Couples who have recently made a home purchase may now be enjoying summer in their new home. Let’s look at their experience in the housing market.

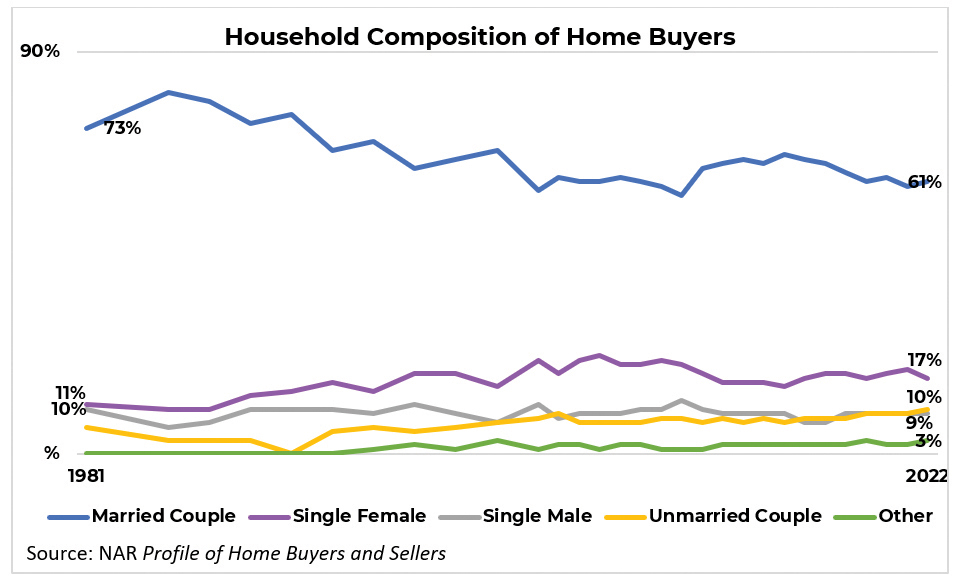

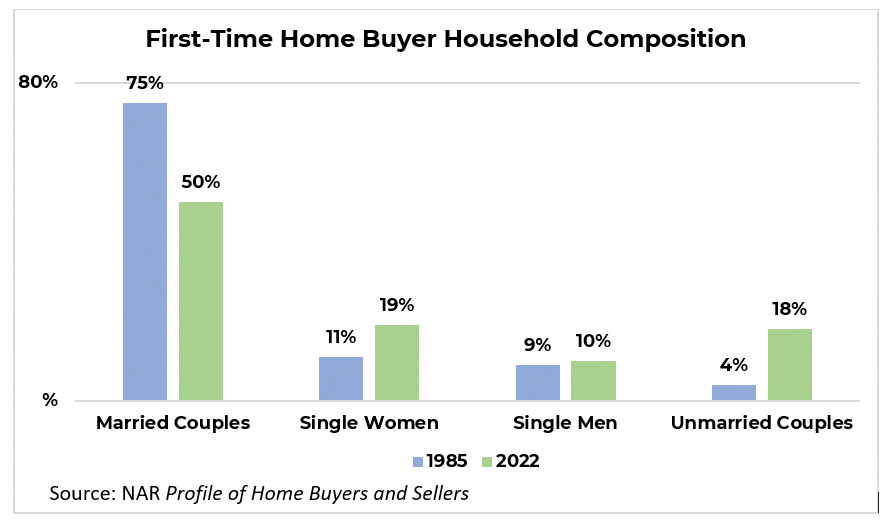

Married couples account for the largest share of homebuyers at 61%, while unmarried couples account for 10% of the market. Notably, unmarried couples are a sizable share of the first-time buyer market at 18%, up from just 4% in 1985. Overall, the typical age of a married couple purchasing is 53, while that of an unmarried couple is 47.

