues to be unpredictable, the American Dream of homeownership remains strong. Add that cornerstone desire for homeownership to the introduction of expanded home financing options through non-conventional mortgage loans, and the real estate horizon looks more promising.

Yet, even the most successful real estate leaders appear to be facing an uphill climb of their own. It’s a hill they’ve been trudging up for years, and it’s known as the commission squeeze. “Commission splits continue to skew more and more toward the agent benefit, and consumers are comparing full-service brokerages to their discount counterparts. These trends put pressure on broker/owner and team leader profits. That’s why we set out to offer a potential secondary profit source for real estate business leaders across the country, whether part of the RE/MAX network or working outside of it,” adds Morrison.

The Story of the U.S.’ First-and-Only National Mortgage Brokerage Franchise

At the helm of RE/MAX, Liniger, the (since retired) CEO had no question that mortgage services were the way of the real estate future. On a mission to bring his vision of a mortgage brokerage franchise to fruition, Liniger collaborated with Morrison. Morrison’s career in the housing industry traversed both real estate and mortgage, making him the ideal leader for the blooming brand.

“When we launched Motto® Mortgage in October 2016, we knew it was a revolutionary and innovative concept that would serve the interests of borrowers, franchisees, mortgage loan originators and real estate professionals,” recounted Morrison. “I have worked in and around real estate and mortgage for over 25 years. There continues to be a growing gap in the needs of real estate brokerage owners and team leaders, as they face narrowing commission splits in a highly competitive housing market. We understand that the professional bond between a real estate agent and a mortgage professional is matchless in the industry. The two work in tandem for the homeowner’s benefit and can create a cohesive, seamless process if the pieces of the puzzles align. Seeing the opportunity for increased profitability available to real estate professionals who add a Motto franchise has been the most rewarding experience of my career.”

Since the 2016 launch, the Motto Mortgage network has grown exponentially and now has more than 200 offices in almost 40 states. Thanks to the real estate industry’s desire for additional services (also referred to as ancillary, secondary or complementary services) and the unique convenience of Motto Franchising’s Mortgage Brokerage-in-a-BoxSM model, real estate leaders across the U.S. have taken note.

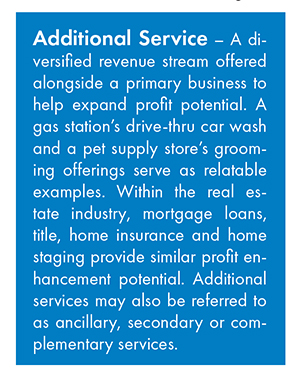

Additional services changing the game

Nestled in a pristine Aiken, South Carolina, shopping center, the Motto Mortgage Simplified storefront welcomes homeowners and hopeful homebuyers alike. Robert Rollings, a local real estate entrepreneur, credits his Motto Mortgage team with bolstering real estate agent recruiting efforts and helping to move challenging home financing scenarios across the finish line.

Like many top real estate professionals, Rollings added mortgage as a complementary business to his existing brokerage in an effort to combat shrinking commission splits in 2019. Additional housing services, like mortgage, title and insurance, can support the primary real estate business—not only offering more revenue opportunity but also enhancing the client experience. Motto Mortgage Simplified diversifies and enhances Rollings’ thriving Shannon Rollings Real Estate business and opens the door to more varied home financing options for his homebuyers.

Rollings’ addition of mortgage services provided his real estate business the financial benefit of capturing more of the transaction from each home purchase and has helped foster the appreciation of his real estate agents and clients. As he explains it, “If we continue to invest in our Motto team, we are confident that more and more homebuyers and real estate agents will want to work with us.”

Another real estate brokerage owner has already experienced the powerful recruiting effects of adding additional mortgage services to a real estate firm. Christian Bennett, co-owner of Motto Mortgage Champions and RE/MAX Champions, credits his Motto Mortgage office in Trinity, Florida, with the real estate business’ recent expansion. “Adding Motto was a gamechanger for us,” says Bennett, with his characteristically warm, yet to-the-point candor.

“A year after opening our Motto Mortgage office, we expanded our real estate operations with another RE/MAX office. This growth was partially thanks to the additional business we earned through our mortgage services. But the greatest factor was the increased agent count we experienced. Real estate agents are drawn to the close working relationships established between our existing agents and our loan originators. Even better, each group refers top-notch talent on both sides. Loan originators have suggested we recruit some extremely skilled real estate agents and our top loan originators were introduced to us by our real estate team.”

Anne Bromberg, a real estate agent with RE/MAX Champions, shares Bennett’s sentiments. “I was an established agent with RE/MAX Champions during the inception of the company’s complementary mortgage business. I recommended that we bring Mary Babinski over as our first loan originator since we had worked well together previously. Intrigued by the comprehensive tools Motto had to offer and the real estate team we had in place, Mary accepted, and we’ve been partnering on home sales ever since. Our collaboration has only strengthened with our close working proximity. My clients know me for my high level of service and when I recommend that they work with Mary for their financing, I know she’ll take care of them with the same caliber of care I do.”

