How much buzz can a four-month-old announcement create? If it impacts the affordability of homeownership one way or the other: plenty.

That was the case over the past couple of days as the Federal Housing Finance Agency (FHFA) has evoked mixed emotions surrounding future and recent changes to the pricing framework of Fannie Mae and Freddie Mac’s conventional loans.

FHFA officials drew industrywide fanfare following a Wednesday announcement that the agency would withdraw a controversial and highly contested loan-level pricing adjustment (LLPA) for conventional borrowers with debt-to-income (DTI) levels at or above 40%.

“I appreciate the feedback FHFA has received from the mortgage industry and other market participants about the challenges of implementing the DTI ratio-based fee,” said Director Sandra L. Thompson in a statement on Wednesday. “To continue this valuable dialogue, FHFA will provide additional transparency on the process for setting the Enterprises’ single-family guarantee fees and will request public input on this issue.”

The agency has faced criticism and fielded feedback since the start of the year after it announced its plans to update upfront fees, including those based on specific DTI standards, which the FHFA claimed would “increase pricing support for purchase borrowers limited by income or by wealth.”

Another change was a newly revamped Loan-Level Price Adjustment (LLPA) Matrix, which lowers fees for some borrowers while increasing them for others based on their credit score and down payment amounts.

Based on a revamped pricing framework—which went into effect on May 1—a borrower with a credit score of 740 or higher making a 15% to 20% down payment will face a 1% surcharge, while a buyer with a credit score of 679 or lower and a down payment of 5% or even less will get a 1.75% fee discount.

The buzz created by the fee changes has spawned some confusion that officials have tried to clear up in recent weeks, including Thompson, who wanted to mitigate confusion surrounding what many in the industry consider to be penalties to lower-risk homebuyers.

“Higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less,” she said in a recent statement. “The updated fees, as was true of the prior fees, generally increase as credit scores decrease for any given level of down payment.”

Thompson contested the claims that the new pricing framework incentivized borrowers to make lower down payments to try and benefit from the lower fees. Instead, she said that those paying 20% or lower of the home’s value usually pay a mortgage insurance premium, which must be added to the fees charged by the agencies.

“Some updated fees are higher, and some are lower, in differing amounts,” she says. “They do not represent pure decreases for high-risk borrowers or pure increases for low-risk borrowers. Many borrowers with high credit scores or large down payments will see their fees decrease or remain flat.”

Some onlookers are still critical of the FHFA’s move to increase Fannie and Freddie mortgage fees despite recent efforts to mitigate confusion and concerns.

While mortgage broker Shant Banosian of Guaranteed Rate understood the purpose of the FHFA’s move, he thinks the move could have been better thought out.

“I think doing it at the expense of people with great credit and having them kind of be penalized for that has been the part that’s really kind of grabbed everyone’s attention,” he says. “The mistake is that, when the FHFA did this, they were equating low credit to low income.

“I can tell you, just from having worked with hundreds of thousands of credit reports, many people with great incomes don’t pay their bills on time,” Banosian continues. “There are many people with really low incomes that pay every single bill on time.”

Melissa Cohn, regional vice president of William Raveis Mortgage, echoed similar sentiments. However, she isn’t surprised at the move, given the FHFA’s overarching mission.

“I guess you have to go back to say, ‘well, what was the FHFA created for?'” she says. “The answer is that it was created to encourage homeownership designed to support first-time homebuyers. It was not to provide a lending source to the wealthy.

“We’ve seen over the past year; they increased the price overlays for second homes,” Cohn continues. “Last year, they increased the overlays for investment properties. Some of the FHFA fees were reduced in a concerted effort to preserve the money for the people they’re really meant to be lending to, and this is sort of, in many ways, the next step.”

The FHFA’s fee increases have been in the works for months—they were announced in January. Despite recent furor about the changes, Cohn notes that the hikes have already been baked into the system, which she says won’t have much impact on consumer sentiment in the market.