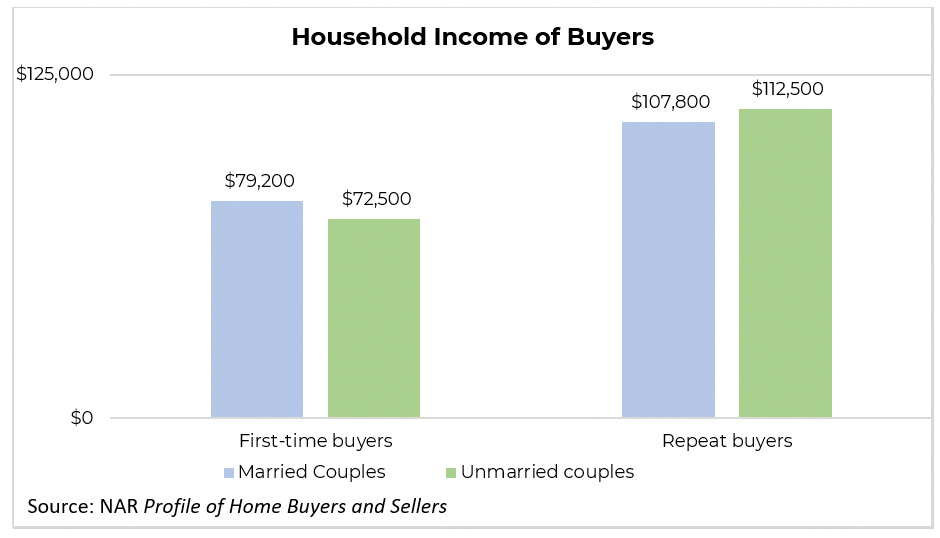

Married and unmarried couples have a significant leg up in a housing market stifled by a rise in both mortgage interest rates and home prices. Married couples who purchased a home as first-time buyers in the last year typically have a household income of $79,200, while unmarried couples usually have a household income of $72,500. These median incomes give both groups considerably more buying power than single homebuyers.

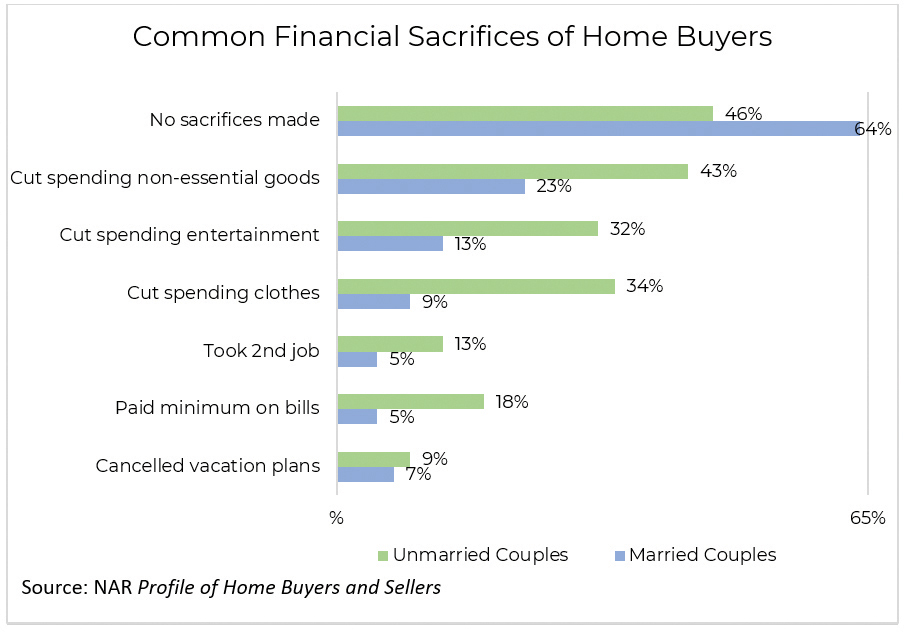

Perhaps due to age differences and the proliferation of unmarried first-time buyers, unmarried couples are significantly more likely to make financial sacrifices to enter homeownership than married couples. In examining the sacrifices made by unmarried couples, this group more closely mirrors single homebuyers than married couples. Single buyers (46%) and unmarried couples (43%), for example, are both more likely than married couples to cut spending on non-essential goods. Married couples are far more likely not to make any financial sacrifices at 64%.

