Most of us know someone who has moved to a different state or area in the last few years. Maybe you have friends who text photos of their new pet chickens, send frustrated messages about bad WiFi, or experience beautiful landscapes they couldn’t enjoy in city-center apartments. This article explores the movers—the reasons they moved, how their search went and how they ultimately purchased their homes.

The median distance moved by recent buyers, according to the National Association of REALTORS®’ (NAR) 2022 Profile of Home Buyers and Sellers, was 50 miles, but many of those buyers moved much further from their previous home. One-quarter moved at least 470 miles to find their new home. This is a marked change from the years before the COVID-19 pandemic. From 1989 to 2021, the median distance moved was just 10 to 15 miles.

While buyers overall made a typical move of 50 miles, by generation there are variations. Younger baby boomers (born 1955 – 1964) moved the longest distance at a median of 90 miles. Older baby boomers (born 1946 – 1954) moved a median of 50 miles. Millennials tended to stay the closest to their past residences, moving just 15 miles.

Based on this generational trend, it is not surprising that those who moved more than 470 miles from their past residence were more likely to be repeat homebuyers. Just 11% were first-time buyers. This dispels one potential myth that abounded in the last year: that first-time buyers are the buyers likely to pick up and move to a new city. It does happen, but NAR data shows it is more likely a repeat buyer who is making the distance move.

The top reasons for long-distance movers to buy varies rather dramatically from the top reasons all buyers cite. Moving for friends and family (25%) is the top motivation for making the big move, followed by retirement (12%). Twelve percent are moving closer to a job, school or transit, and 11% for a job relocation. Among all buyers, the top reason for buying is traditionally the simple desire to own a home of one’s own. However, this reason ranks lower among long-distance buyers, likely due to the group’s high share of repeat homebuyers.

It’s often noted that long-distance movers include a high share of all-cash buyers. The reasoning is that these buyers may be moving to a more affordable location, enabling them to pay all cash for their next home. Long-distance movers do outperform all buyers when it comes to paying cash, but only slightly (25% versus 22%). For additional points of comparison, only 3% of first-time buyers pay all cash for their home compared to 27% of all repeat buyers. It is likely that NAR’s data is capturing an oversample of repeat buyers. It is also noteworthy that the 2022 Profile of Home Buyers and Sellers showed an overall increase in all-cash buyers—up from 13% in the 2021 Profile.

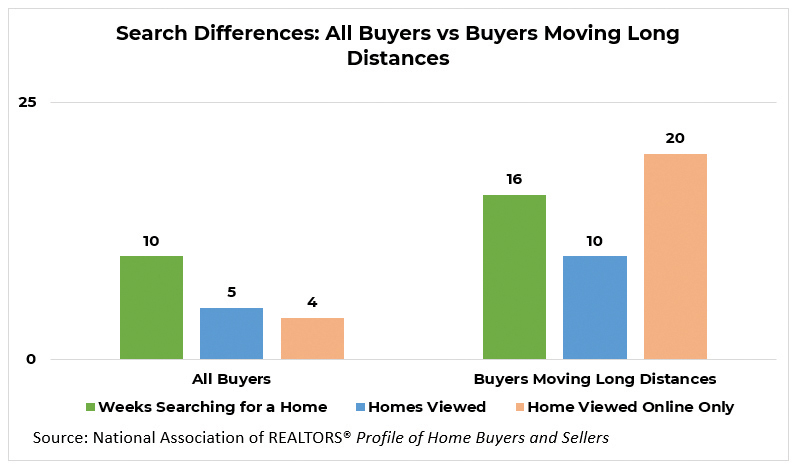

Distance moved makes a big difference in how long recent buyers searched for homes. The 2022 report showed the typical buyer searched for 10 weeks and, over that course of time, looked at five homes in person and four homes online only. The typical buyer moving a long distance searched for 16 weeks and viewed 10 homes in person and 20 online only. Many buyers moving long distances may have had more time to look for homes, particularly if they were moving for retirement or to be close to friends and family. One can imagine a buyer who may have even tried out a short-term rental and then pondered the neighborhood and home choice before buying.

Also notable is how these long-haul movers toured homes. They were much more likely to use technology as a tool in their online search. This trend should be underlined as it may help real estate agents and brokers customize their listings in areas where they know they have strong migration patterns, such as the Sunbelt states. It’s worth reiterating that these long-distance buyers are more likely to be seniors. It’s a group of buyers who are often considered not tech-savvy, but in fact, seniors today are often tech-savvy and use technology as a tool to search.

To add to these insights, let’s look at a second source of data, the REALTORS® Confidence Index. This monthly survey tracks what percentage of buyers did not physically see the home before purchasing. That share continues to be not insignificant. The latest reading is at 8%. While NAR only began tracking that data during the COVID-19 pandemic, it appears to be a trend that may stick. Long-distance movers very likely make up the biggest portion of these buyers.

One last metric is interesting when examining long-distance movers: the share who purchased with an agent or broker. Long-distance movers use agents and brokers at higher rates than other buyers. This statistic is especially noteworthy as these buyers are likely not using the same agent they used to sell their previous home or even someone they knew before. They are more likely than others to use a website to find their agent. And it stands to reason that these buyers will need to rely on their agent in a different way than local movers. While local movers know their favorite coffee shop, park or place to grab a pint, long-distance movers will rely on the local expertise of real estate agents and brokers. Trust in the real estate agent or broker becomes paramount as they examine the faults and features of various homes and neighborhoods.

Here’s a trend to watch: Will everyone with a new chicken coop who moved to distant places with beautiful views move back? Or are they in their new location to stay? And will the migration trend persist as baby boomers continue into retirement and welcome their grandbabies? For more on these trends and others, keep your eye out each year for the Profile of Home Buyers and Sellers.

For more information, visit https://www.nar.realtor/.