After what has been one of the most unusual years in recent history for real estate, brokers are—for the first time in five months—feeling better about their industry, with some signs that a battered housing market is finally on the upswing.

In December, RISMedia’s Broker Confidence Index (BCI) rose for the first time in five months after plunging 20% over the course of a volatile year that saw inflation, war and mortgage rates smother the pandemic housing boom of 2020-21. Rising to 5.5 from a 5.3 reading in November, leading real estate practitioners were seemingly encouraged by a significant dip in mortgage rates over the last few weeks, along with some positive inflation news that has also bolstered the broader economy.

One year ago, the inaugural BCI survey measured in at 8.2, with inflation still transitory and mortgage rates sitting at around 3% flat. Since then, a whirlwind housing correction driven by the Federal Reserve’s attempt to curb price increases with historically large interest rate increases left many homebuyers priced out of the market and sellers sitting cautiously on the sideline. Inventory remains scarce as builders deal with their own confidence issues, and deeper inequalities continue to push homeownership further out of reach for many groups.

One year ago, the inaugural BCI survey measured in at 8.2, with inflation still transitory and mortgage rates sitting at around 3% flat. Since then, a whirlwind housing correction driven by the Federal Reserve’s attempt to curb price increases with historically large interest rate increases left many homebuyers priced out of the market and sellers sitting cautiously on the sideline. Inventory remains scarce as builders deal with their own confidence issues, and deeper inequalities continue to push homeownership further out of reach for many groups.

Despite all these challenges, brokers expressed more optimism when asked about their confidence for next year compared to right now, with that rating coming in a full point higher than December’s reading at 6.5.

Despite all these challenges, brokers expressed more optimism when asked about their confidence for next year compared to right now, with that rating coming in a full point higher than December’s reading at 6.5.

Todd C. Menard, CEO of West USA Realty in Arizona, saw “available inventory of resale homes, lower interest rates and less consumer fear” as bolstering his confidence in the 2023 housing market. A handful of brokers who were still hesitant about the current market expressed significantly higher confidence in 2023.

Todd C. Menard, CEO of West USA Realty in Arizona, saw “available inventory of resale homes, lower interest rates and less consumer fear” as bolstering his confidence in the 2023 housing market. A handful of brokers who were still hesitant about the current market expressed significantly higher confidence in 2023.

“We’ve been through changeable markets in the past,” said Gavin Payne, broker associate and owner of Better Homes and Gardens Real Estate Haven Properties.

The 2022 Housing Recession

Looking back on RISMedia’s BCI readings, it was clear that brokers have a much more on-the-ground and nuanced understanding of their markets than pundits, or other voices that predicted a total crash in 2022.

Way back in February, a solid majority of brokers said that the Fed’s interest rates were going to affect their businesses, and an even larger majority predicted sales would be down, almost exactly lining up with the beginning of an ongoing 10-month streak of lower month-to-month existing home sales.

Way back in February, a solid majority of brokers said that the Fed’s interest rates were going to affect their businesses, and an even larger majority predicted sales would be down, almost exactly lining up with the beginning of an ongoing 10-month streak of lower month-to-month existing home sales.

“The market is very strong. Prices are going up because inventory remains scarce. The main headwind is interest rates,” said Michael Nourmand, president of Nourmand and Associates REALTORS® in California, back in February.

“Mortgage rates are up, but inventory is low. Buyers are out there, but properties on the market are expiring. I think that a correctly priced house will still sell quickly regardless of the mortgage rates due to people’s desire for change in the uncertain world of COVID,” said Fern Karhu, broker/owner of Realty Connect USA in New York, also in February.

Prices have indeed remained more resilient than many expected, and homes continue to move off the market relatively quickly. At the same time, outside observers were predicting that the market could carry the momentum of the pandemic, or would experience an all-out crash.

In April, two months before the Fed dropped its first historic 75 basis point rate hike, brokers were already preparing for a higher interest rate environment, and understanding what that would mean for real estate going forward.

“Interest rate increases have begun to slow the pace of sales in our area,” said Travis Baron, broker/owner of RE/MAX Premier Realty in California. “I feel confident in the ability of the market to maintain values as the overall economy changes, but we are definitely seeing signs of fewer sales and inventory growing.”

April was also the first month that interest rates and mortgage rates became the No. 1 most mentioned factor that brokers cited as affecting their confidence in the industry. Just under half (48%) talked about increasing rates as a concern compared to 28% in March and 27% in February.

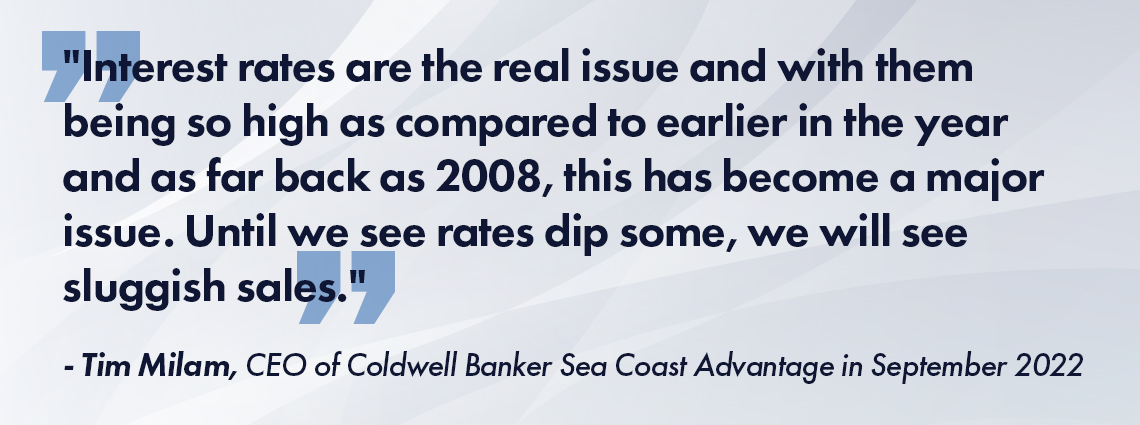

Between April 1 and July 1, rates rose a full percentage point, quickly becoming a primary factor in a slowing market. In November, brokers cited interest rates as the single biggest obstacle to success in 2022 (rates peaked at around 7% at the beginning of the month).

Between April 1 and July 1, rates rose a full percentage point, quickly becoming a primary factor in a slowing market. In November, brokers cited interest rates as the single biggest obstacle to success in 2022 (rates peaked at around 7% at the beginning of the month).

What We Learned

It was also clear that brokers were getting ahead of the curve as they anticipated the changing real estate environment. In May, RISMedia asked brokers what steps they were taking for a changing market. More than one in 10(13%) said they were already telling agents to get “back to basics”—listing presentations, nurturing leads, database management, etc. More than one in three (35%) said they were “very” prepared for the changing market even back then.

Craig West, co-owner and CEO of Berkshire Hathaway HomeServices Indiana Realty, said in May that he was already ramping up “training, one-on-one coaching, collaboration with monthly mastermind groups, marketing resources to include social media and digital, and a renewed focus on relationship building with their client database” with agents.

Brokers also made it clear that they are not particularly confident in the mainstream media’s ability to provide pertinent, accurate information on the housing market. In September, only a fractional 2% of respondents thought the media was “very accurate” in covering real estate, and a clear majority (57%) thought mainstream news outlets were either somewhat or very inaccurate.

The biggest complaint from brokers was that negative news stories focused on the national market were frightening potential buyers and sellers in local markets that were, in fact, thriving.

“The media is scaring our clients when in fact there’s still significant demand here,” said Sarah Drennan, executive vice president at Terrie O’Connor REALTORS® in New Jersey, back in September.

The reality that even a major correction affects every market differently is something that brokers clearly understand, but is seemingly lost on many pundits. Even as the BCI overall plunged in the fall, many brokers continued to express high confidence, often saying that their markets proved more resilient to the various headwinds.

“It is a changing market for sure, but still plenty of opportunities available. Market change is inevitable, but we must change to stay productive and not worry about losing ground but how we can grow to capture more of the sales that are available,” said John O’Reilley, broker/owner of Better Homes and Gardens Base Camp in Virginia, back in October.

In September and October, as sales fell and the BCI dipped, one in four (25%) brokers still rated their confidence at an 8 or higher—evidence that the inherently local nature of real estate makes generalizations nearly impossible.

“Professionals are busy no matter what the rates are or what the news has to say about the state of the economy,” said Katie Clark, executive vice president of agent development at e-merge Real Estate in Ohio, in September.

The Road Ahead

Housing experts have continued to predict a relatively flat year in 2023, with the caveat that everything depends on how far the Fed has to go in its mandate to tamp down inflation. Even if mortgage rates settle, there remain plenty of other roadblocks—affordability and inventory top of mind.

But the fact that brokers saw reason for optimism even during the sleepy holiday season implies that these obstacles can be overcome.

“I am cautiously optimistic about my local market,” said Zack Hensrude, managing broker at RE/MAX Elite in Washington in November. “I am doubling down on my systems and education.”

“Experienced agents will take marketshare and never give it back,” said Pam Kiker, broker/owner of The Kiker Team in Colorado.

Some issues, like affordability, inventory and discriminatory lending and housing policies, predate the pandemic by years or decades, and will take much longer to solve. Real estate professionals also face threats from a variety of lawsuits and investigations, with the current commision structure and MLS policies on the line.

But Shannon Daniele, broker/owner of HomeSmart Realty Group in California, believes that it is the individual broker and agent that gets to decide what their business environment will be like.

“This is a great time to be a real estate agent,” he said. “A tree in a windstorm. What part of the tree are you attached to? You can be part of the leaves that blow off easily, or be a part of the rooting system and the tree trunk by always selling on value.”