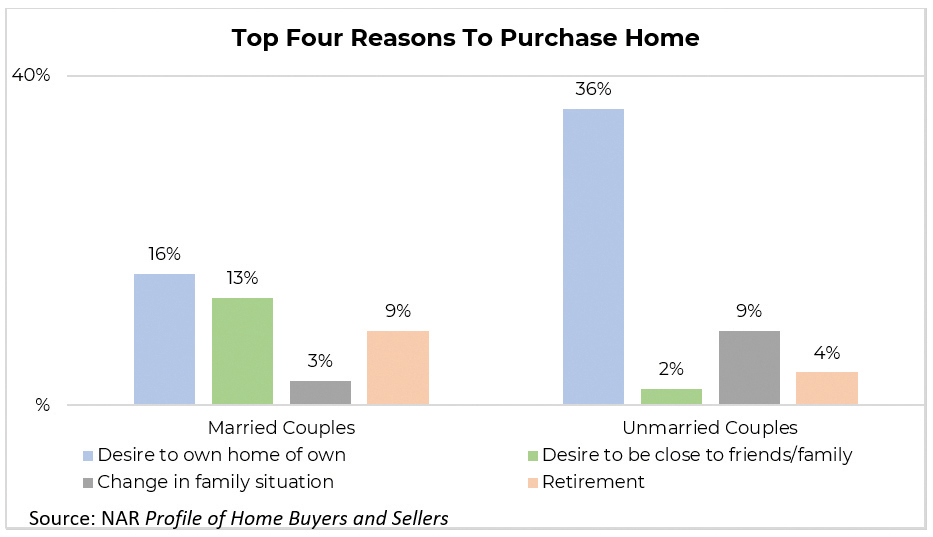

The reasons cited for purchasing a home show the different motivations of married and unmarried couples when it comes to the home purchase. Both are most likely to purchase because they want to own a home of their own. However, the share is quite different: 36% for unmarried couples compared to 16% for married couples. Additionally, the desire to be close to one’s family and retirement are more common reasons for a married couple’s purchase, whereas a change in a family situation is more common for unmarried couples.

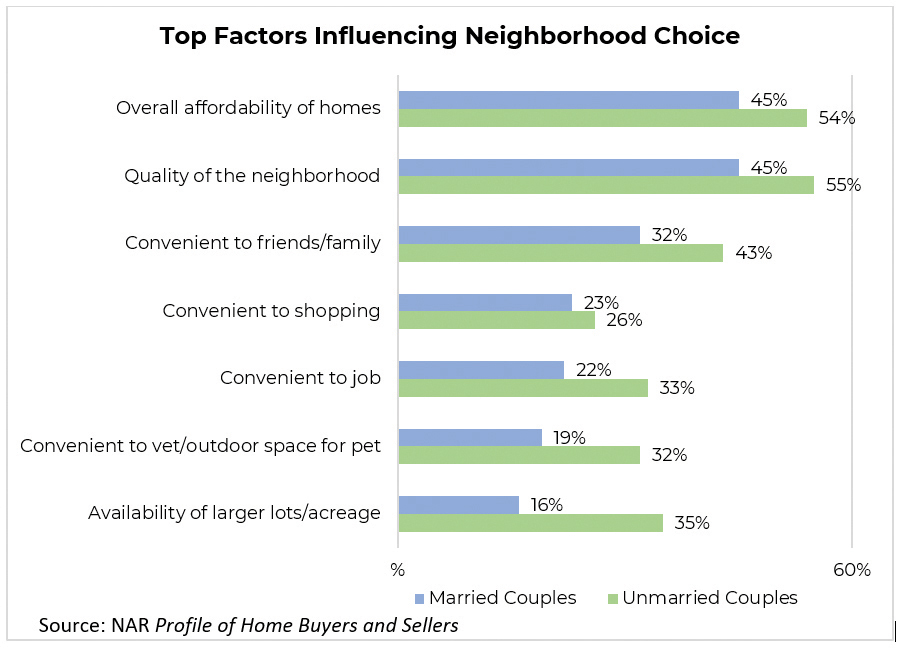

There are also considerable differences between unmarried and married couples when it comes to choosing a location. Both place affordability and quality of the neighborhood as top factors, but other reasons diverge. While all factors seem more important to unmarried buyers than to married buyers, there is a wider spread between their views on some factors. Unmarried couples are much more likely to be concerned about convenience to jobs and places for pets. Unmarried couples were also more likely to cite a desire to be close to friends and family (also important to single-women buyers) and a desire for more space.

For more homebuyer and seller trends, check out the National Association of REALTORS®’ Profile of Home Buyers and Sellers at https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers.