RISMedia’s Broker Confidence Index (BCI) appears to be see-sawing as the industry slides into an atypical summer season, jumping again in June after a sharp dip in May, with real estate business leaders still contending with a hard inventory crunch and persistently high interest rates.

Emerging shakily from the housing “correction” and hounded by gloomy macroeconomic rumblings—from a regional bank crisis to broader recession predictions—brokers have never fully lost optimism gained at the start of the year when sales and demand began picking up. After the BCI fell sharply from 6.9 to 6.3 in May, a rebound last month from 6.3 to 6.7 indicates industry executives feel confident that markets have reached a floor.

“It’s business as usual,” said Beth Roybal, co-owner and designated broker of Realty of Maine. “Keep working!”

The up-and-down movements of the BCI reflect a market and economy in flux, with dips corresponding to changes in home sales, mortgage rates and major news developments around inflation and the banking sector. But the index does not appear headed for recent lows tracked last winter, when the BCI dropped to 5.3.

“Our condition will improve within 12 – 18 months,” said Jack Fry, broker/owner of RE/MAX of Reading in Pennsylvania.

But today’s challenges remain the same as they were three or four months ago—and somewhat similar to what they were two years ago. Almost one-third of brokers (30%) cited inventory as a major obstacle in their region, even as many others celebrated increasing buyer demand.

That imbalance is what made the pandemic market so difficult for buyers, and even with mortgage rates at more than double what they were in 2021, brokers are still feeling the strain of that dynamic. Rod Messick, CEO of Berkshire Hathaway HomeServices Homesale Realty based in Pennsylvania said “sellers seem stalled” as a “continued low-inventory” environment pervades the market.

But unlike the pandemic market, many brokers are experiencing a drag from higher mortgage rates, which also rebounded after initially shrinking from last winter’s peak of over 7%. While some economists have been surprised at how persistent demand for homes has remained against the higher rates (which are not particularly high by historic standards), some regions at least are feeling the effects.

A quarter (25%) of brokers surveyed this month cited rates as a major factor affecting their confidence in the industry, even after the Federal Reserve skipped on hiking rates last month.

Buyer bans

With the lack of homes on the market becoming a deepening crisis, some governments have turned to innovative—and extreme—measures to protect their housing stock. At both the federal and local levels, attempts have been made to stop big institutional buyers from snatching up housing stock. Several states have either passed or are considering bans on foreign buyers—at least from certain countries—which has raised major concerns around discrimination and fair housing, regardless of the effect on inventory.