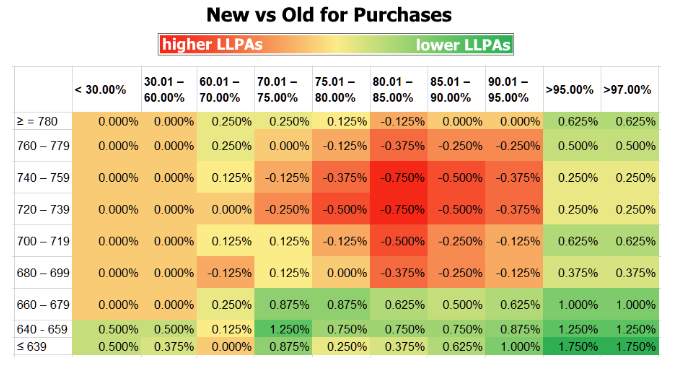

Cohn elaborates further on the topic as she runs through a new heat map chart showing how much more (or less) borrowers in different credit brackets will pay on new purchase loans.

A significant change in the conventional mortgage is that the borrowers making down payments between 5% and 25% will pay more fees than those paying less than 5%.

Cohn acknowledges that the shift benefits borrowers who are seeking maximum financing, which typically are first-time homebuyers. On the flip side, the chart also shows that buyers with credit scores at or above 720 paying financing that covers between 70% and 95% are getting dinged by the change.

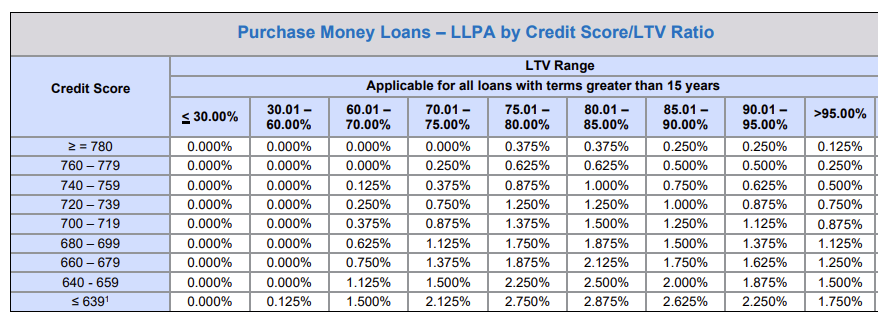

However, according to Cohn, a second chart showing the total fee borrowers in different credit brackets will pay can help debunk and ease concerns.

“With the volatility in the bond market and other things shaping where mortgage rates are going, you wouldn’t know the difference,” she says. “If you look at a Fannie Mae LLPA matrix today after these changes, those with the worst credit still pay a higher price than those with the best credit. It’s just those with the best credit are paying a little bit more than they were, and those with lesser credit are paying a little bit less.”

While the initial coverage of the LLPA changes caused a stir in the industry, some pundits suggest that, conceptually, the move isn’t as shocking as it would appear.

“Good credit has always subsidized less-than-good credit in any or all aggregate risk,” says Paul Hindman, managing director at Grid Origination Services. “Think of how home, health, auto and life insurance work, and how those with the least claims subsidized those with the most. This structure is required to smooth out the risk.”

Hindman views the conventional LLPA as a “product choice redirect,” requiring a more nuanced analysis for borrowers and their advisors.

“Expert mortgage loan officers will navigate this change as they have with all changes,” he says. “It comes down to understanding the change and navigating the required communication for its most practical application.”

Banosian doesn’t expect a significant long-term impact on interest rates or business flow because of the resiliency of borrowers set on buying a home.

While he acknowledges that the headlines stirred up concerns and questions about the LLPAs, Banosian notes that the price adjustments don’t significantly change borrowers’ overall prices.

As agents work with consumers and guide them through the transaction process with new fees, Banosian recommends evaluating other financing options outside of Fannie and Freddie mortgages to provide borrowers with an array of ways to realize their homeownership goals.

“My advice to the clients, knowing what I know, would be to explore all your options because it just got a little bit more expensive for certain clients to get money,” he says. “Make sure you navigate and ensure your loan option goes through every single scenario with you that you qualify for.”