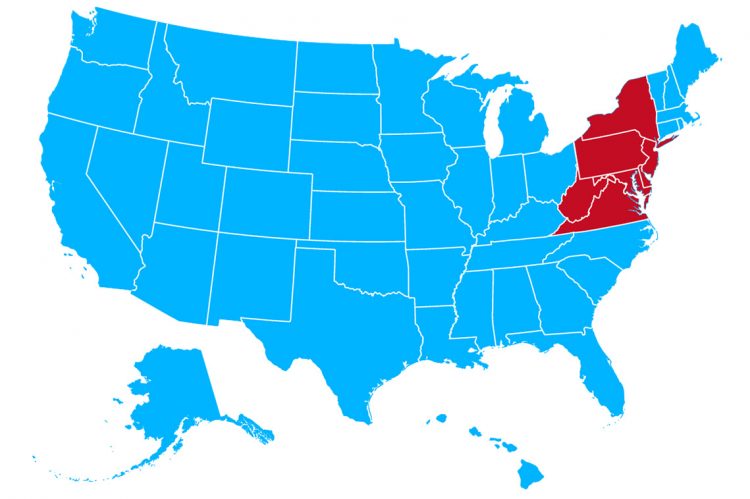

The Mid-Atlantic region’s housing market is feeling waves of confusion as the spring buying season kicks off, according to a new report from Bright MLS.

Bright MLS’s March Housing Report found that elevated mortgage rates continue to erode buyers’ purchasing power, and low inventory in most markets restrained market activity. On the other hand, homes are still selling fast and about one-third of homes sold over asking price throughout the region last month.

While home sales will continue to ramp up, the report’s data points to a relatively subdued spring housing market in the face of economic uncertainty, volatile mortgage rates and limited inventory. Price growth has slowed, but the tightness in supply continues to put pressure on buyers. The market may begin to look more balanced in the second half of 2023, but there will be a lot of variation across local areas.

In addition, showing activity, an indicator of what is to come in the market, is down year-over-year (-27.6%), and pending sales are down 25.4%. Although active listings were 26.9% higher than a year ago, new listings were down 29.4%. There is still just over one month of supply across the Mid-Atlantic market. The median sales price in the region was $368,000 in March, a relatively flat increase of just 0.8%.

Philadelphia metro data:

- Philadelphia home shoppers faced less competition than the typical start to the homebuyer season. However, the metro’s lack of available homes kept the market competitive, fueling higher home prices and quick sales among a smaller pool of buyers.

- The median home price in the region rose 5.5% to $324,995, still below the national median home price of $363,000, but nearly 30% higher than three years ago.

- A typical home in the metro spent 13 days on the market, four days longer than a year ago, but nine days faster than in February.

- Pending home sales rose in the Philadelphia metro area for the third consecutive month. However, the 6,396 homes that went under contract in the metro was 25.4% lower than a year ago.

- Showings were up slightly month-over-month, but down nearly 27% year-over-year.

- Active listings were up nearly 23.7% year-over-year, while the number of new listings coming onto the market was down 25% compared to last year at this time.

- Available inventory was 40% lower than it was four years ago, while new listings were at their lowest level in two decades.

Baltimore metro data:

- Home prices in the Baltimore metro declined in March for the first time since 2018. The metro’s median home price fell 1.5% year-over-year to $335,000, marking an end to a 53-month growth streak in which prices appreciated by nearly 30%.

- Like the rest of the Mid-Atlantic, the number of available homes for sale across the metro remains limited, with just over one month of supply. However, some markets in the Baltimore metro area experienced a bigger run up on prices during the pandemic housing market, which could explain the slight pullback on home prices.

- The typical seasonal increase in housing market activity resulted in higher closed sales and showing activity and a decline in days on market compared to February, but the uptick was below the typical start to the spring home buyer market.

- On a year-over-year basis, closed sales, new pending sales and showings were down 24.8%, 27.9% and 30.6%, respectively.

- Homes continue to sell fast in the Baltimore region, spending a median of 10 days on market, an indication that although there are fewer buyers in the market, there is competition for the limited number of homes for sale.

- In addition to affordability, a lack of inventory in the Baltimore market limits the number of available choices for buyers. 35% fewer homes were listed for sale compared to a year ago, keeping active listings nearly 60% below 2019 levels.

Washington metro data:

- Higher mortgage rates and record-high home prices set the stage for a slower than normal start to the spring home-buying market in the D.C. region. Home prices are still rising in some local markets across the region, but the median home price fell for the second time in four months, primarily driven by price declines among single-family detached homes.

- The median home price in the region was $545,000, down 2.0% from a year ago. Despite the price dip, the median price in the Washington, D.C., metro area is still about 14% higher than it was three years ago.

- In a sign of a slower market, closed sales, new pending sales and showings were all down nearly 30% from a year ago.

- Buyers who remain in the market are finding limited choice, with inventory roughly half (51%) of what it was in 2019. The number of new listings is still far below what would be seen in a typical spring housing market.

- Another nod toward the intensity of the market is the pace at which homes are selling. The median days on market was nine days, down from 20 in February and 30 in January.

Major takeaway:

“Home sales and showings are lower than a year ago, indicating a slow market, but there is more to the story in the Mid-Atlantic,” said Bright MLS Chief Economist Dr. Lisa Sturtevant. “Relatively high mortgage rates and a lack of inventory has cooled what is typically the start of the spring housing market. However, at the same time, interested buyers are still finding the market competitive. Sellers who price their homes realistically are still seeing multiple offers, and homes are selling fast.”

Sturtevant added, “Based on this scenario, we are seeing a housing market that is fast-paced on a transactional level. At the same time, sellers should still be ready to expect buyers to ask for things like home inspections and closing-cost assistance, unheard of during the pandemic market.”

About the data in Philadelphia, Sturtevant said that higher home prices and mortgage rates will keep some buyers on the sidelines, making this spring home-buying market more subdued than in recent years. At the same time, the lack of available homes for sale will keep the competition high among those looking to close on a home. Although buyers may have more leverage when it comes to negotiating, sellers will continue to have the upper hand unless there is an influx of new listings.

Sturtevant also stated that, despite a slight decrease in home prices in March, the data in Baltimore suggests that buyers shouldn’t expect to see significant price declines in the coming months. While affordability will limit the number of buyers, there will still be stiff competition due to a lack of homes for sale. Sellers interested in listing their homes will continue to benefit from the home-price appreciation they have benefited from in recent years.

For Washington, Sturtevant surmised that the lack of new listings is countering lower buyer activity and keeping the market competitive for those who are trying to buy in the Washington metro. However, high home prices and rising affordability challenges could be putting a ceiling on home sales transactions this spring. Prices may fall further in the region, but the very limited inventory will keep any declines modest.

For the full report, visit BrightMLS.com/MarketInsights.