The Power of One-Stop Shopping in the Competitive Real Estate Industry

Today’s abundance of real estate brokerage options remains the legacy of the housing surge that swept the nation in the late 2010s. As a seemingly endless reserve of competitors challenge revenues and commission splits continue to shrink for brokerage owners and team leaders, real estate entrepreneurs have sought solutions. The end goal for each of these forward-thinking entrepreneurs: becoming the preferred housing experts in their communities. Of course, being resourceful, reliable and knowledgeable became the baseline. What more could a real estate professional do to win over their potential client base? Make buying and selling homes more convenient for the consumer.

Keith Pike, owner of Motto Mortgage Alliance and RE/MAX Elite in Little Rock, Arkansas, values the one-stop shopping that his mortgage franchise affords his real estate firm. “One-stop shopping allows our agents to connect their clients with mortgage professionals they truly trust. They can communicate closely about the needs and desires of their clients and even pop into the loan originator’s office to ask technical home financing questions whenever needed. This streamlines the experience for clients and builds trust for everyone. Before we had our Motto office, we couldn’t trust what would happen if financing got difficult. Outside mortgage professionals tend to ‘ghost’ homebuyers if something gets hard. With our team of loan originators, they’ll do everything they can to find a way to make it work.”

Motto Mortgage Franchising’s Vice President of Marketing and Advertising, Kelly Gill, echoes Pike’s view of this modern real estate business model. “As a Motto Mortgage brand leader who came from a more traditional mortgage lending background, I see the true uniqueness in what we offer franchisees—the ability to bring the mortgage and real estate relationship together to create a compelling partnership between agent and loan originator. We’ve created an opportunity for real estate brokerages to align with a mortgage solution that shares their culture, relationships and values. This approach brings a new kind of synergy to the customer experience and a new market advantage to the entrepreneur. With a real estate broker/owner or a team lead encouraging that team environment, the consumer can have an elevated experience that they may return to, time and time again.”

Real estate entrepreneurs at the heart of the model

Motto Mortgage follows the compass established by Liniger nearly 50 years ago at the inception of RE/MAX. The direction of every initiative, every solution and every business direction tracks the needs of the business owners. Entrepreneurship and homeownership are two of the bedrocks of the American economy. Trailblazers—especially those working to secure homeownership for others—deserve expanded opportunity for revenue potential without all the barriers often baked into such ventures. Motto Mortgage’s pioneering DNA has attracted the best of these worlds; the savviest of real estate leaders and industry trailblazers.

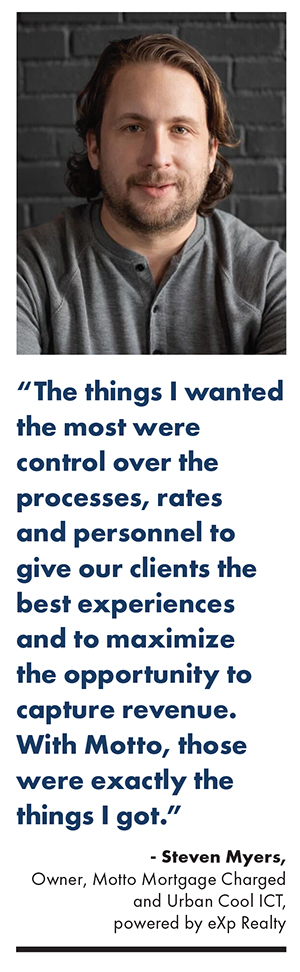

Terri Larson, Motto Mortgage Franchising’s vice president of operations, explains how her team keeps the needs of franchise owners at the forefront of every process. “From an operational perspective, we create a clear path toward success for real estate broker/owners and team leaders. Whether an office is just getting started with onboarding or they have graduated to the growth and development team, our primary function is to help our network identify opportunities to make positive business strides, to become operationally efficient, and to assist them in identifying ‘what’s next’ for their firm. Most of our franchise owners say office launch was much easier than they had anticipated and that our support goes above and beyond their expectations. There’s nothing I like hearing more.”

Steven Myers, owner of Motto Mortgage Charged and Urban Cool ICT, powered by eXp Realty in Wichita, Kansas, is one such advocate of the franchisor’s support model. “The things I wanted the most were control over the processes, rates and personnel to give our clients the best experiences and to maximize the opportunity to capture revenue. With Motto, those were exactly the things I got.”

Each office in the Motto Mortgage network is independently owned, operated and licensed. This information is not intended as an offer to sell, or the solicitation of an offer to buy, a Motto Mortgage franchise. It is for informational purposes only. We will not offer you a franchise in states or other jurisdictions where registration is required unless and until we have complied with applicable pre-sale registration requirements in your state (or have been exempted therefrom) and a Franchise Disclosure Document has been delivered to you before the sale in compliance with applicable law. New York residents: This advertisement is not an offering. An offering can be made by prospectus only. Minnesota Reg. No. F-8089. Motto Franchising, LLC, 5075 South Syracuse St #1200, Denver, CO 80237, 1.866.668.8649.

© 2022 Motto Franchising, LLC.

For more information visit https://www.mottomortgage.com/.