After consecutive months of almost no movement, RISMedia’s measure of real estate confidence, the Broker Confidence Index (BCI), jumped this month, powering from 6.4 to 6.9—almost exactly where it was a year ago.

Through most of 2023, brokers have remained more than a little cautious, telling RISMedia that they’re keeping marketing spending roughly flat and are unsure about spring inventory.

But this latest reading would indicate that conditions have broadly met or exceeded expectations in the early parts of spring, and brokers are growing more optimistic in the near term.

“There is substantially more buyer activity/interest here,” says Joe Lins, president, CEO and owner of CENTURY 21 Discovery in Southern California.

After a long, slow decline through much of 2022 and a quick rebound to start the new year, the big question was whether brokers were seeing a temporary blip ahead of more market woes, or whether winter was the bottom and 2023 would serve as bounceback. Overall, national data has been decidedly mixed since January, and two straight BCI surveys showed brokers starkly divided on the likely path of the market.

But this latest reading seems to show brokers warming up to the idea of a more normal—even healthy—real estate climate in 2023, with less focus on interest rates or the possibility of a recession.

“(We have) increases in new listings and pending sales,” says Todd C. Menard, CEO of West USA Realty in Arizona. ”Focus on the sellers, (and) buyers will come.”

A flat circle

In April of last year, the BCI clocked in at 7, having fallen 1.2 points from 8.2 in December 2021. This year, the BCI gained about the same amount in the same timeframe, up 1.4 points from 5.5 in December 2022.

The seemingly more normalized, cyclical progression would seem to point to a return to long-term seasonal trends, and an emergence from the pandemic market, which was anything but normal—dubbed at one point a “weird recession” by National Association of REALTORS® Chief Economist Lawrence Yun.

Maybe even more encouraging, the BCI is returning to where it was before the Federal Reserve began raising interest rates, right as that campaign of rate hikes is expected to end. Even though the annualized rate of home sales is roughly a million less than it was in April 2022, brokers seem to be expecting improvement.

This would again point to a general sentiment from brokers that the industry has seen the worst of the downturn, and could avoid the worst-case scenario of a housing crash or recession.

“(We’re being) realistic about the last few years,” says Jim Fite, president and CEO of CENTURY 21 Judge Fite Company in Texas. “Most (agents) have not experienced a ‘real’ market.”

The biggest challenge identified by brokers is again, inventory, which both real estate insiders and outside experts agree has no easy solution. An overwhelming 60% in this month’s survey mentioned inventory as a factor affecting their confidence, or affecting their agents’ motivation.

Only 16% mentioned rates this month as affecting their confidence level, compared to 45% who worried about rates in April 2022 (one month after the Fed’s first hike). At the time, 40% worried about inventory shortages.

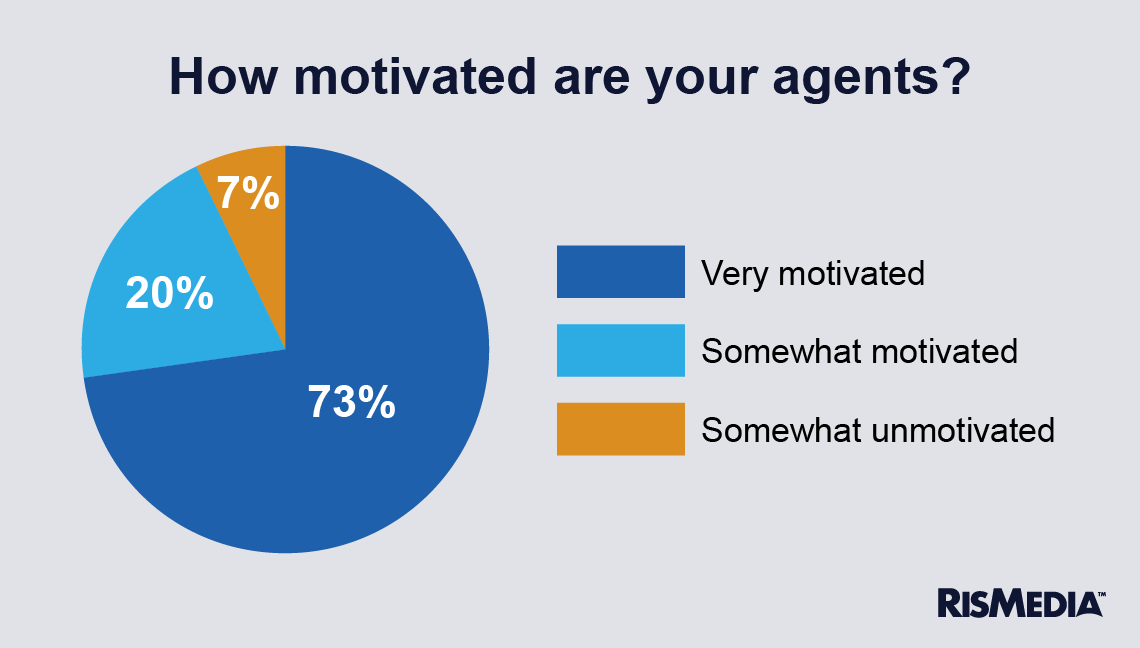

This month, we also asked brokers how motivated their agents were to take advantage of new opportunities in the spring market. That appeared to be a negligible concern for brokers, with over 93% saying their agents were at least somewhat motivated.

Surprisingly, the brokers who said their agents were “very motivated” to work in this new market had roughly the same confidence as those who said their agents were only “somewhat motivated” or “somewhat unmotivated.” The brokers of “very motivated” agents had a confidence level of 7 compared to 6.5 for all other respondents.

Those who felt their agents were less motivated mostly cited a lack of inventory or inexperience as factors.