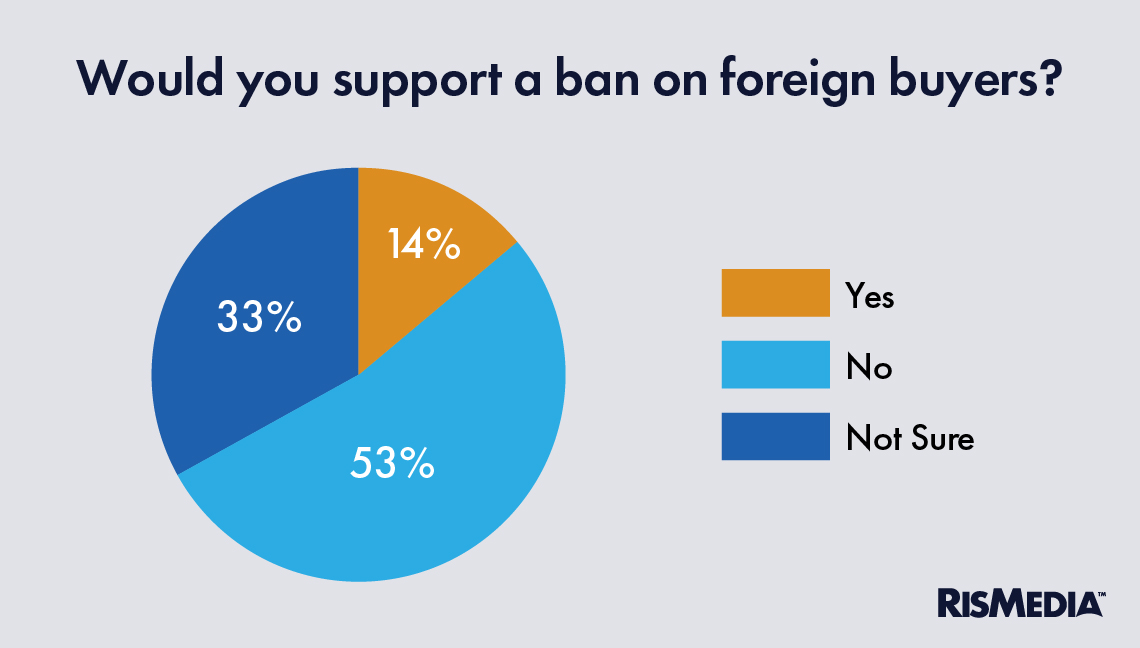

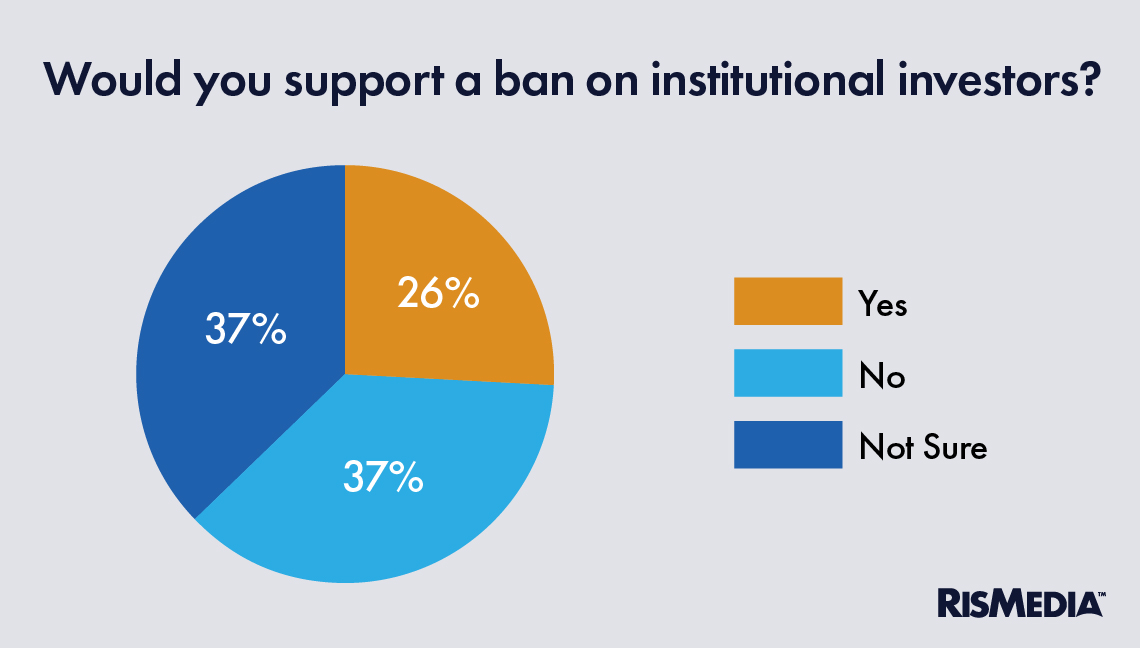

We asked brokers this month if they would support either of these bans in their areas, finding that despite a lot of media attention and fear-mongering, a huge majority of real estate leaders are against these types of restrictions on buyers.

While a ban on investors was more popular than a ban on foreigners, neither had any sort of broad support. Also, the number of brokers who said they were “not sure” about these bans reflects the complexity and nuance of these policies, which, in practice, have been designed very differently—with some restricting only the sale of single-family homes to investors or only land near sensitive military installations from foreign buyers.

Canada, which is also deep in an inventory crisis, had to amend a broad ban on foreign homebuyers following pushback and fears that it would actually depress the housing market further.

Interestingly, brokers who supported a ban on either of these types of buyers had a lower overall confidence level than the average, at 6.1. Those who said they would not support these bans had a higher confidence level, at 7.1.